Question: Please solve questions e ) , f ) , g ) and show steps on how to solve. Thanks ( e ) ( 3 marks

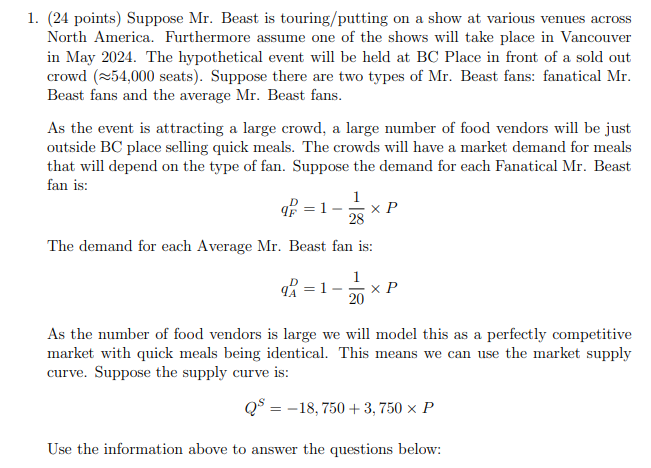

Please solve questions e f g and show steps on how to solve. Thanks e marks Suppose the government imposes a tax driving the price of a quick meal up to $ and the tax incidence on consumers is What is the value of the per unit tax? Whats the government revenue? How large of a deadweight loss would exist?

f marks Instead of a tax, suppose Vancouver city council becomes concerned with how much trash the Mr Beast fans could generate and limits the total number of quick meals to Q What happens to the price in this market hint: there will not be a shortage in the market How large is the deadweight loss here?

g marks Explain if producers prefer the outcome with no government, the imposition of a tax, or the quota using Producer Surplus.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock