Question: please solve the first one or two 3 P6-11 Current yield and yield to maturity An annual coupon bond has a $1,000 face value, coupon

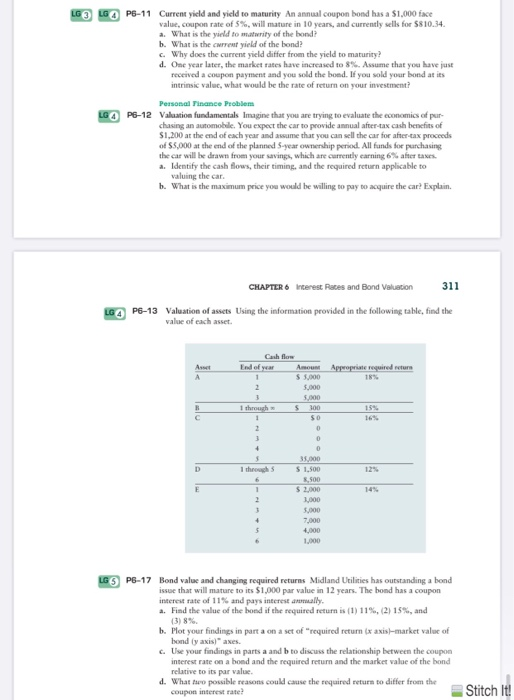

3 P6-11 Current yield and yield to maturity An annual coupon bond has a $1,000 face value, coupon rate of 5%, will mature in 10 years, and currently sells for $810.34. a. What is the yield to maturity of the bond? b. What is the current yield of the bond? c. Why does the current yield differ from the yield to maturity? d. One year later, the market rates have increased to 8%. Assume that you have just received a coupon payment and you sold the bond. If you sold your bond at its intrinsic value, what would be the rate of return on your investment? Personal Finance Problem LG P6-12 Valuation fundamentals Imagine that you are trying to evaluate the economics of pur- chasing an automobile. You expect the car to provide annual after-tax cash benefits of $1,200 at the end of each year and assume that you can sell the car for after tax proceeds of $5,000 at the end of the planned 5-year ownership period. All funds for purchasing the car will be drawn from your savings, which are currently earning 6% after taxes a. Identify the cash flows, their timing, and the required return applicable to valuing the car. b. What is the maximum price you would be willing to pay to acquire the car? Explain. CHAPTER 6 Interest Races and Bond Valuation 311 LG P8-13 Valuation of assets Using the information provided in the following table, find the value of each anet A A Cash flow End of year Amount Appropriate required return 1 $ 500 2 3 5,000 1 through 5 300 1 $0 2 0 0 0 35,000 1 throuchs $ 1.500 6. 8,500 1 $ 2,000 2 1,000 1 5,000 + 7,000 5 4,000 D 5 P6-17 Bond value and changing required returns Midland Utilities has outstanding a bond issue that will mature to its $1,000 par value in 12 years. The bond has a coupon interest rate of 11% and pays interest armally .. Find the value of the bond if the required return is (1) 11%, (2)15%, and b. Plot your findings in part a on a set of "required return (x axis-market value of bond (y axis axes. c. Use your findings in parts a and b to discuss the relationship between the coupon interest rate on a bond and the required return and the market value of the bond relative to its par value d. What two possible reasons could cause the required return to differ from the coupon interest rate! Stitch It

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts