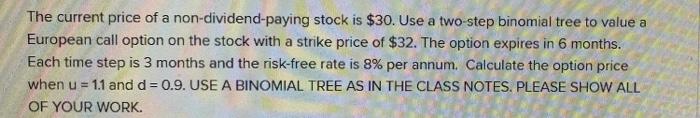

Question: Please solve. Please show your work. Please explain your reasoning. The current price of a non-dividend paying stock is $30. Use a two-step binomial tree

The current price of a non-dividend paying stock is $30. Use a two-step binomial tree to value European call option on the stock with a strike price of $32. The option expires in 6 months. Each time step is 3 months and the risk-free rate is 8% per annum. Calculate the option price when u = 1.1 and d = 0.9. USE A BINOMIAL TREE AS IN THE CLASS NOTES, PLEASE SHOW ALL OF YOUR WORK

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts