Question: Please solve step by step, current same answer solved by someone on chegg is wrong ABC Ltd expects that its net income and capital expenditures

Please solve step by step, current same answer solved by someone on chegg is wrong

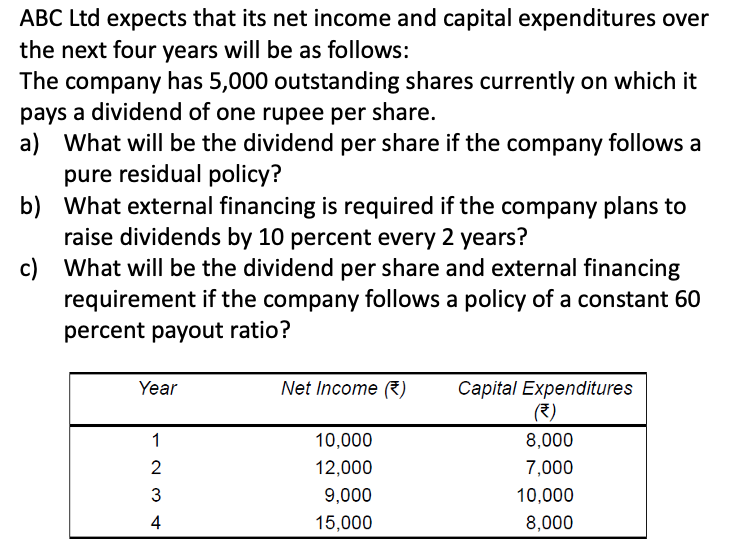

ABC Ltd expects that its net income and capital expenditures over the next four years will be as follows: The company has 5,000 outstanding shares currently on which it pays a dividend of one rupee per share. a) What will be the dividend per share if the company follows a pure residual policy? b) What external financing is required if the company plans to raise dividends by 10 percent every 2 years? c) What will be the dividend per share and external financing requirement if the company follows a policy of a constant 60 percent payout ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts