Question: Please solve the problem using a financial calculator and explain the steps. ||||||| Example 3:(constant cash flows) Alyeska Salmon Inc is considering a new automated

Please solve the problem using a financial calculator and explain the steps.

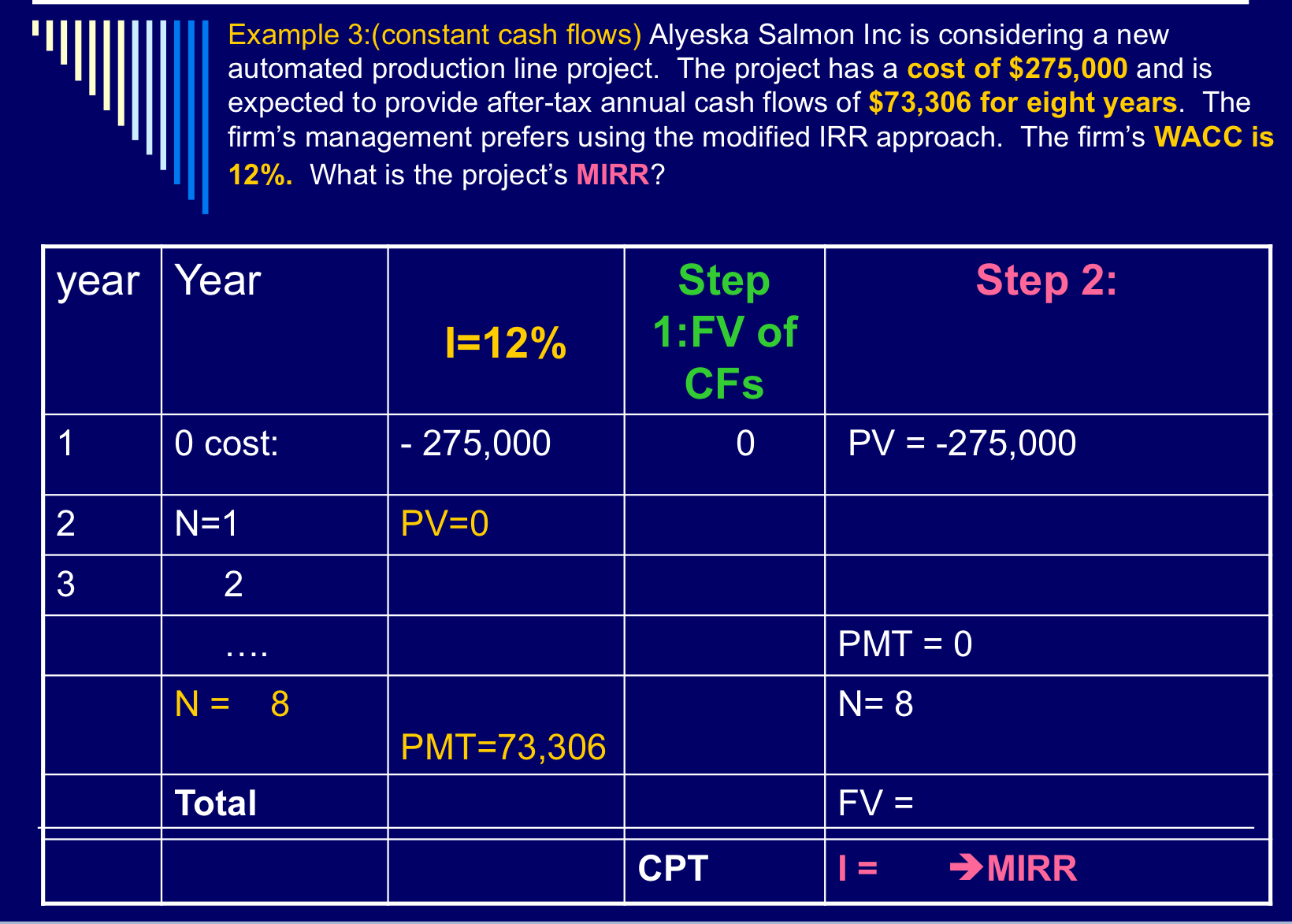

||||||| Example 3:(constant cash flows) Alyeska Salmon Inc is considering a new automated production line project. The project has a cost of $275,000 and is expected to provide after-tax annual cash flows of $73,306 for eight years. The firm's management prefers using the modified IRR approach. The firm's WACC is 12%. What is the project's MIRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts