Question: Please solve the problem step by step using the table below SELECTING AND FINANCING HOUSING Using Your Personal Financial Plan sheet 24, calculate the affordable

Please solve the problem step by step using the table below

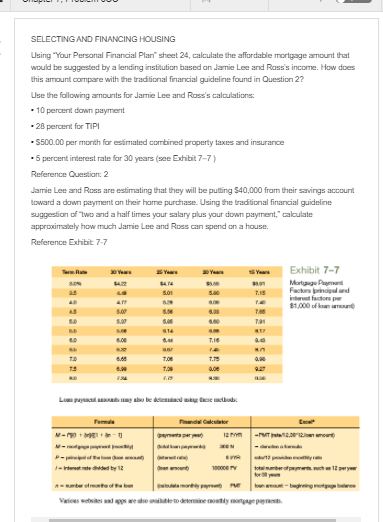

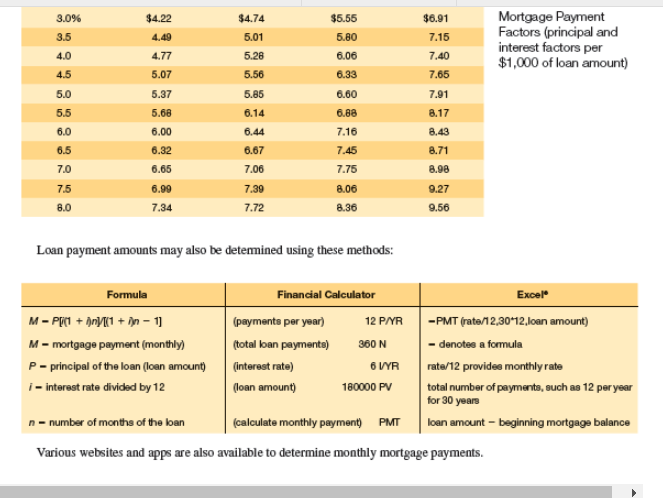

SELECTING AND FINANCING HOUSING Using Your Personal Financial Plan" sheet 24, calculate the affordable mortgage amount that would be suggested by a landing institution based on Jannie Lee and Ross's income. How does this amount compare with the traditional financial guideline found in Question 2? Use the following amounts for Jamie Lee and Ross's calculations: - 10 percent down payment . 28 percent for TIPI S500.00 per month for estimated combined property taxes and insurance 5 percent interest rate for 30 years (see Exhibit 7-7) Reference Question 2 Jamie Lee and Ross are estimating that they will be putting $40,000 from their savings account toward a down payment on their home purchase. Using the traditional financial guideline suggestion of two and a half times your salary plus your down payment, calculate approximately how much Jamie Lee and Ross can spend on a house. Reference Exhibit 7-7 Exhibit 7-7 Mortgages Factor principal and 81,000 of 5.01 5.00 7.15 5.00 TA 614 6.00 6. 7.16 T.OR 6.00 La paungo te da se to Farma de Gakulator Detta pery 12 - 2012 I needed by 12 10000 too. chey PE Abone of them Views to determine 3.09 $4.22 $4.74 $5.55 $6.91 3.5 4.49 5.01 5.80 7.15 Mortgage Payment Factors (principal and interest factors per $1,000 of loan amount) 4.0 4.77 5.28 6.06 7.40 4.5 5.07 5.56 6.33 7.65 5.0 5.37 5.85 6.60 7.91 5.5 5.68 6.14 6.88 8.17 6.0 6.00 6.44 7.16 8.43 6.5 6.32 6.67 7.45 8.71 7.0 6.65 7.06 7.75 8.98 7.5 6.99 7.39 8.06 9.27 8.0 7.34 7.72 8.36 9.56 Loan payment amounts may also be determined using these methods: Formula Financial Calculator Excel M-PC + Dny (1 +in-1 (payments per year) 12 P/YR -PMT (rate/12,30-12 loan amount) M - mortgage payment (monthly) (total loan payments) 360 N - denotes a formula P-principal of the loan (loan amount) (interest rate) 6 V/YR rate/12 providee monthly rate i-interest rate divided by 12 (loan amount) 180000 PV total number of payments, such as 12 per year for 30 years n-number of months of the lan (calculate monthly payment) PMT loan amount - beginning mortgage balance Various websites and apps are also available to determine monthly mortgage payments. SELECTING AND FINANCING HOUSING Using Your Personal Financial Plan" sheet 24, calculate the affordable mortgage amount that would be suggested by a landing institution based on Jannie Lee and Ross's income. How does this amount compare with the traditional financial guideline found in Question 2? Use the following amounts for Jamie Lee and Ross's calculations: - 10 percent down payment . 28 percent for TIPI S500.00 per month for estimated combined property taxes and insurance 5 percent interest rate for 30 years (see Exhibit 7-7) Reference Question 2 Jamie Lee and Ross are estimating that they will be putting $40,000 from their savings account toward a down payment on their home purchase. Using the traditional financial guideline suggestion of two and a half times your salary plus your down payment, calculate approximately how much Jamie Lee and Ross can spend on a house. Reference Exhibit 7-7 Exhibit 7-7 Mortgages Factor principal and 81,000 of 5.01 5.00 7.15 5.00 TA 614 6.00 6. 7.16 T.OR 6.00 La paungo te da se to Farma de Gakulator Detta pery 12 - 2012 I needed by 12 10000 too. chey PE Abone of them Views to determine 3.09 $4.22 $4.74 $5.55 $6.91 3.5 4.49 5.01 5.80 7.15 Mortgage Payment Factors (principal and interest factors per $1,000 of loan amount) 4.0 4.77 5.28 6.06 7.40 4.5 5.07 5.56 6.33 7.65 5.0 5.37 5.85 6.60 7.91 5.5 5.68 6.14 6.88 8.17 6.0 6.00 6.44 7.16 8.43 6.5 6.32 6.67 7.45 8.71 7.0 6.65 7.06 7.75 8.98 7.5 6.99 7.39 8.06 9.27 8.0 7.34 7.72 8.36 9.56 Loan payment amounts may also be determined using these methods: Formula Financial Calculator Excel M-PC + Dny (1 +in-1 (payments per year) 12 P/YR -PMT (rate/12,30-12 loan amount) M - mortgage payment (monthly) (total loan payments) 360 N - denotes a formula P-principal of the loan (loan amount) (interest rate) 6 V/YR rate/12 providee monthly rate i-interest rate divided by 12 (loan amount) 180000 PV total number of payments, such as 12 per year for 30 years n-number of months of the lan (calculate monthly payment) PMT loan amount - beginning mortgage balance Various websites and apps are also available to determine monthly mortgage payments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts