Question: Please solve the following question using excel and show all work. Thank you! One year ago, your company purchased a machine used in manufacturing for

Please solve the following question using excel and show all work. Thank you!

Please solve the following question using excel and show all work. Thank you!

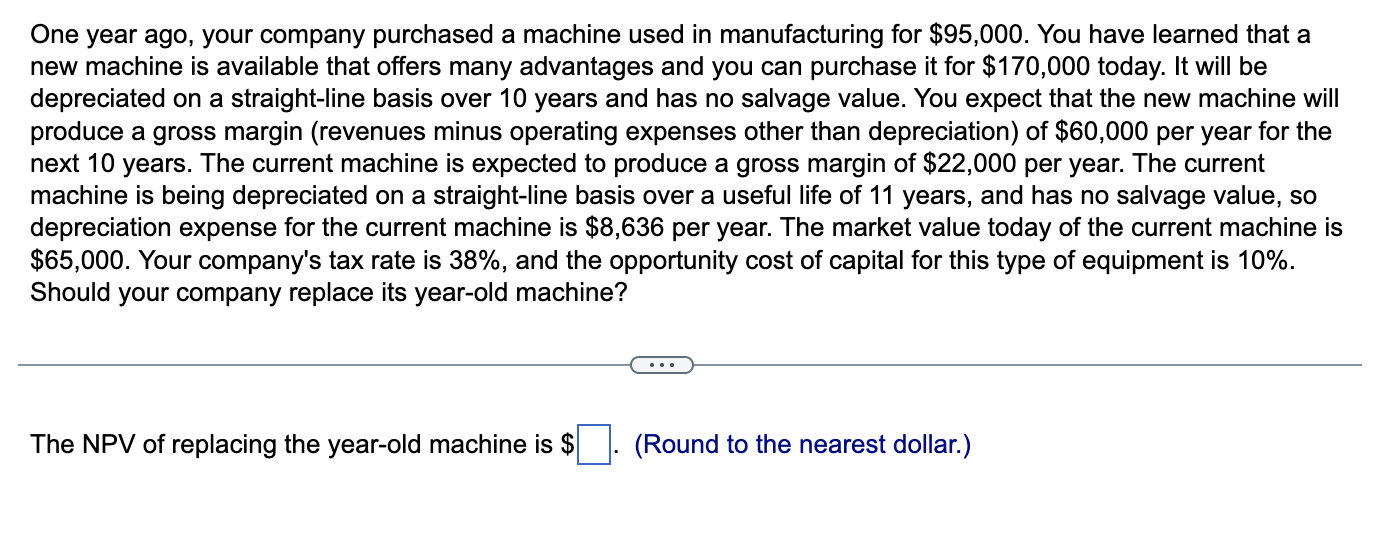

One year ago, your company purchased a machine used in manufacturing for $95,000. You have learned that a new machine is available that offers many advantages and you can purchase it for $170,000 today. It will be depreciated on a straight-line basis over 10 years and has no salvage value. You expect that the new machine will produce a gross margin (revenues minus operating expenses other than depreciation) of $60,000 per year for the next 10 years. The current machine is expected to produce a gross margin of $22,000 per year. The current machine is being depreciated on a straight-line basis over a useful life of 11 years, and has no salvage value, so depreciation expense for the current machine is $8,636 per year. The market value today of the current machine is $65,000. Your company's tax rate is 38%, and the opportunity cost of capital for this type of equipment is 10%. Should your company replace its year-old machine? The NPV of replacing the year-old machine is $. (Round to the nearest dollar.) One year ago, your company purchased a machine used in manufacturing for $95,000. You have learned that a new machine is available that offers many advantages and you can purchase it for $170,000 today. It will be depreciated on a straight-line basis over 10 years and has no salvage value. You expect that the new machine will produce a gross margin (revenues minus operating expenses other than depreciation) of $60,000 per year for the next 10 years. The current machine is expected to produce a gross margin of $22,000 per year. The current machine is being depreciated on a straight-line basis over a useful life of 11 years, and has no salvage value, so depreciation expense for the current machine is $8,636 per year. The market value today of the current machine is $65,000. Your company's tax rate is 38%, and the opportunity cost of capital for this type of equipment is 10%. Should your company replace its year-old machine? The NPV of replacing the year-old machine is $. (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts