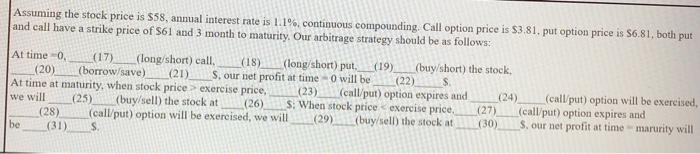

Question: please solve the blanks numbered 17, 18, 19, 20, 21, 22, 23, 24 Assuming the stock price is $58, annual interest rate is 1.1% continuous

Assuming the stock price is $58, annual interest rate is 1.1% continuous compounding, Call option price is $3,81, put option price is $6.81, both put and call have a strike price of S61 and 3 month to maturity. Our arbitrage strategy should be as follows: At time 0. (17) (long/short) call (18) (long/short) put. (19) (buy/short) the stock (20) (borrow/save) (21) S. our net profit at time - 0 will be (22) At time at maturity, when stock price > exercise price, (23) (call put) option expires and (call/put) option will be exercised, we will (25) (buy/sell) the stock at S: When stock price exercise price (27) (call/put) option expires and (call/put) option will be exercised, we will (29) (buy sell the stock at (30) S. our net profit at time marurity will be (31) (26) (28)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts