Question: Please solve Question 5 and 6 both please 5. A homeowner made a mortgage ten years ago for $140,000 at 6.0% for 30 years. Today

Please solve Question 5 and 6 both please

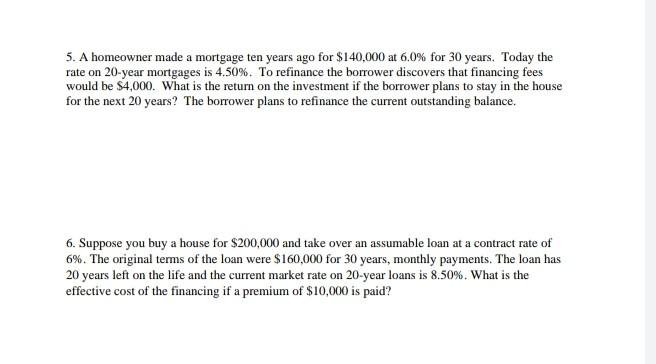

5. A homeowner made a mortgage ten years ago for $140,000 at 6.0% for 30 years. Today the rate on 20-year mortgages is 4.50%. To refinance the borrower discovers that financing fees would be $4,000. What is the return on the investment if the borrower plans to stay in the house for the next 20 years? The borrower plans to refinance the current outstanding balance. 6. Suppose you buy a house for $200,000 and take over an assumable loan at a contract rate of 6%. The original terms of the loan were $160,000 for 30 years, monthly payments. The loan has 20 years left on the life and the current market rate on 20-year loans is 8.50%. What is the effective cost of the financing if a premium of $10,000 is paid

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts