Question: Please solve. Please show your work. Please explain your reasoning. The price of a one-year European call option on a non-dividend-paying stock is $6. The

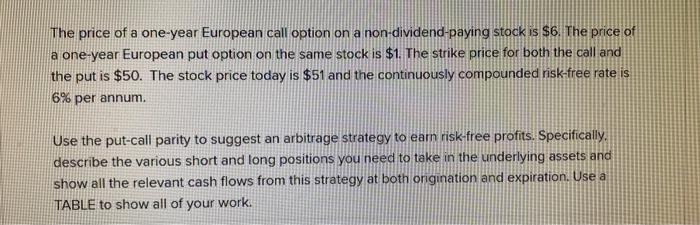

The price of a one-year European call option on a non-dividend-paying stock is $6. The price of a one-year European put option on the same stock is $1. The strike price for both the call and the put is $50. The stock price today is $51 and the continuously compounded risk-free rate is 6% per annum. Use the put-call parity to suggest an arbitrage strategy to ear risk-free profits. Specifically, describe the various short and long positions you need to take in the underlying assets and show all the relevant cash flows from this strategy at both origination and expiration. Use a TABLE to show all of your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts