Question: please solve the problem with excel or the forumulas below using a finance calculator thank you Magnetic Corporation expects dividends to grow at a rate

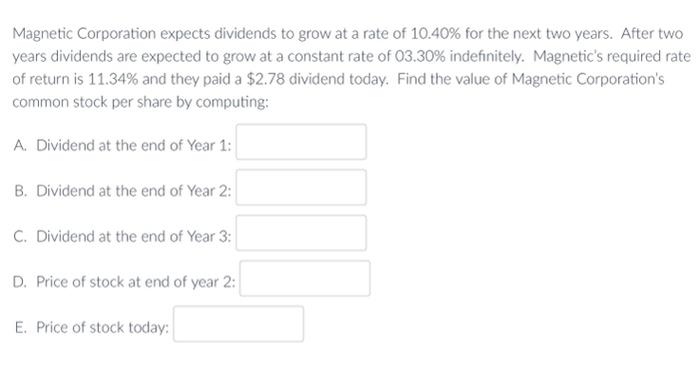

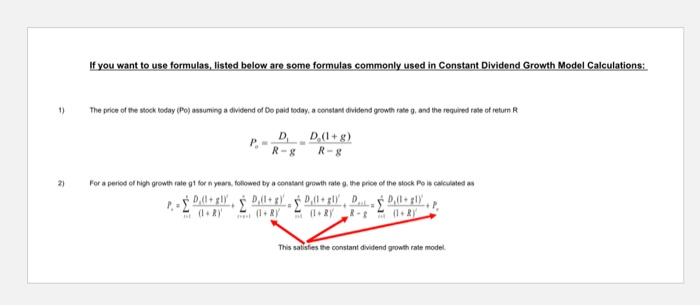

Magnetic Corporation expects dividends to grow at a rate of 10.40% for the next two years. After two years dividends are expected to grow at a constant rate of 03.30% indefinitely. Magnetic's required rate of return is 11.34% and they paid a $2.78 dividend today. Find the value of Magnetic Corporation's common stock per share by computing: A. Dividend at the end of Year 1: B. Dividend at the end of Year 2: C. Dividend at the end of Year 3 : D. Price of stock at end of year 2 : E. Price of stock today: If you want to use formulas, listed below are some formulas commonly used in Constant Dividend Growth Model Calculations: The price of the stock boday (Po) assuming a dividend of Do paid boday, a constast dividend growth rate g, and the requied rale of return R Pg=RgD1=RgD0(1+g) For a peried of high growth rate g1 for n year. folowed by a conasant growth rate 0 . the phot of the siock po is calculated as This satisfies the constant divifend growth rate model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts