Question: Please solve question 11. Also show all calculation, Thank you. 11. Martin Company uses the aging method to adjust the allowance for uncollectible accounts at

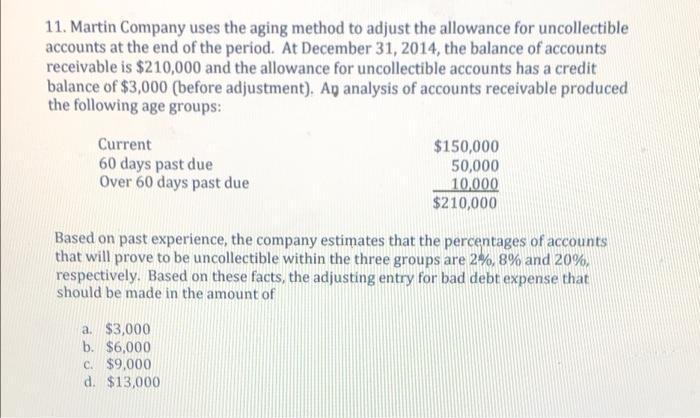

11. Martin Company uses the aging method to adjust the allowance for uncollectible accounts at the end of the period. At December 31, 2014, the balance of accounts receivable is $210,000 and the allowance for uncollectible accounts has a credit balance of $3,000 (before adjustment). Ag analysis of accounts receivable produced the following age groups: Current 60 days past due Over 60 days past due $150,000 50,000 10,000 $210,000 Based on past experience, the company estimates that the percentages of accounts that will prove to be uncollectible within the three groups are 2%, 8% and 20%, respectively. Based on these facts, the adjusting entry for bad debt expense that should be made in the amount of a. $3,000 b. $6,000 c. $9,000 d. $13,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts