Question: Please solve part C Problem 1 (10 point): You are looking to purchase a house valued at $325,000 in the suburbs of Kansas City. You

Please solve part C

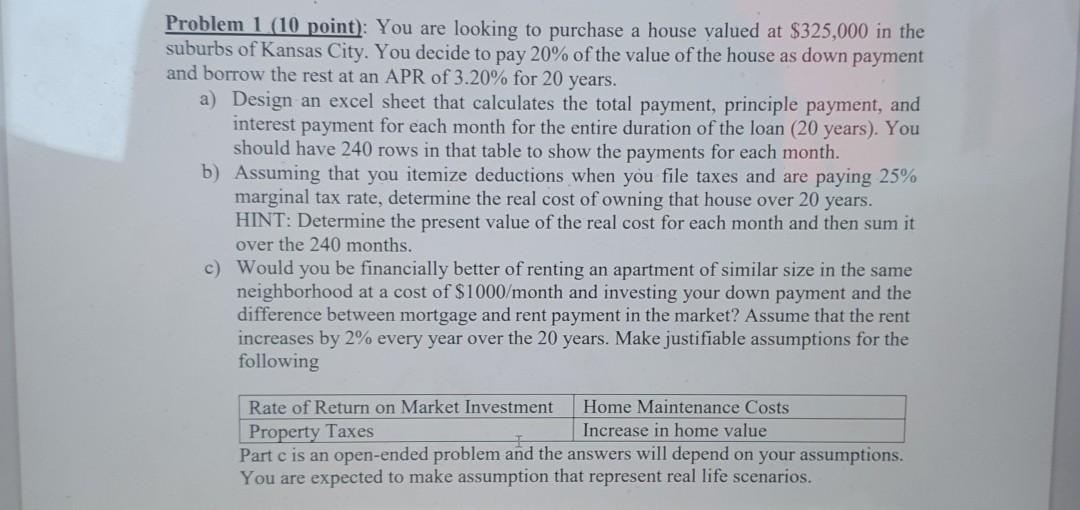

Problem 1 (10 point): You are looking to purchase a house valued at $325,000 in the suburbs of Kansas City. You decide to pay 20% of the value of the house as down payment and borrow the rest at an APR of 3.20% for 20 years. a) Design an excel sheet that calculates the total payment, principle payment, and interest payment for each month for the entire duration of the loan (20 years). You should have 240 rows in that table to show the payments for each month. b) Assuming that you itemize deductions when you file taxes and are paying 25% marginal tax rate, determine the real cost of owning that house over 20 years. HINT: Determine the present value of the real cost for each month and then sum it over the 240 months. c) Would you be financially better of renting an apartment of similar size in the same neighborhood at a cost of $1000/month and investing your down payment and the difference between mortgage and rent payment in the market? Assume that the rent increases by 2% every year over the 20 years. Make justifiable assumptions for the following Rate of Return on Market Investment Home Maintenance Costs Property Taxes Increase in home value Part c is an open-ended problem and the answers will depend on your assumptions. You are expected to make assumption that represent real life scenarios. Problem 1 (10 point): You are looking to purchase a house valued at $325,000 in the suburbs of Kansas City. You decide to pay 20% of the value of the house as down payment and borrow the rest at an APR of 3.20% for 20 years. a) Design an excel sheet that calculates the total payment, principle payment, and interest payment for each month for the entire duration of the loan (20 years). You should have 240 rows in that table to show the payments for each month. b) Assuming that you itemize deductions when you file taxes and are paying 25% marginal tax rate, determine the real cost of owning that house over 20 years. HINT: Determine the present value of the real cost for each month and then sum it over the 240 months. c) Would you be financially better of renting an apartment of similar size in the same neighborhood at a cost of $1000/month and investing your down payment and the difference between mortgage and rent payment in the market? Assume that the rent increases by 2% every year over the 20 years. Make justifiable assumptions for the following Rate of Return on Market Investment Home Maintenance Costs Property Taxes Increase in home value Part c is an open-ended problem and the answers will depend on your assumptions. You are expected to make assumption that represent real life scenarios

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts