Question: Please solve the following questions using EXCEL FILE! Consider the following expected cash flows of a company accrue to its shareholders. Given that the uncertainty

Please solve the following questions using EXCEL FILE!

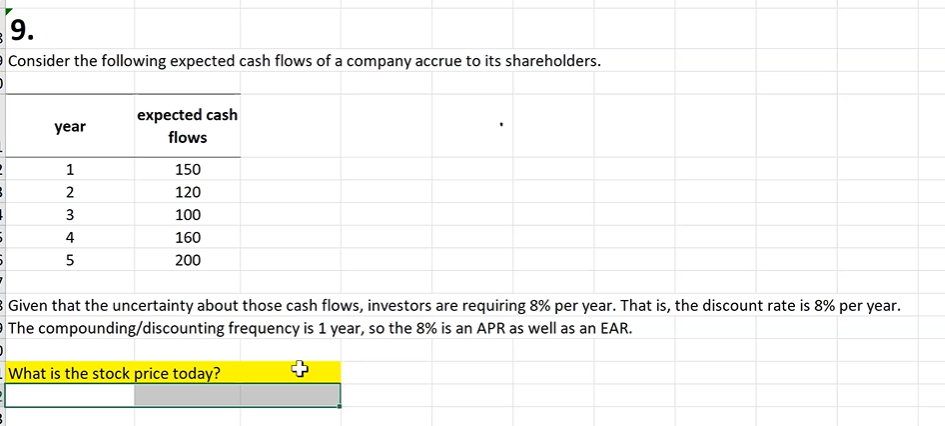

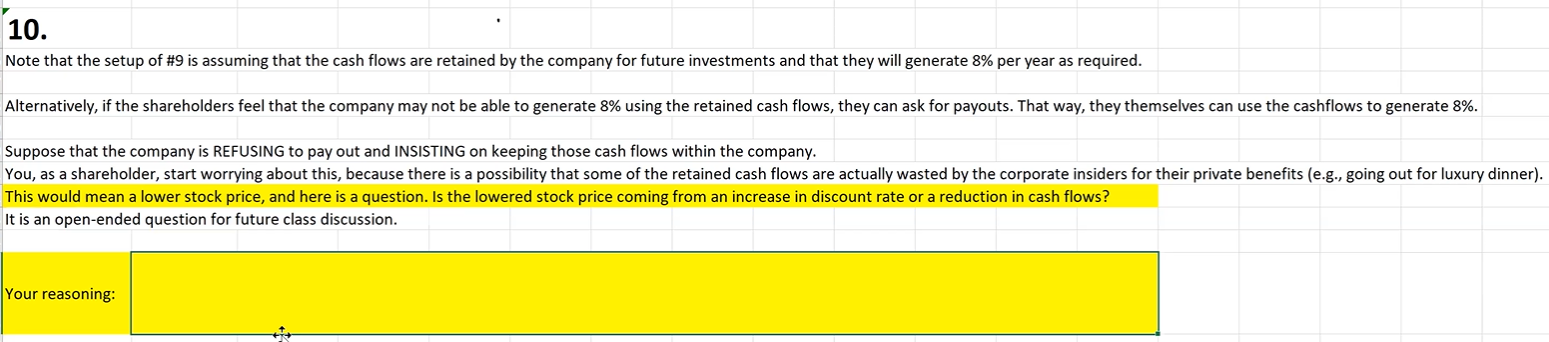

Consider the following expected cash flows of a company accrue to its shareholders. Given that the uncertainty about those cash flows, investors are requiring 8% per year. That is, the discount rate is 8% per year. The compounding/discounting frequency is 1 year, so the 8% is an APR as well as an EAR. 10. Note that the setup of \#9 is assuming that the cash flows are retained by the company for future investments and that they will generate 8% per year as required. Suppose that the company is REFUSING to pay out and INSISTING on keeping those cash flows within the company. This would mean a lower stock price, and here is a question. Is the lowered stock price coming from an increase in discount rate or a reduction in cash flows? t is an open-ended question for future class discussion. lour reasoning

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts