Question: Please solve the problem and provide detailed explanations with reasonings. Thanks. The bank statement for the Mini Mart Corporation shows a balance of $1,280 on

Please solve the problem and provide detailed explanations with reasonings. Thanks.

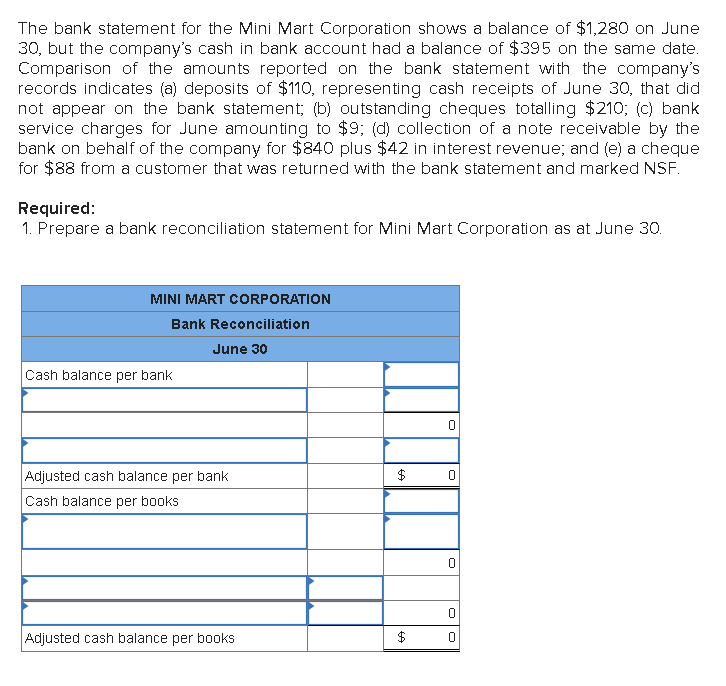

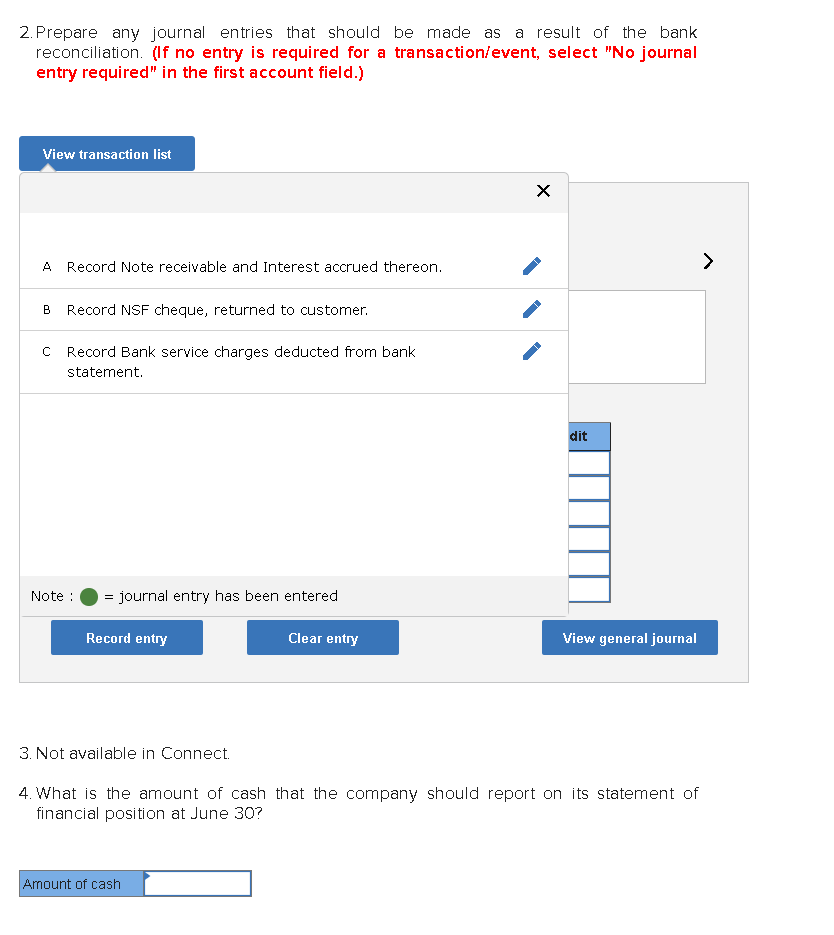

The bank statement for the Mini Mart Corporation shows a balance of $1,280 on June 30 , but the company's cash in bank account had a balance of $395 on the same date. Comparison of the amounts reported on the bank statement with the company's records indicates (a) deposits of $110, representing cash receipts of June 30 , that did not appear on the bank statement; (b) outstanding cheques totalling $210; (c) bank service charges for June amounting to $9; (d) collection of a note receivable by the bank on behalf of the company for $840 plus $42 in interest revenue; and (e) a cheque for $88 from a customer that was returned with the bank statement and marked NSF. Required: 1. Prepare a bank reconciliation statement for Mini Mart Corporation as at June 30 . 2. Prepare any journal entries that should be made as a result of the bank reconciliation. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) A Record Note receivable and Interest accrued thereon. B Record NSF cheque, returned to customer. C Record Bank service charges deducted from bank statement. Note: = journal entry has been entered 3. Not available in Connect. 4. What is the amount of cash that the company should report on its statement of financial position at June 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts