Question: please solve problem 12,14, 16 and 1 12. The O'Neill Shoe Manufacturing Company will produce a special-style shoe if the order size is large enough

please solve problem 12,14, 16 and 1

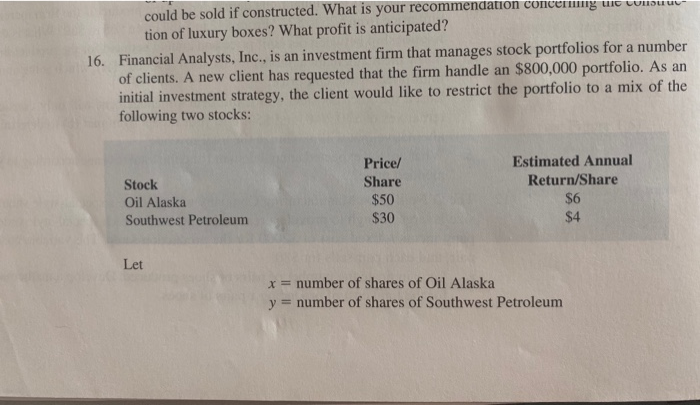

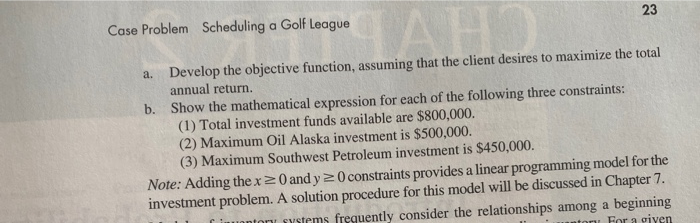

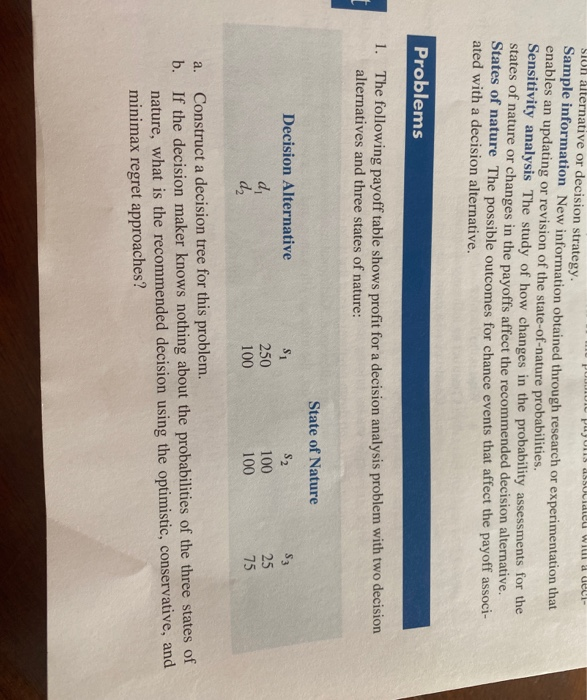

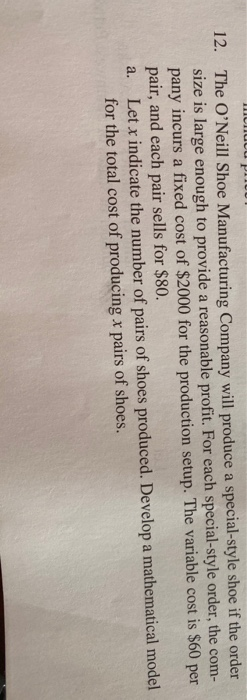

12. The O'Neill Shoe Manufacturing Company will produce a special-style shoe if the order size is large enough to provide a reasonable profit. For each special-style order, the com- pany incurs a fixed cost of $2000 for the production setup. The variable cost is $60 per pair, and each pair sells for $80. a. Let x indicate the number of pairs of shoes produced. Develop a mathematical model for the total cost of producing x pairs of shoes. Chapter 1 Introduction b. Let P indicate the total profit. Develop a mathematical model for the total profit real ized from an order for x pairs of shoes. c. What is the breakeven point? madin offers commuter training seminars on a variety of topics. In the seminars each 14. Eastman Publishing Company is considering publishing a paperback textbook on spread- sheet applications for business. The fixed cost of manuscript preparation, textbook design, and production setup is estimated to be $160,000. Variable production and material costs are estimated to be $6 per book. Demand over the life of the book is estimated to be 4000 copies The publisher plans to sell the text to college and university bookstores for $46 each. a. What is the breakeven point? b. What profit or loss can be anticipated with a demand of 3800 copies? c. With a demand of 3800 copies, what is the minimum price per copy that the publisher must charge to break even? d. If the publisher believes that the price per copy could be increased to $50.95 and not affect the anticipated demand of 4000 copies, what action would you recommend? What profit or loss can be anticipated? ou for construction of a new stadium for a major league could be sold if constructed. What is your recommendation conceng ucu tion of luxury boxes? What profit is anticipated? 16. Financial Analysts, Inc., is an investment firm that manages stock portfolios for a number of clients. A new client has requested that the firm handle an $800,000 portfolio. As an initial investment strategy, the client would like to restrict the portfolio to a mix of the following two stocks: Estimated Annual Return/Share Stock Oil Alaska Southwest Petroleum Price/ Share $50 $30 $6 Let x = number of shares of Oil Alaska y = number of shares of Southwest Petroleum Case Problem Scheduling a Golf League 23 a. Develop the objective function, assuming that the client desires to maximize the total annual return b. Show the mathematical expression for each of the following three constraints: (1) Total investment funds available are $800,000. (2) Maximum Oil Alaska investment is $500,000. (3) Maximum Southwest Petroleum investment is $450,000. Note: Adding the x 20 and y constraints provides a linear programming model for the investment problem. A solution procedure for this model will be discussed in Chapter 7. veteme frequently consider the relationships among a beginning Popu l ated will a deci Sun alternative or decision strategy. Sample information New information obtained through research or experimentation that enables an updating or revision of the state-of-nature probabilities. Sensitivity analysis The study of how changes in the probability assessments for the states of nature or changes in the payoffs affect the recommended decision alternative. States of nature The possible outcomes for chance events that affect the payoff associ- ated with a decision alternative. Problems 1. The following payoff table shows profit for a decision analysis problem with two decision alternatives and three states of nature: State of Nature Decision Alternative S1 250 100 100 100 a. b. Construct a decision tree for this problem. If the decision maker knows nothing about the probabilities of the three states of nature, what is the recommended decision using the optimistic, conservative, and minimax regret approaches