Question: please solve question 6 ( a,b,c,d,e) a 1 In the Dakota problem, show that the current basis remains optimal if c3, the price of chairs,

please solve question 6 ( a,b,c,d,e)

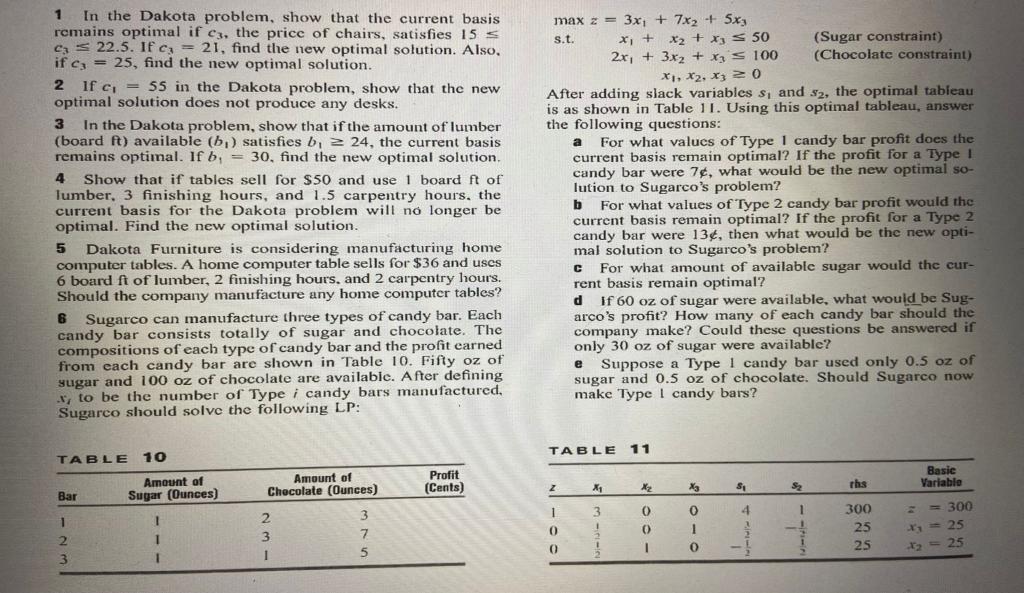

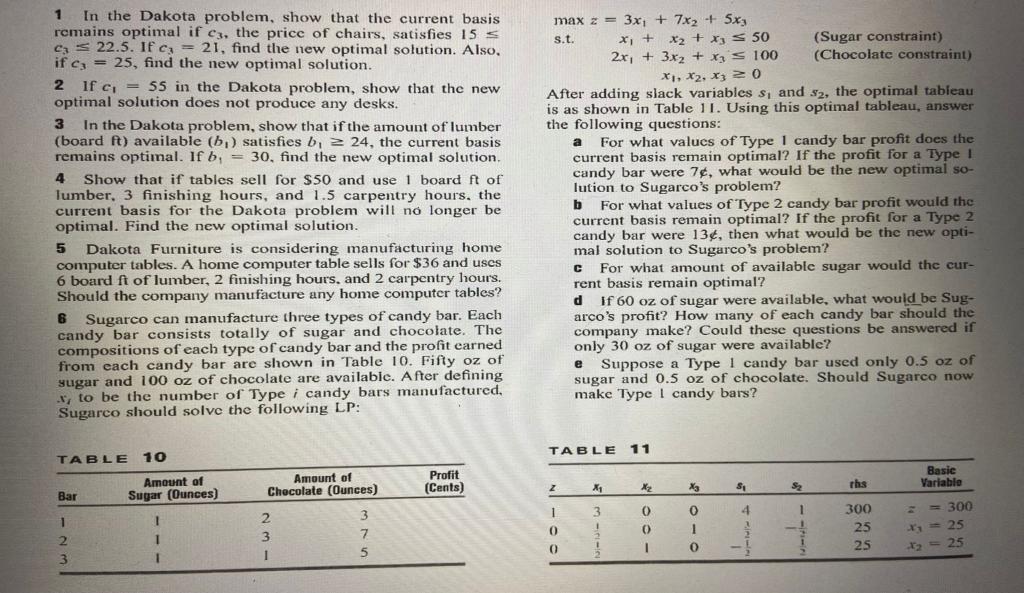

a 1 In the Dakota problem, show that the current basis remains optimal if c3, the price of chairs, satisfies 155 C = 22.5. If c = 21, find the new optimal solution. Also, if c; = 25, find the new optimal solution. 2 if c = 55 in the Dakota problem, show that the new optimal solution does not produce any desks. 3 In the Dakota problem, show that if the amount of lumber (board ft) available (b) satisfies b, 224, the current basis remains optimal. If b, = 30, find the new optimal solution, 4 Show that if tables sell for $50 and use 1 board ft of lumber, 3 finishing hours, and 1.5 carpentry hours, the current basis for the Dakota problem will no longer be optimal. Find the new optimal solution. 5 Dakota Furniture is considering manufacturing home computer tables. A home computer table sells for $36 and uses 6 board ft of lumber, 2 finishing hours, and 2 carpentry hours. Should the company manufacture any home computer tables? 6 Sugarco can manufacture three types of candy bar. Each candy bar consists totally of sugar and chocolate. The compositions of each type of candy bar and the profit earned from each candy bar are shown in Table 10. Fifty oz of sugar and 100 oz of chocolate are available. After defining .x, to be the number of Type i candy bars manufactured, Sugarco should solve the following LP: max 2 = 3x + 7x2 + 5x St. x + X2 + xy S 50 (Sugar constraint) 2x + 3x2 + xy S 100 (Chocolate constraint) X1, X2, X3 20 After adding slack variables s, and 52, the optimal tableau is as shown in Table 11. Using this optimal tableau, answer the following questions: For what values of Type I candy bar profit does the current basis remain optimal? If the profit for a Type I candy bar were 74, what would be the new optimal so- lution to Sugarco's problem? b For what values of Type 2 candy bar profit would the current basis remain optimal? If the profit for a Type 2 candy bar were 13, then what would be the new opti- mal solution to Sugarco's problem? For what amount of available sugar would the cur- rent basis remain optimal? If 60 oz of sugar were available, what would be Sug- arco's profit? How many of each candy bar should the company make? Could these questions be answered if only 30 oz of sugar were available? Suppose a Type I candy bar used only 0.5 oz of sugar and 0.5 oz of chocolate. Should Sugarco now make Type I candy bars? 1 e TABLE 11 TABLE 10 Amount of Sugar (Ounces) Amount of Chocolate (Ounces) Profit (Cents) Basic Variable Z X1 X X3 S, S this Bar 1 3 1 4 1 3 ! 0 0 0 1 2 3 7 0 1 0 300 25 25 300 * = 25 X = 25 3 1 5 0 1 1