Question: please solve question (e), thanks Consider the following pre-merger information about a bidding firm (Firm B) and a target firm (Firm T). Assume that both

please solve question (e), thanks

please solve question (e), thanks

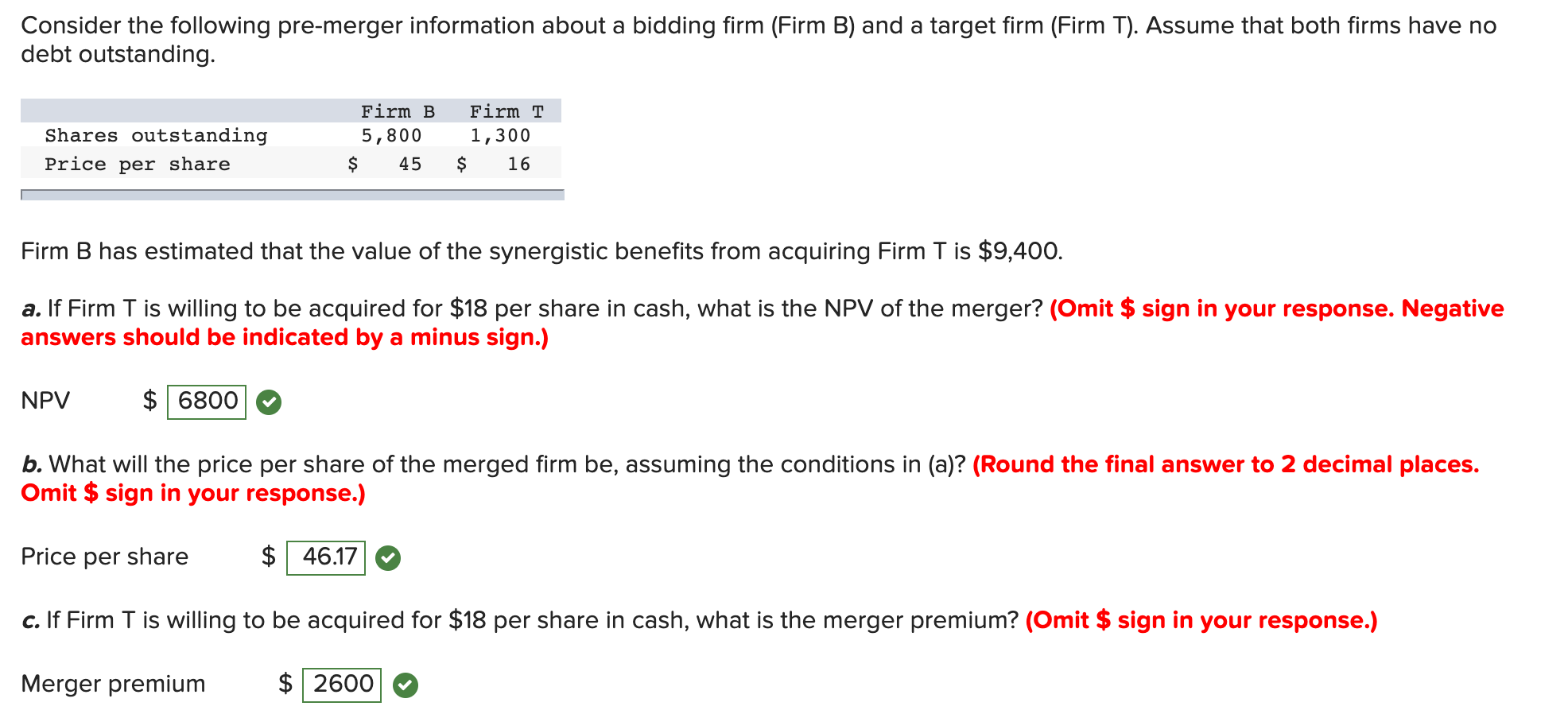

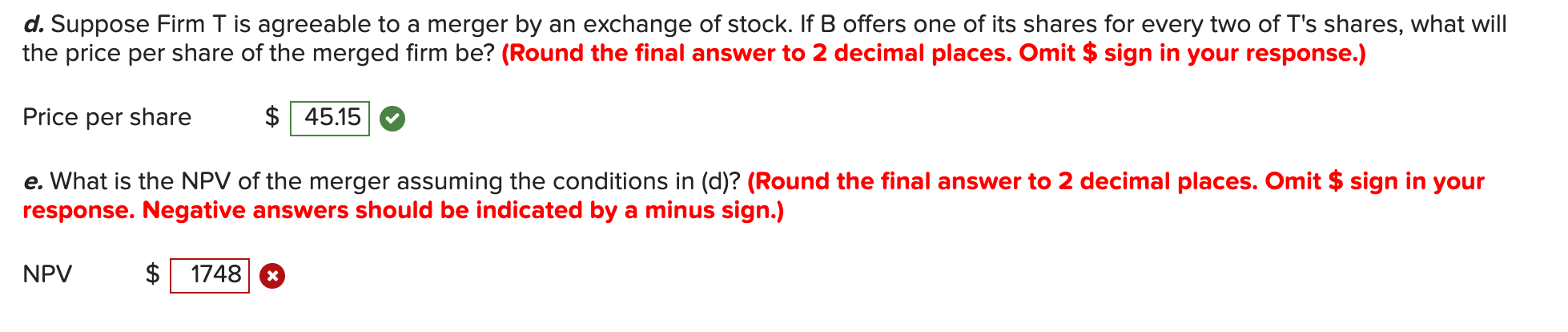

Consider the following pre-merger information about a bidding firm (Firm B) and a target firm (Firm T). Assume that both firms have no debt outstanding. Shares outstanding Price per share Firm B 5,800 $ 45 Firm T 1,300 $ 16 Firm B has estimated that the value of the synergistic benefits from acquiring Firm T is $9,400. a. If Firm T is willing to be acquired for $18 per share in cash, what is the NPV of the merger? (Omit $ sign in your response. Negative answers should be indicated by a minus sign.) NPV $ 6800 b. What will the price per share of the merged firm be, assuming the conditions in (a)? (Round the final answer to 2 decimal places. Omit $ sign in your response.) Price per share $ 46.17 c. If Firm T is willing to be acquired for $18 per share in cash, what is the merger premium? (Omit $ sign in your response.) Merger premium $ 2600 d. Suppose Firm T is agreeable to a merger by an exchange of stock. If B offers one of its shares for every two of T's shares, what will the price per share of the merged firm be? (Round the final answer to 2 decimal places. Omit $ sign in your response.) Price per share $ 45.15 e. What is the NPV of the merger assuming the conditions in (d)? (Round the final answer to 2 decimal places. Omit $ sign in your response. Negative answers should be indicated by a minus sign.) NPV $ 1748 x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts