Question: Please solve please provide detailed answer with explanation and computation Which of the following statements concerning the differences between employees and independent contractors is true?

Please solve please provide detailed answer with explanation and computation

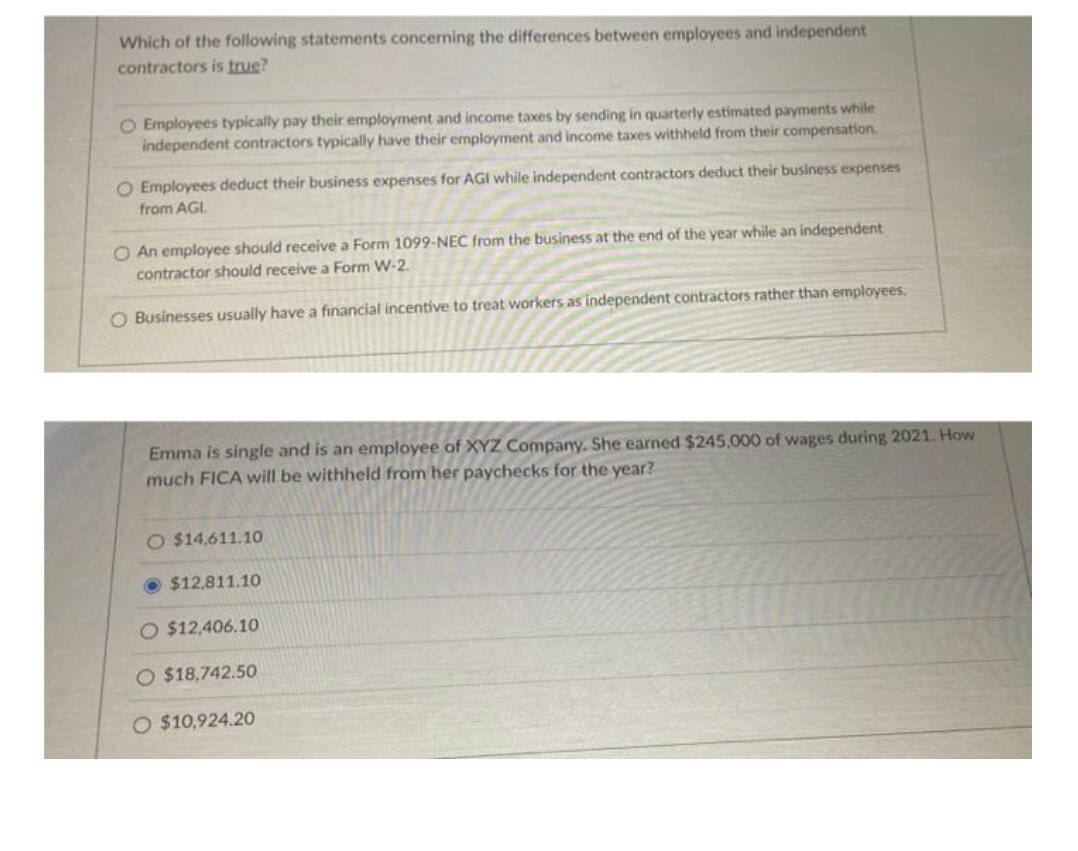

Which of the following statements concerning the differences between employees and independent contractors is true? Employees typically pay their employment and income taxes by sending in quarterly estimated payments while independent contractors typically have their employment and income taxes withheld from their compensation. Employees deduct their business expenses for AGI while independent contractors deduct their business expenses from AGI. An employee should receive a Form 1099-NEC from the business at the end of the year while an independent contractor should receive a Form W-2. Businesses usually have a financial incentive to treat workers as independent contractors rather than employees. Emma is single and is an employee of XYZ Company. She earned $245,000 of wages during 2021. How much FICA will be withheld from her paychecks for the year? $14,611.10 $12,811.10 $12.406.10 $18.742.50 $10,924.20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts