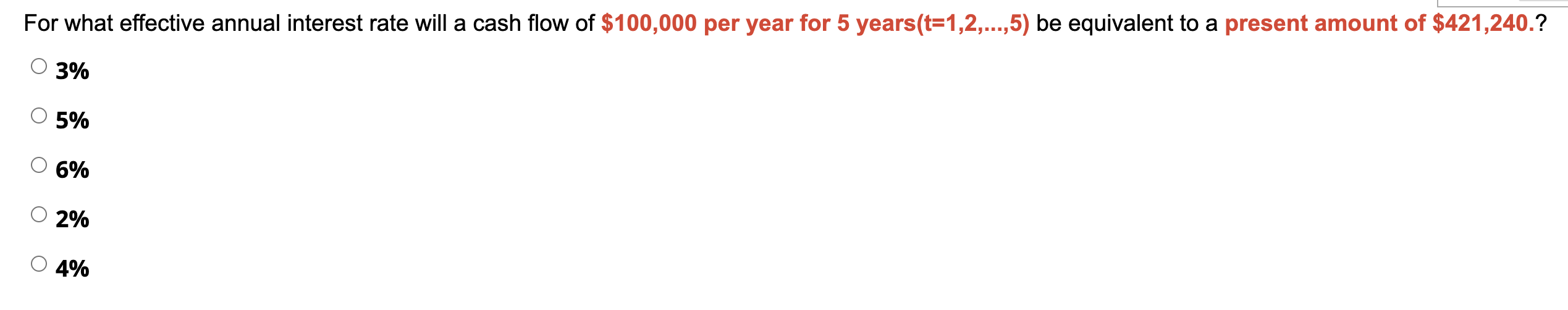

Question: Please solve quickly For what effective annual interest rate will a cash flow of $100,000 per year for 5 years(t=1,2,...,5) be equivalent to a present

Please solve quickly

Please solve quickly

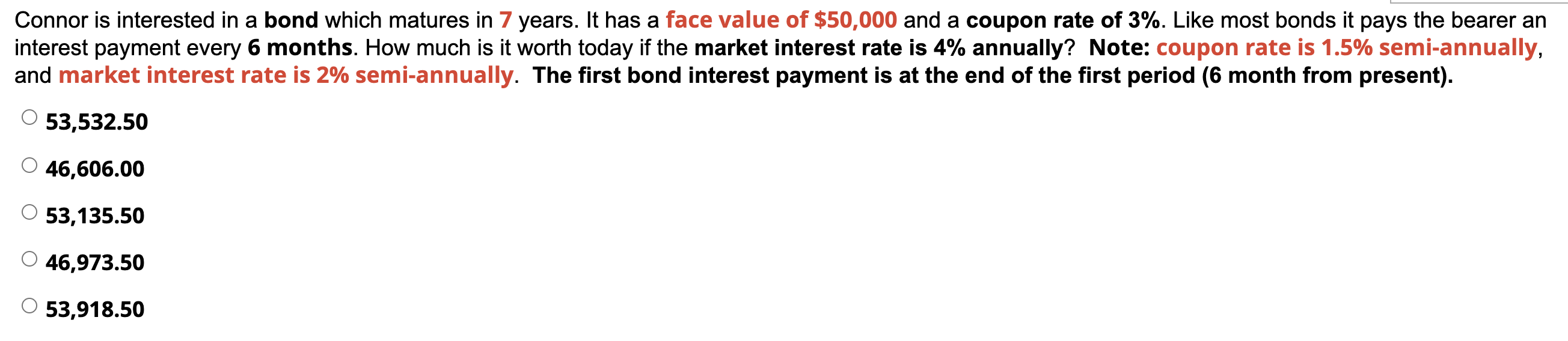

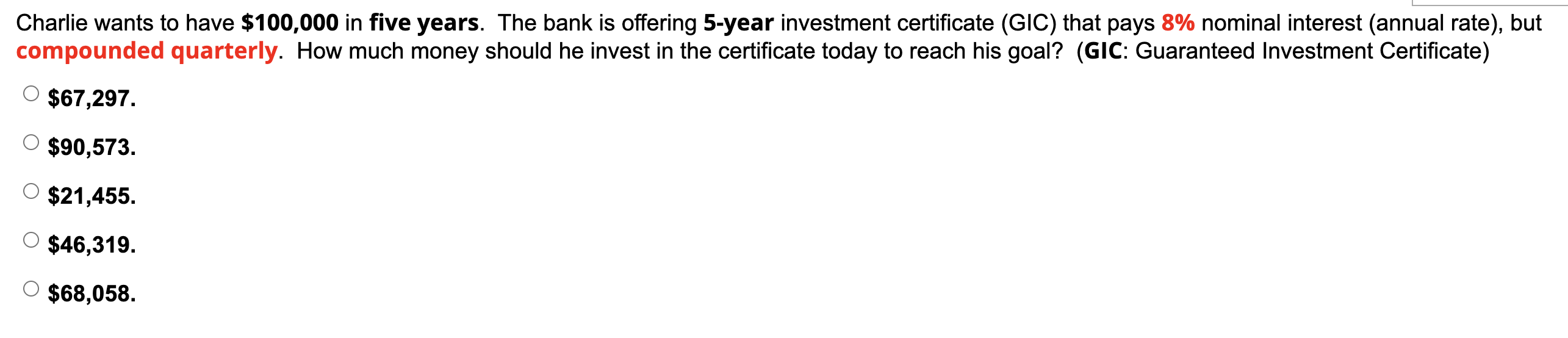

For what effective annual interest rate will a cash flow of $100,000 per year for 5 years(t=1,2,...,5) be equivalent to a present amount of $421,240.? O 3% 5% 6% 2% 4% Connor is interested in a bond which matures in 7 years. It has a face value of $50,000 and a coupon rate of 3%. Like most bonds it pays the bearer an interest payment every 6 months. How much is it worth today if the market interest rate is 4% annually? Note: coupon rate is 1.5% semi-annually, and market interest rate is 2% semi-annually. The first bond interest payment is at the end of the first period (6 month from present). 53,532.50 46,606.00 53,135.50 46,973.50 53,918.50 Charlie wants to have $100,000 in five years. The bank is offering 5-year investment certificate (GIC) that pays 8% nominal interest (annual rate), but compounded quarterly. How much money should he invest in the certificate today to reach his goal? (GIC: Guaranteed Investment Certificate) $67,297. $90,573. $21,455. $46,319. $68,058

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts