Question: please solve! Problem 2 Go to page 131, Brayden's Bobbles, calculate the Receivable Turn, Average Days Sales Outstanding, Inventory Turn and the Average Days Sales

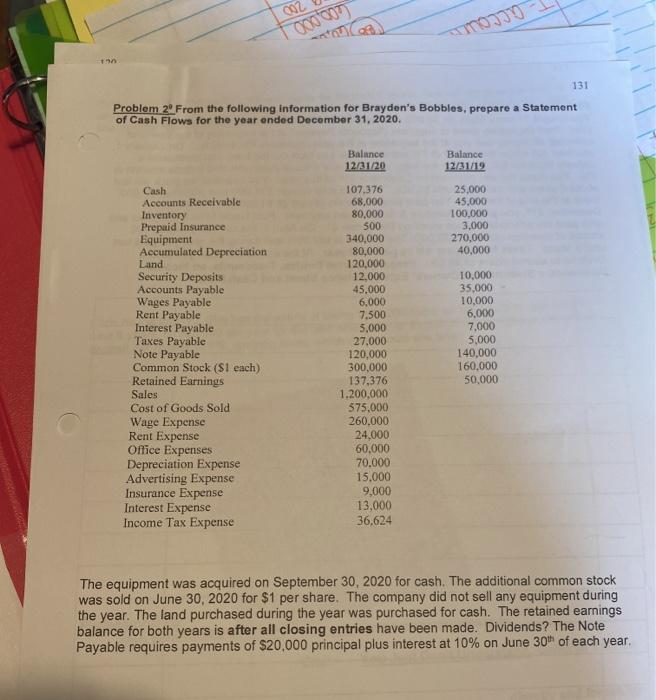

Problem 2 Go to page 131, Brayden's Bobbles, calculate the Receivable Turn, Average Days Sales Outstanding, Inventory Turn and the Average Days Sales in Inventory. (Remember Inventory turn was way in the beginning). 002 Ooo 007 STOJI 131 Problem 2. From the following information for Brayden's Bobbles, prepare a Statement of Cash Flows for the year onded December 31, 2020. Balance 12/31/20 Balance 12/31/19 25.000 45.000 100,000 3,000 270,000 40.000 Cash Accounts Receivable Inventory Prepaid Insurance Equipment Accumulated Depreciation Land Security Deposits Accounts Payable Wages Payable Rent Payable Interest Payable Taxes Payable Note Payable Common Stock (S1 each) Retained Earnings Sales Cost of Goods Sold Wage Expense Rent Expense Office Expenses Depreciation Expense Advertising Expense Insurance Expense Interest Expense Income Tax Expense 107,376 68,000 80,000 500 340,000 80,000 120.000 12.000 45.000 6,000 7.500 5,000 27,000 120,000 300,000 137,376 1.200,000 575,000 260.000 24,000 60,000 70.000 15.000 9,000 13,000 36,624 10,000 35.000 10,000 6,000 7,000 5.000 140,000 160,000 50,000 The equipment was acquired on September 30, 2020 for cash. The additional common stock was sold on June 30, 2020 for $1 per share. The company did not sell any equipment during the year. The land purchased during the year was purchased for cash. The retained earnings balance for both years is after all closing entries have been made. Dividends? The Note Payable requires payments of $20,000 principal plus interest at 10% on June 30 of each year. Problem 2 Go to page 131, Brayden's Bobbles, calculate the Receivable Turn, Average Days Sales Outstanding, Inventory Turn and the Average Days Sales in Inventory. (Remember Inventory turn was way in the beginning). 002 Ooo 007 STOJI 131 Problem 2. From the following information for Brayden's Bobbles, prepare a Statement of Cash Flows for the year onded December 31, 2020. Balance 12/31/20 Balance 12/31/19 25.000 45.000 100,000 3,000 270,000 40.000 Cash Accounts Receivable Inventory Prepaid Insurance Equipment Accumulated Depreciation Land Security Deposits Accounts Payable Wages Payable Rent Payable Interest Payable Taxes Payable Note Payable Common Stock (S1 each) Retained Earnings Sales Cost of Goods Sold Wage Expense Rent Expense Office Expenses Depreciation Expense Advertising Expense Insurance Expense Interest Expense Income Tax Expense 107,376 68,000 80,000 500 340,000 80,000 120.000 12.000 45.000 6,000 7.500 5,000 27,000 120,000 300,000 137,376 1.200,000 575,000 260.000 24,000 60,000 70.000 15.000 9,000 13,000 36,624 10,000 35.000 10,000 6,000 7,000 5.000 140,000 160,000 50,000 The equipment was acquired on September 30, 2020 for cash. The additional common stock was sold on June 30, 2020 for $1 per share. The company did not sell any equipment during the year. The land purchased during the year was purchased for cash. The retained earnings balance for both years is after all closing entries have been made. Dividends? The Note Payable requires payments of $20,000 principal plus interest at 10% on June 30 of each year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts