Question: You have a total of 10,000 to invest in three different funds - ToyTown, C&G and Pixel Ltd. The expected return and risk level for

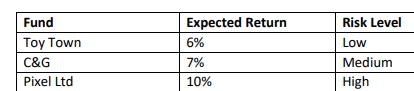

You have a total of £10,000 to invest in three different funds - ToyTown, C&G and Pixel Ltd. The expected return and risk level for each of the fund is given below table:

To minimise your risk across the three funds you decide to invest at least twice as much in Toy Town as you invest in C&G. You also decide that as Pixel Ltd is considered a high-risk fund, to limit the amount you invest in this fund to £2000.

Taking account of your decisions to minimise the risk, produce a model and determine the optimal amount to invest in each of the three funds so as to maximise the expected return?

What does your solution tell you about the problem?

Fund Expected Return Risk Level Toy Town 6% Low C&G 7% Medium Pixel Ltd 10% High

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

solution Let t c p be the amount of money invested in ... View full answer

Get step-by-step solutions from verified subject matter experts