Question: please solve : section 1 section 2 section 3 TAX TABLES Tax rates & allowances for 2021/22 The current rates and allowances for income tax,

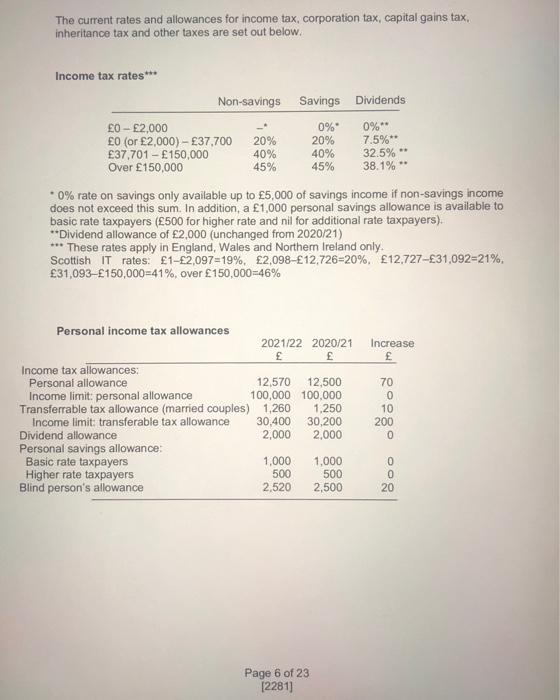

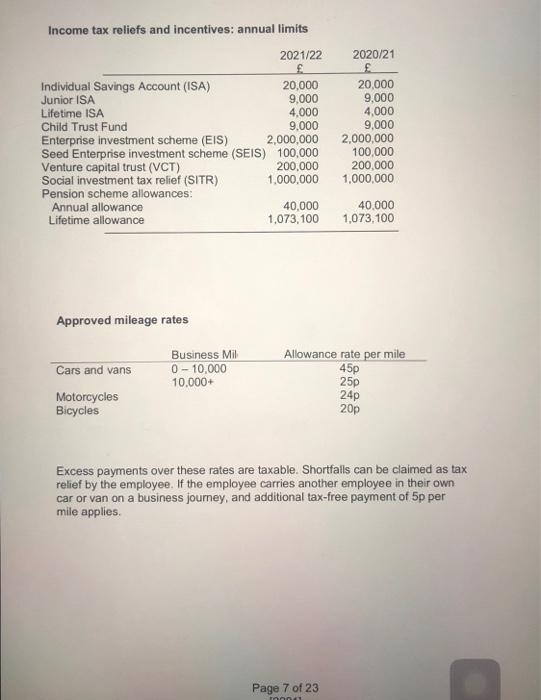

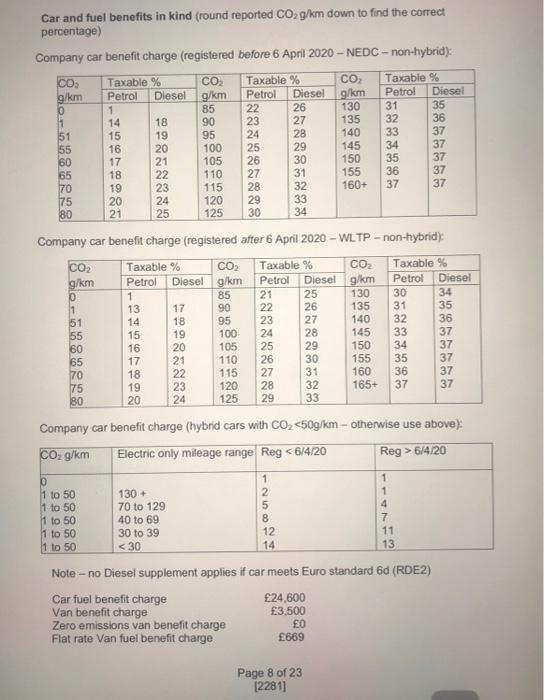

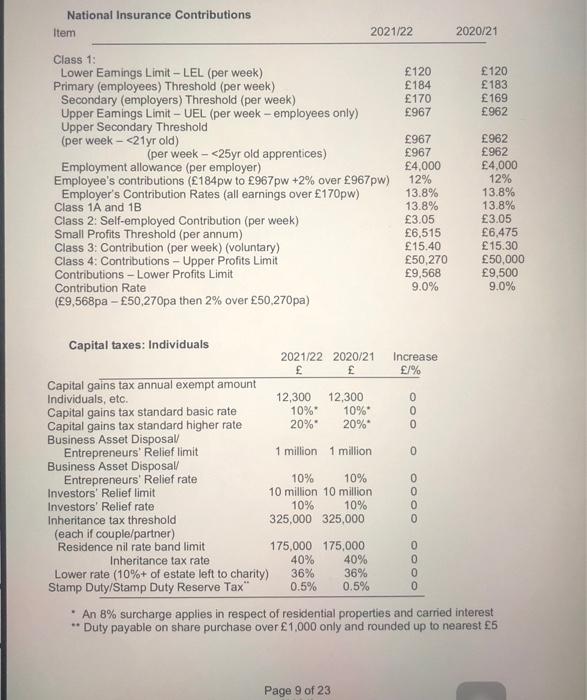

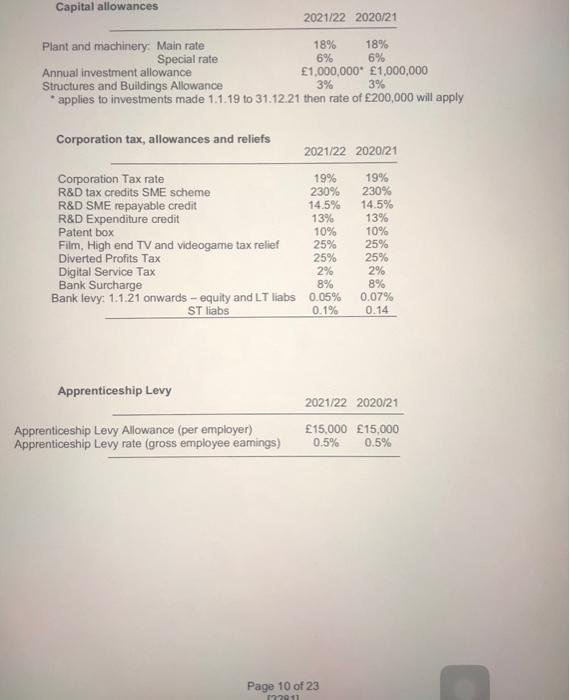

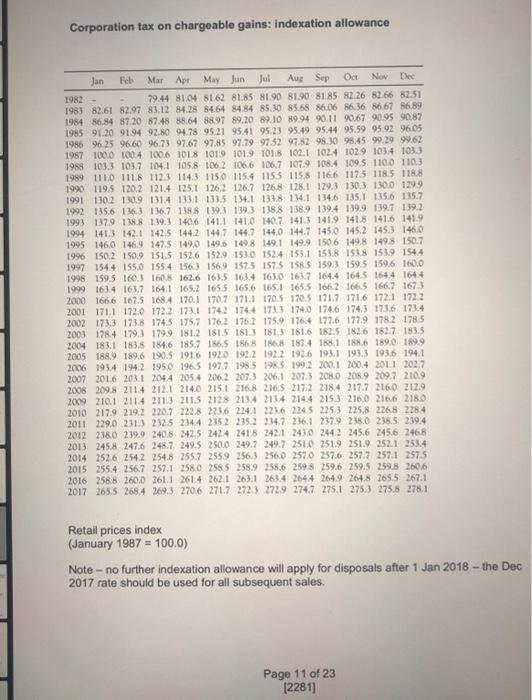

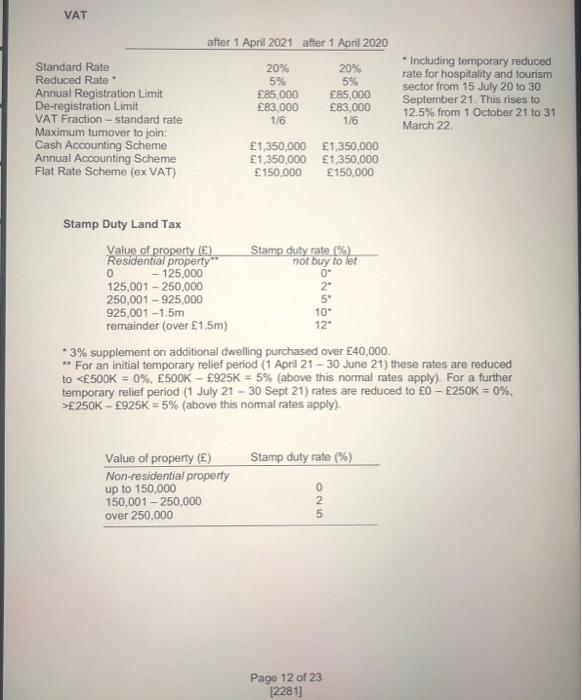

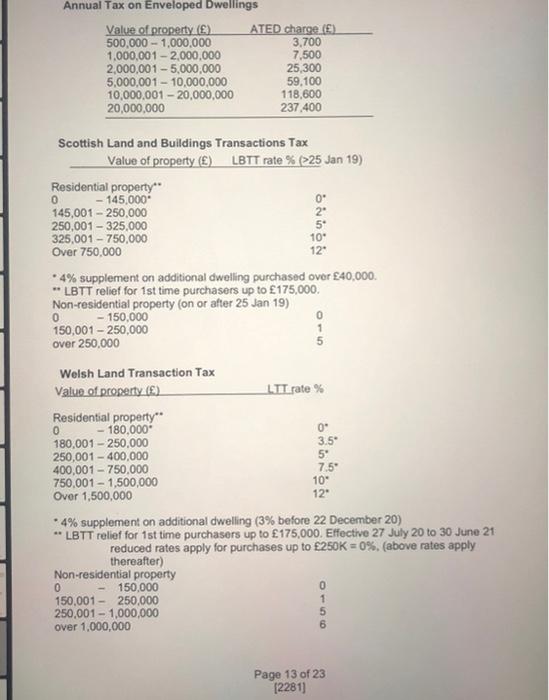

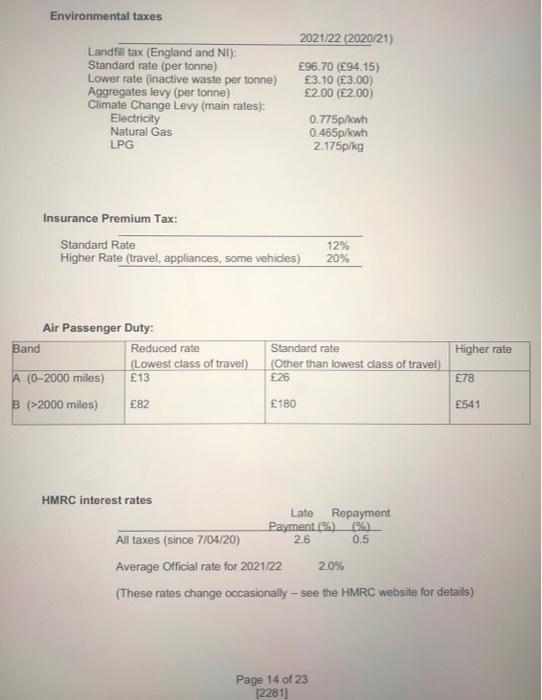

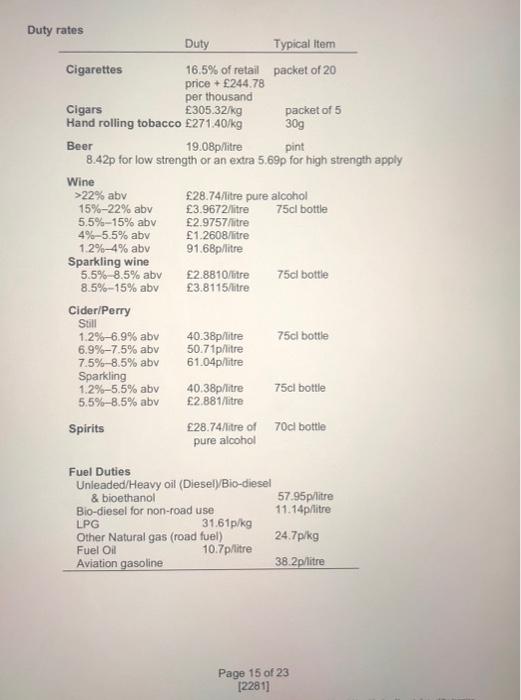

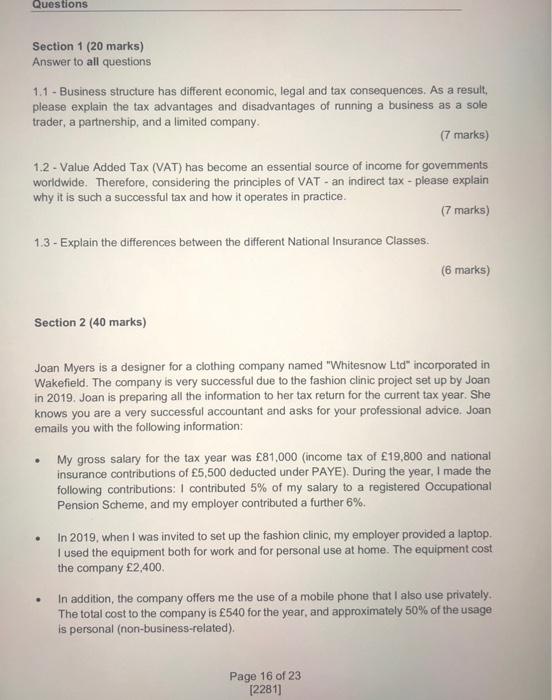

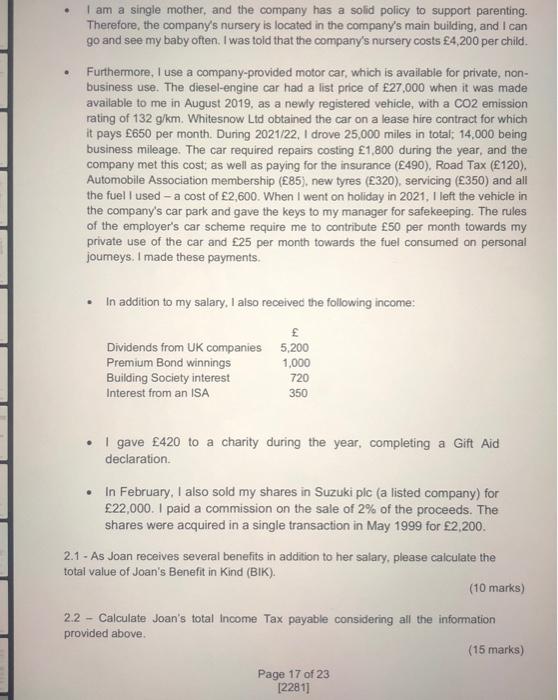

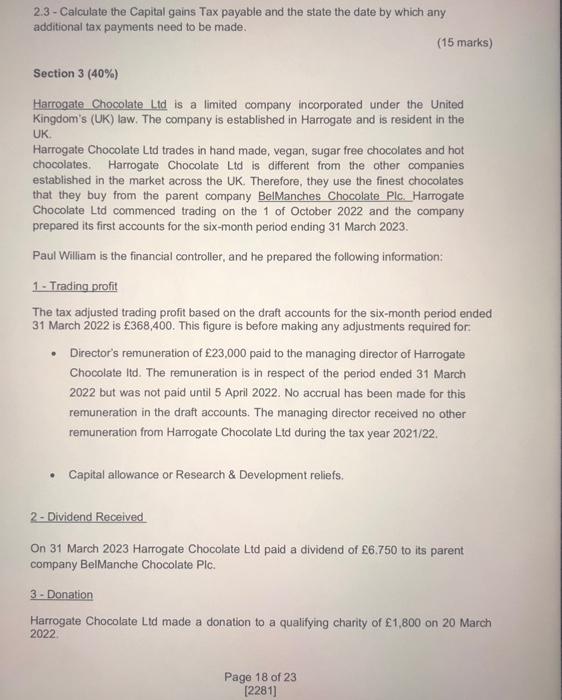

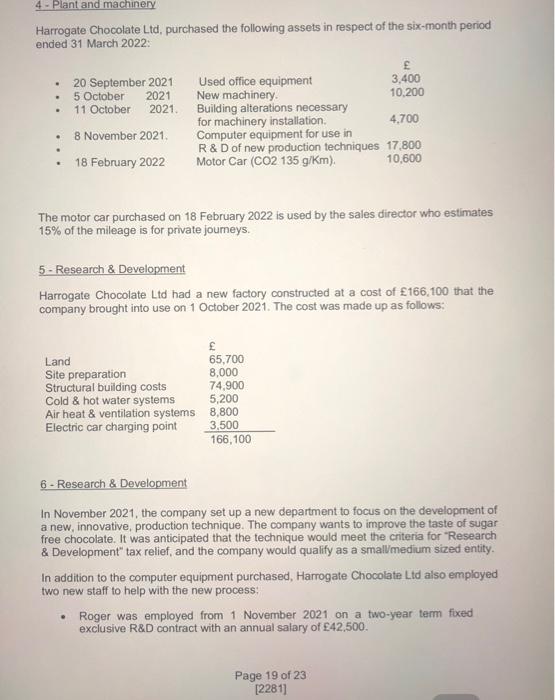

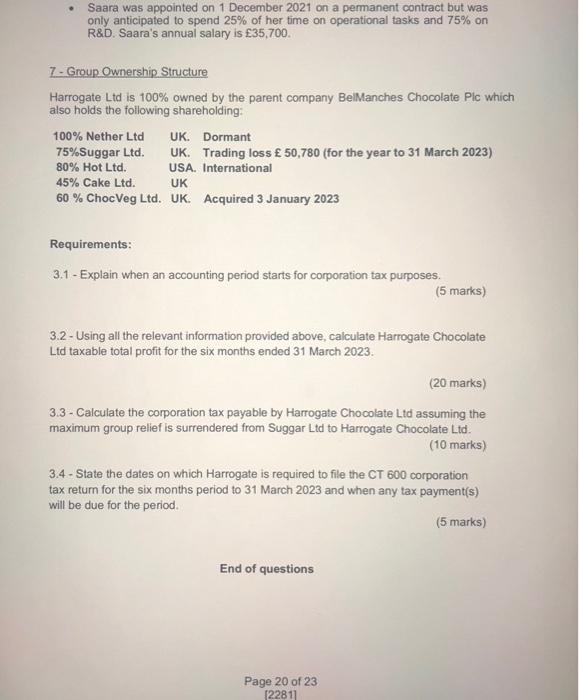

TAX TABLES Tax rates \& allowances for 2021/22 The current rates and allowances for income tax, corporation tax, capital gains tax. inheritance tax and other taxes are set out below. Income tax rates + - 0% rate on savings only available up to 5,000 of savings income if non-savings income does not exceed this sum. In addition, a 1,000 personal savings allowance is available to basic rate taxpayers ( 500 for higher rate and nil for additional rate taxpayers). "Dividend allowance of 2,000 (unchanged from 2020/21) *. These rates apply in England, Wales and Northem Ireland only. Scottish IT rates: 12,097=19%, 2,09812,726=20%,12,72731,092=21%, 31,093150,000=41%, over 150,000=46% Income tax reliefs and incentives: annual limits Approved mileage rates Excess payments over these rates are taxable. Shortfalls can be claimed as tax relief by the employee. If the employee carries another employee in their own car or van on a business journey, and additional tax-free payment of 5p per mile applies. Car and fuel benefits in kind (round reported CO2g/km down to find the correct percentage) Company car benefit charge (registered before 6 April 2020 - NEDC - non-hybrid): Company car benefit charge (registered after 6 April 2020 - WLTP - non-hybrid) Company car benefit charge (hybrid cars with CO2250K5925K=5% (above this nomal rates apply). Scottish Land and Buildings Transactions Tax Value of property (E) LBTT rate % (>25 Jan 19) - 4% supplement on additional dwelling purchased over E40,000 * LBTT relief for 1 st time purchasers up to 175,000. Non-residential property (on or after 25 Jan 19) - 4% supplement on additional dwelling ( 3% before 22 December 20 ) * LBTT relief for 1 st time purchasers up to 175,000. Effective 27 July 20 to 30 June 21 reduced rates apply for purchases up to 2250K=0%, (above rates apply thereafter) Air Passenger Duty: HMRC interest rates (These rates change occasionally - see the HMRC website for detalls) Duty 1.1 - Business structure has different economic, legal and tax consequences. As a result, please explain the tax advantages and disadvantages of running a business as a sole trader, a partnership, and a limited company. (7 marks) 1.2 - Value Added Tax (VAT) has become an essential source of income for govemments worldwide. Therefore, considering the principles of VAT - an indirect tax-please explain why it is such a successful tax and how it operates in practice. (7 marks) 1.3 - Explain the differences between the different National Insurance Classes. ( 6 marks) Section 2 ( 40 marks) Joan Myers is a designer for a clothing company named "Whitesnow Ltd" incorporated in Wakefield. The company is very successful due to the fashion clinic project set up by Joan in 2019. Joan is preparing all the information to her tax return for the current tax year. She knows you are a very successful accountant and asks for your professional advice. Joan emails you with the following information: - My gross salary for the tax year was 81,000 (income tax of 19,800 and national insurance contributions of 5,500 deducted under PAYE). During the year, I made the following contributions: 1 contributed 5% of my salary to a registered Occupational Pension Scheme, and my employer contributed a further 6%. - In 2019, when I was invited to set up the fashion clinic, my employer provided a laptop. I used the equipment both for work and for personal use at home. The equipment cost the company 2,400. - In addition, the company offers me the use of a mobile phone that I also use privately. The total cost to the company is 540 for the year, and approximately 50% of the usage is personal (non-business-related). Therefore, the company's nursery is located in the company's main building, and I can go and see my baby often. I was toid that the company's nursery costs 4,200 per child. - Furthermore, I use a company-provided motor car, which is available for private, nonbusiness use. The diesel-engine car had a list price of 27,000 when it was made available to me in August 2019, as a newly registered vehicle, with a CO2 emission rating of 132g/km. Whitesnow Ltd obtained the car on a lease hire contract for which it pays 650 per month. During 2021/22, I drove 25,000 miles in total; 14,000 being business mileage. The car required repairs costing 1,800 during the year, and the company met this cost; as well as paying for the insurance ( 490), Road Tax ( 120). Automobile Association membership ( 85), new tyres (320), servicing (350) and all the fuel I used - a cost of 2,600. When I went on holiday in 2021 , I left the vehicle in the company's car park and gave the keys to my manager for safekeeping. The rules of the employer's car scheme require me to contribute 50 per month towards my private use of the car and 25 per month towards the fuel consumed on personal joumeys. I made these payments. - In addition to my salary, I also received the following income: - I gave 420 to a charity during the year, completing a Gift Aid declaration. - In February, I also sold my shares in Suzuki plc (a listed company) for 22,000. 1 paid a commission on the sale of 2% of the proceeds. The shares were acquired in a single transaction in May 1999 for 2,200. 2.1 - As Joan receives several benefits in addition to her salary, please calculate the totai value of Joan's Benefit in Kind (BIK). (10 marks) 2.2 - Calculate Joan's total income Tax payable considering all the information provided above. (15 marks) 2.3-Calculate the Capital gains Tax payable and the state the date by which any additional tax payments need to be made. (15 marks) Section 3(40%) Harrogate Chocolate Ltd is a limited company incorporated under the United Kingdom's (UK) law. The company is established in Harrogate and is resident in the UK. Harrogate Chocolate Ltd trades in hand made, vegan, sugar free chocolates and hot chocolates, Harrogate Chocolate Ltd is different from the other companies established in the market across the UK. Therefore, they use the finest chocolates that they buy from the parent company BelManches Chocolate Plc. Harrogate Chocolate Ltd commenced trading on the 1 of October 2022 and the company prepared its first accounts for the six-month period ending 31 March 2023. Paul William is the financial controller, and he prepared the following information: 1- Trading profit The tax adjusted trading profit based on the draft accounts for the six-month period ended 31 March 2022 is 368,400. This figure is before making any adjustments required for: - Director's remuneration of 23,000 paid to the managing director of Harrogate Chocolate itd. The remuneration is in respect of the period ended 31 March 2022 but was not paid until 5 April 2022. No accrual has been made for this remuneration in the draft accounts. The managing director received no other remuneration from Harrogate Chocolate Ltd during the tax year 2021/22. - Capital allowance or Research \& Development reliefs. 2- Dividend Received On 31 March 2023 Harrogate Chocolate Ltd paid a dividend of 6.750 to its parent company BelManche Chocolate Plc. 3-Donation Harrogate Chocolate Ltd made a donation to a qualifying charity of 1,800 on 20 March 2022. Page 18 of 23 [2281] Harrogate Chocolate Ltd, purchased the following assets in respect of the six-month period ended 31 March 2022: The motor car purchased on 18 February 2022 is used by the sales director who estimates 15% of the mileage is for private journeys. 5- Research \& Development Harrogate Chocolate Ltd had a new factory constructed at a cost of 166,100 that the company brought into use on 1 October 2021 . The cost was made up as follows: 6 - Research \& Development In November 2021, the company set up a new department to focus on the development of a new, innovative, production technique. The company wants to improve the taste of sugar free chocolate. It was anticipated that the technique would meet the criteria for "Research & Development" tax relief, and the company would qualify as a smallmedium sized entity. In addition to the computer equipment purchased, Harrogate Chocolate Ltd also employed two new staff to help with the new process: - Roger was employed from 1 November 2021 on a two-year term fixed exclusive R\&D contract with an annual salary of 42,500. - Saara was appointed on 1 December 2021 on a permanent contract but was only anticipated to spend 25% of her time on operational tasks and 75% on R\&D. Saara's annual salary is 35,700. 7- Group Ownership Structure Harrogate Ltd is 100% owned by the parent company BelManches Chocolate Plc which also holds the following shareholding: Requirements: 3.1 - Explain when an accounting period starts for corporation tax purposes. (5 marks) 3.2 - Using all the relevant information provided above, calculate Harrogate Chocolate Ltd taxable total profit for the six months ended 31 March 2023. (20 marks) 3.3 - Calculate the corporation tax payable by Harrogate Chocolate Ltd assuming the maximum group relief is surrendered from Suggar Ltd to Harrogate Chocolate Ltd. (10 marks) 3.4- State the dates on which Harrogate is required to file the CT 600 corporation tax retum for the six months period to 31 March 2023 and when any tax payment(s) will be due for the period. (5 marks) End of questions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts