Question: please solve Project Audit Test END-OF-YEAR ACTIVITIES Journal 1. What is the amount of the deposit for Pennsylvania state income taxes withheld from the December

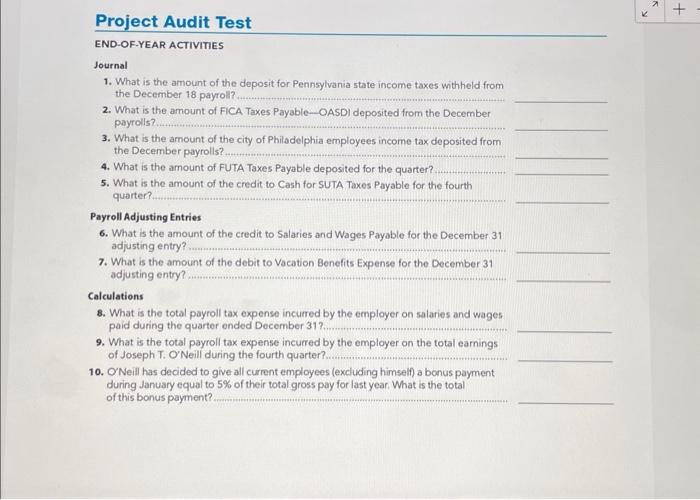

Project Audit Test END-OF-YEAR ACTIVITIES Journal 1. What is the amount of the deposit for Pennsylvania state income taxes withheld from the December 18 payroll? 2. What is the amount of FICA Taxes Payable-OASDI deposited from the December Payrols? 3. What is the amount of the city of Philadelphia employees income tax deposited from the December payrolls? 4. What is the amount of FUTA Taxes Payable deposited for the quarter? 5. What is the amount of the credit to Cash for SUTA Taxes Payable for the fourth quarter? Payroll Adjusting Entries 6. What is the amount of the credit to Salaries and Wages Payable for the December.31 adjusting entry? 7. What is the amount of the debit to Vacation Benefits Expense for the December 31 adjusting entry? Calculations 8. What is the total payroll tax expense incurred by the employer on salaries and wages paid duning the quarter ended December 31 ? 9. What is the total payroll tax expense incured by the employer on the total earnings of Joseph T. O'Neill during the fourth quarter? 10. O'Neill has decided to give all current employees (excluding himself) a bonus payment during danuary equal to 5% of their total gross pay for last year. What is the total of this bonus payment? Project Audit Test END-OF-YEAR ACTIVITIES Journal 1. What is the amount of the deposit for Pennsylvania state income taxes withheld from the December 18 payroll? 2. What is the amount of FICA Taxes Payable-OASDI deposited from the December Payrols? 3. What is the amount of the city of Philadelphia employees income tax deposited from the December payrolls? 4. What is the amount of FUTA Taxes Payable deposited for the quarter? 5. What is the amount of the credit to Cash for SUTA Taxes Payable for the fourth quarter? Payroll Adjusting Entries 6. What is the amount of the credit to Salaries and Wages Payable for the December.31 adjusting entry? 7. What is the amount of the debit to Vacation Benefits Expense for the December 31 adjusting entry? Calculations 8. What is the total payroll tax expense incurred by the employer on salaries and wages paid duning the quarter ended December 31 ? 9. What is the total payroll tax expense incured by the employer on the total earnings of Joseph T. O'Neill during the fourth quarter? 10. O'Neill has decided to give all current employees (excluding himself) a bonus payment during danuary equal to 5% of their total gross pay for last year. What is the total of this bonus payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts