Question: please solve questions 3 and 4 QUESTION 1 Given the following information on a MPT, what is the anticipated total cash flow available to investors

please solve questions 3 and 4

please solve questions 3 and 4

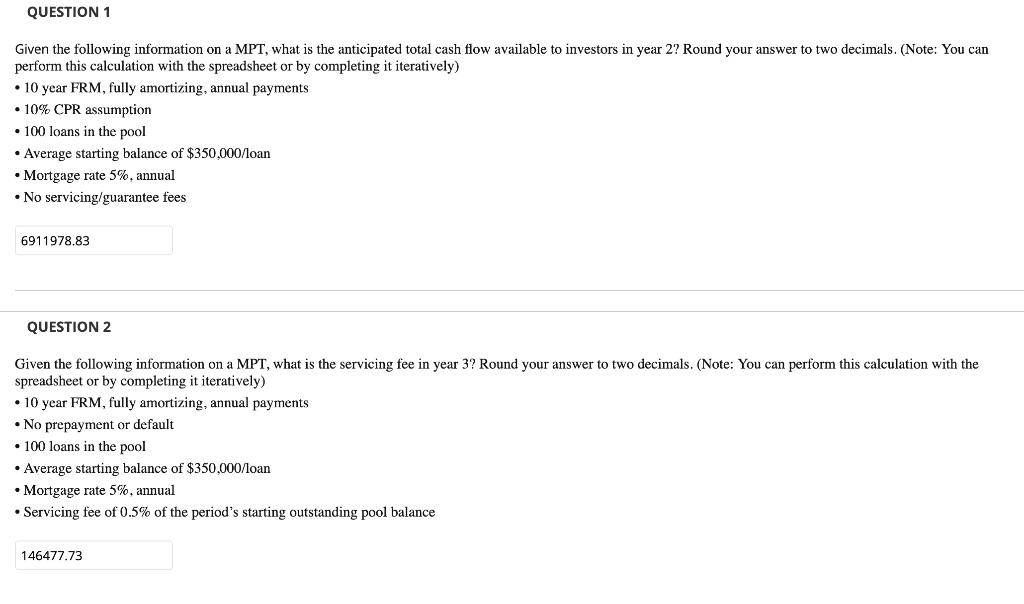

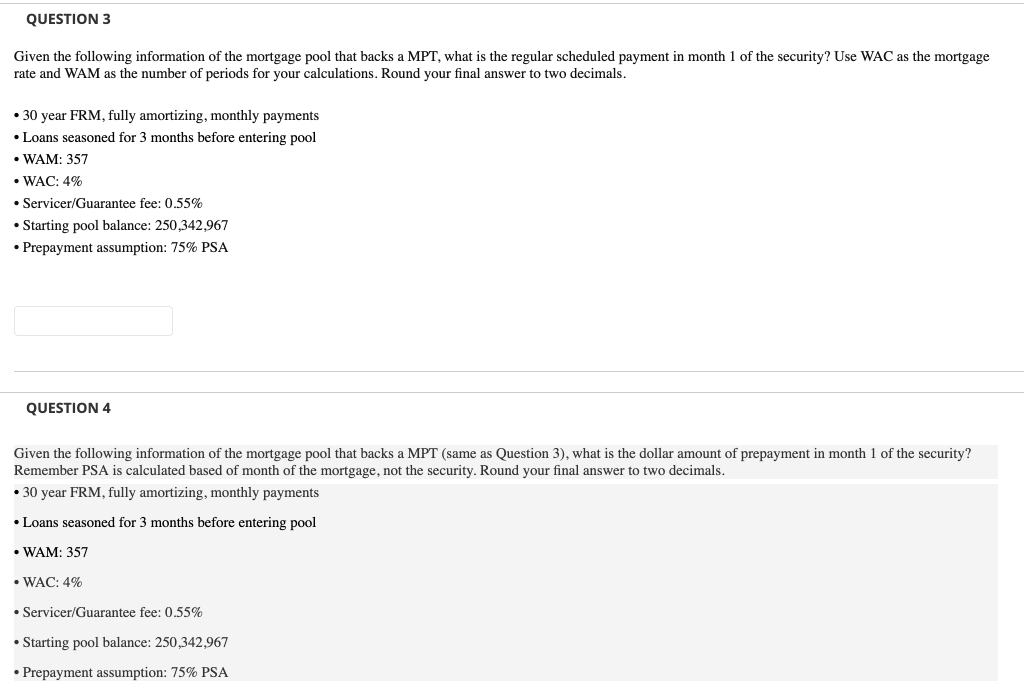

QUESTION 1 Given the following information on a MPT, what is the anticipated total cash flow available to investors in year 2? Round your answer to two decimals. (Note: You can perform this calculation with the spreadsheet or by completing it iteratively) 10 year FRM, fully amortizing, annual payments 10% CPR assumption 100 loans in the pool Average starting balance of $350,000/loan Mortgage rate 5% annual No servicing/guarantee fees 6911978.83 QUESTION 2 Given the following information on a MPT, what is the servicing fee in year 3? Round your answer to two decimals. (Note: You can perform this calculation with the spreadsheet or by completing it iteratively) 10 year FRM, fully amortizing, annual payments No prepayment or default 100 loans in the pool Average starting balance of $350,000/loan Mortgage rate 5%, annual Servicing fee of 0.5% of the period's starting outstanding pool balance 146477.73 QUESTION 3 Given the following information of the mortgage pool that backs a MPT, what is the regular scheduled payment in month 1 of the security? Use WAC as the mortgage rate and WAM as the number of periods for your calculations. Round your final answer to two decimals. 30 year FRM, fully amortizing, monthly payments Loans seasoned for 3 months before entering pool WAM: 357 WAC: 4% Servicer/Guarantee fee: 0.55% Starting pool balance: 250,342,967 Prepayment assumption: 75% PSA QUESTION 4 Given the following information of the mortgage pool that backs a MPT (same as Question 3), what is the dollar amount of prepayment in month 1 of the security? Remember PSA is calculated based of month of the mortgage, not the security. Round your final answer to two decimals. 30 year FRM, fully amortizing, monthly payments Loans seasoned for 3 months before entering pool WAM: 357 WAC: 4% Servicer/Guarantee fee: 0.55% Starting pool balance: 250,342,967 Prepayment assumption: 75% PSA QUESTION 1 Given the following information on a MPT, what is the anticipated total cash flow available to investors in year 2? Round your answer to two decimals. (Note: You can perform this calculation with the spreadsheet or by completing it iteratively) 10 year FRM, fully amortizing, annual payments 10% CPR assumption 100 loans in the pool Average starting balance of $350,000/loan Mortgage rate 5% annual No servicing/guarantee fees 6911978.83 QUESTION 2 Given the following information on a MPT, what is the servicing fee in year 3? Round your answer to two decimals. (Note: You can perform this calculation with the spreadsheet or by completing it iteratively) 10 year FRM, fully amortizing, annual payments No prepayment or default 100 loans in the pool Average starting balance of $350,000/loan Mortgage rate 5%, annual Servicing fee of 0.5% of the period's starting outstanding pool balance 146477.73 QUESTION 3 Given the following information of the mortgage pool that backs a MPT, what is the regular scheduled payment in month 1 of the security? Use WAC as the mortgage rate and WAM as the number of periods for your calculations. Round your final answer to two decimals. 30 year FRM, fully amortizing, monthly payments Loans seasoned for 3 months before entering pool WAM: 357 WAC: 4% Servicer/Guarantee fee: 0.55% Starting pool balance: 250,342,967 Prepayment assumption: 75% PSA QUESTION 4 Given the following information of the mortgage pool that backs a MPT (same as Question 3), what is the dollar amount of prepayment in month 1 of the security? Remember PSA is calculated based of month of the mortgage, not the security. Round your final answer to two decimals. 30 year FRM, fully amortizing, monthly payments Loans seasoned for 3 months before entering pool WAM: 357 WAC: 4% Servicer/Guarantee fee: 0.55% Starting pool balance: 250,342,967 Prepayment assumption: 75% PSA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts