Question: Please solve question 10 If at next week's 26-week, $2 billion Treasury Bill auction, Goldman Sachs bids 2.7% for $100 million, Citibank bids 2.6% for

Please solve question 10

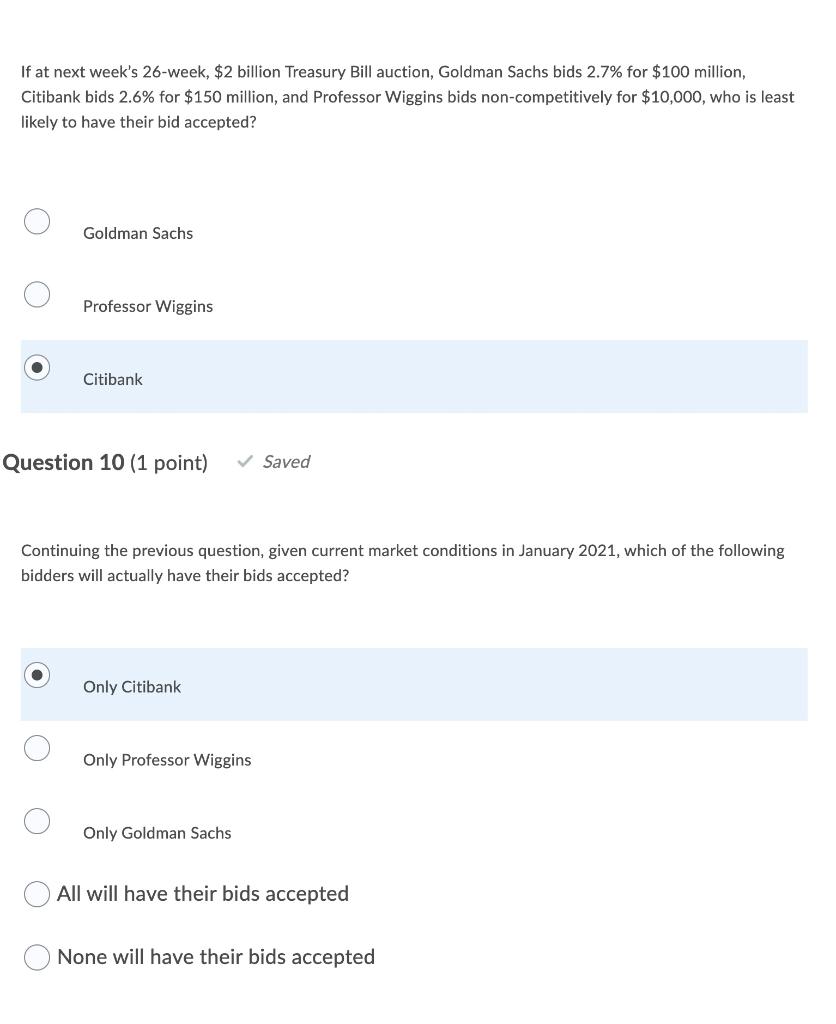

If at next week's 26-week, $2 billion Treasury Bill auction, Goldman Sachs bids 2.7% for $100 million, Citibank bids 2.6% for $150 million, and Professor Wiggins bids non-competitively for $10,000, who is least likely to have their bid accepted? Goldman Sachs Professor Wiggins Citibank Question 10 (1 point) Saved Continuing the previous question, given current market conditions in January 2021, which of the following bidders will actually have their bids accepted? Only Citibank Only Professor Wiggins Only Goldman Sachs All will have their bids accepted None will have their bids accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts