Question: Please solve Question B Year 7,8 and 9 On August 3, Cinco Construction purchased special-purpose equipment at a cost of $4,100,000. The useful life of

Please solve Question B Year 7,8 and 9

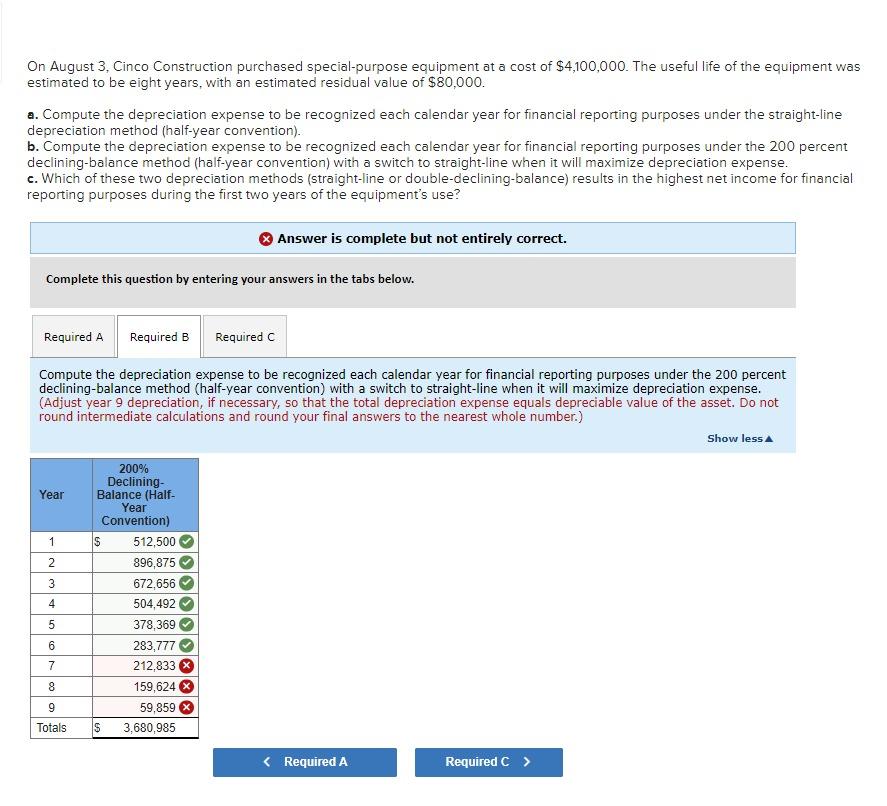

On August 3, Cinco Construction purchased special-purpose equipment at a cost of $4,100,000. The useful life of the equipment was estimated to be eight years, with an estimated residual value of $80,000. a. Compute the depreciation expense to be recognized each calendar year for financial reporting purposes under the straight-line depreciation method (half-year convention). b. Compute the depreciation expense to be recognized each calendar year for financial reporting purposes under the 200 percent declining balance method (half-year convention) with a switch to straight-line when it will maximize depreciation expense. c. Which of these two depreciation methods (straight-line or double-declining-balance) results in the highest net income for financial reporting purposes during the first two years of the equipment's use? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B Required Compute the depreciation expense to be recognized each calendar year for financial reporting purposes under the 200 percent declining-balance method (half-year convention) with a switch to straight-line when it will maximize depreciation expense. (Adjust year 9 depreciation, if necessary, so that the total depreciation expense equals depreciable value of the asset. Do not round intermediate calculations and round your final answers to the nearest whole number.) Show less Year 1 2 3 4 200% Declining- Balance (Half- Year Convention) $ 512,500 896,875 672,656 504,492 378,369 283,777 212.833 159,624 59,859 S 3,680,985 5 6 7 8 9 Totals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts