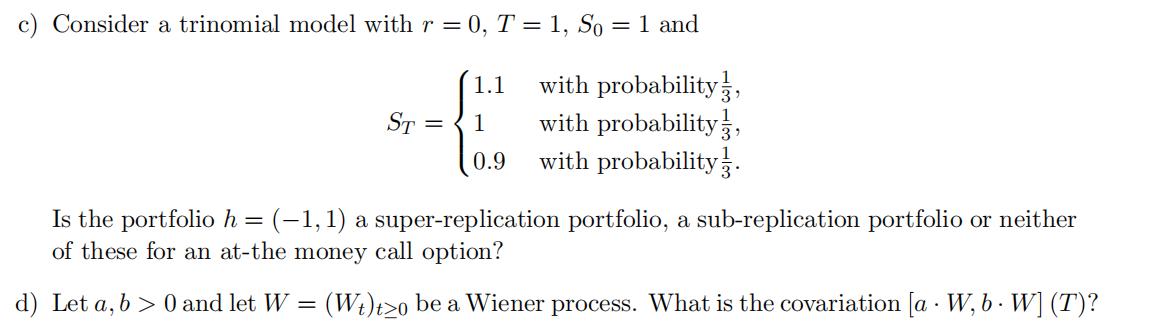

Question: c) Consider a trinomial model with r = 0, T = 1, So = 1 and with probability, with probability, with probability. 1.1 ST

c) Consider a trinomial model with r = 0, T = 1, So = 1 and with probability, with probability, with probability. 1.1 ST = 1 0.9 Is the portfolio h = (-1, 1) a super-replication portfolio, a sub-replication portfolio or neither of these for an at-the money call option? d) Let a, b>0 and let W = (Wt)tzo be a Wiener process. What is the covariation [a. W, b. W] (T)?

Step by Step Solution

3.48 Rating (168 Votes )

There are 3 Steps involved in it

ANS C To determine whether the portfolio h 1 1 is a superreplication portfolio a subreplication portfolio or neither for an atthemoney call option we ... View full answer

Get step-by-step solutions from verified subject matter experts