Question: Please solve the above questions and show your work (correct answers given). Question 6 0 out of 1 points Planning for your retirement In this

Please solve the above questions and show your work (correct answers given).

Please solve the above questions and show your work (correct answers given).

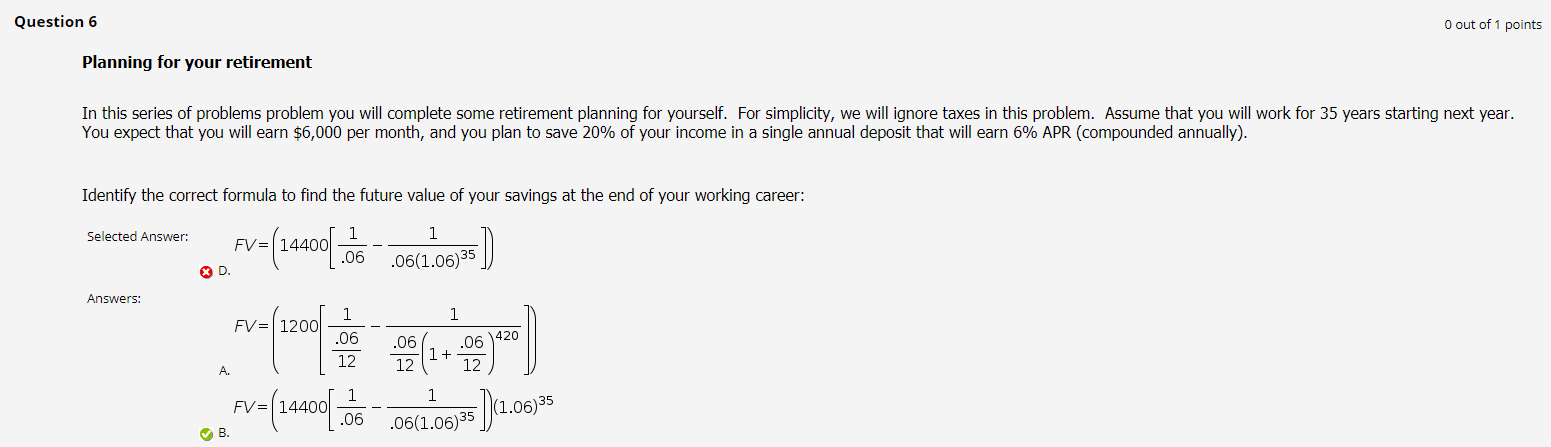

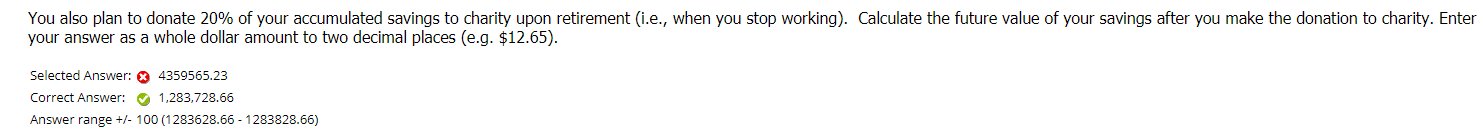

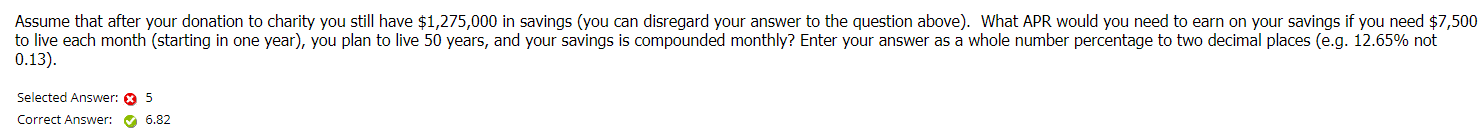

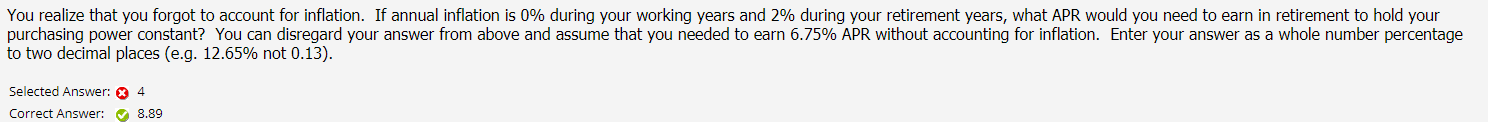

Question 6 0 out of 1 points Planning for your retirement In this series of problems problem you will complete some retirement planning for yourself. For simplicity, we will ignore taxes in this problem. Assume that you will work for 35 years starting next year. You expect that you will earn $6,000 per month, and you plan to save 20% of your income in a single annual deposit that will earn 6% APR (compounded annually). Identify the correct formula to find the future value of your savings at the end of your working career: Selected Answer: 1 -v=(20001.. -06(1.06)35 ) Answers: FV= 1200 1 .06 12 .06 12 1 420 .06 1+ 12 A. PV=(2,400 1 .06 .06(1.0)35 )(1.06)35 B. You also plan to donate 20% of your accumulated savings to charity upon retirement (i.e., when you stop working). Calculate the future value of your savings after you make the donation to charity. Enter your answer as a whole dollar amount to two decimal places (e.g. $12.65). Selected Answer: 4359565.23 Correct Answer: 1,283,728.66 Answer range +/- 100 (1283628.66 - 1283828.66) Assume that after your donation to charity you still have $1,275,000 in savings (you can disregard your answer to the question above). What APR would you need to earn on your savings if you need $7,500 to live each month (starting in one year), you plan to live 50 years, and your savings is compounded monthly? Enter your answer as a whole number percentage to two decimal places (e.g. 12.65% not 0.13). Selected Answer: 5 Correct Answer: 6.82 You realize that you forgot to account for inflation. If annual inflation is 0% during your working years and 2% during your retirement years, what APR would you need to earn in retirement to hold your purchasing power constant? You can disregard your answer from above and assume that you needed to earn 6.75% APR without accounting for inflation. Enter your answer as a whole number percentage to two decimal places (e.g. 12.65% not 0.13). Selected Answer: X 4 Correct Answer: 8.89 Question 6 0 out of 1 points Planning for your retirement In this series of problems problem you will complete some retirement planning for yourself. For simplicity, we will ignore taxes in this problem. Assume that you will work for 35 years starting next year. You expect that you will earn $6,000 per month, and you plan to save 20% of your income in a single annual deposit that will earn 6% APR (compounded annually). Identify the correct formula to find the future value of your savings at the end of your working career: Selected Answer: 1 -v=(20001.. -06(1.06)35 ) Answers: FV= 1200 1 .06 12 .06 12 1 420 .06 1+ 12 A. PV=(2,400 1 .06 .06(1.0)35 )(1.06)35 B. You also plan to donate 20% of your accumulated savings to charity upon retirement (i.e., when you stop working). Calculate the future value of your savings after you make the donation to charity. Enter your answer as a whole dollar amount to two decimal places (e.g. $12.65). Selected Answer: 4359565.23 Correct Answer: 1,283,728.66 Answer range +/- 100 (1283628.66 - 1283828.66) Assume that after your donation to charity you still have $1,275,000 in savings (you can disregard your answer to the question above). What APR would you need to earn on your savings if you need $7,500 to live each month (starting in one year), you plan to live 50 years, and your savings is compounded monthly? Enter your answer as a whole number percentage to two decimal places (e.g. 12.65% not 0.13). Selected Answer: 5 Correct Answer: 6.82 You realize that you forgot to account for inflation. If annual inflation is 0% during your working years and 2% during your retirement years, what APR would you need to earn in retirement to hold your purchasing power constant? You can disregard your answer from above and assume that you needed to earn 6.75% APR without accounting for inflation. Enter your answer as a whole number percentage to two decimal places (e.g. 12.65% not 0.13). Selected Answer: X 4 Correct Answer: 8.89

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts