Question: Please solve the book tax difference. Problem 16-50 (LO 16-2) (Static) [The following information applies to the questions displayed below.] In 2021, OCC Corporation made

Please solve the book tax difference.

Please solve the book tax difference.

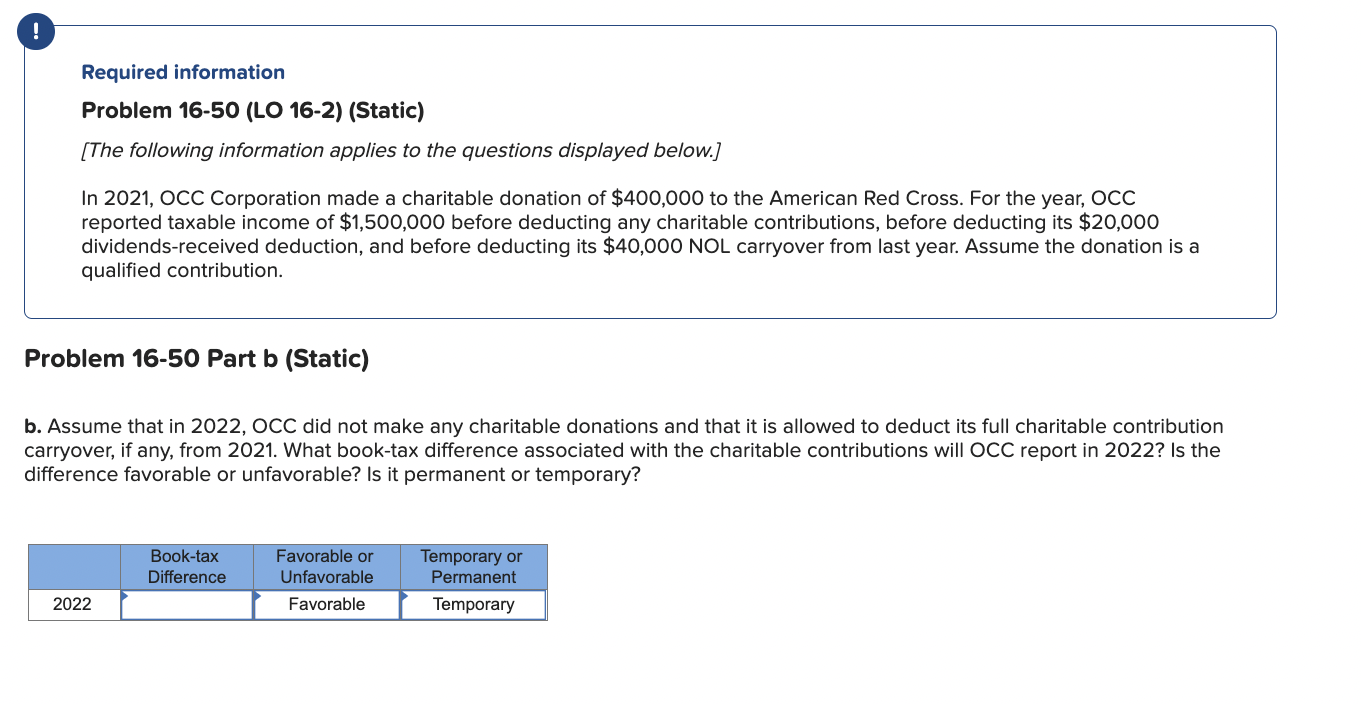

Problem 16-50 (LO 16-2) (Static) [The following information applies to the questions displayed below.] In 2021, OCC Corporation made a charitable donation of $400,000 to the American Red Cross. For the year, OCC reported taxable income of $1,500,000 before deducting any charitable contributions, before deducting its $20,000 dividends-received deduction, and before deducting its $40,000NOL carryover from last year. Assume the donation is a qualified contribution. roblem 16-50 Part b (Static) Assume that in 2022, OCC did not make any charitable donations and that it is allowed to deduct its full charitable contribution rryover, if any, from 2021. What book-tax difference associated with the charitable contributions will OCC report in 2022 ? Is the fference favorable or unfavorable? Is it permanent or temporary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts