Question: Please solve showing every stepand formular no room for except thank you Assignment 2 (opt... BUSI 2121 Case First Draft pd PRESENTATION.pd 2 12 Question

Please solve showing every stepand formular no room for except thank you

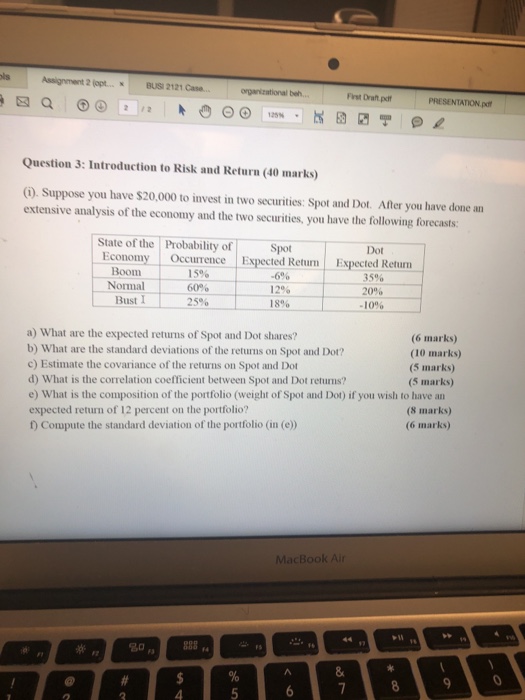

Please solve showing every stepand formular no room for except thank you Assignment 2 (opt... BUSI 2121 Case First Draft pd PRESENTATION.pd 2 12 Question 3: Introduction to Risk and Return (40 marks) (1). Suppose you have $20,000 to invest in two securities: Spot and Dot. After you have done an extensive analysis of the economy and the two securities, you have the following forecasts: State of the Probabiity ofSpot Dot Economy Occurrence Expected Return Expected Return Boom Normal Bust I 1 500 60% 25% -6% 12% 18% 35% 20% -10% (6 marks) (10 marks) (5 marks) (5 marks) a) What are the expected returns of Spot and Dot shares? b) What are the standard deviations of the retums on Spot and Dot? c) Estimate the covariance of the returns on Spot and Dot d) What is the correlation coefficient between Spot and Dot retuns? e) What is the composition of the portfolio (weight of Spot and Dot) if you wish to have an expected return of 12 percent on the portfolio? 1 Compute the standard deviation of the portfolio (in (e) (8 marks) (6 marks) MacBook Ai 0888

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts