Question: please solve the problems Part 1: Discounting, NPV, and IRR. Please list anyone else you worked with and how long you worked with them. For

please solve the problems

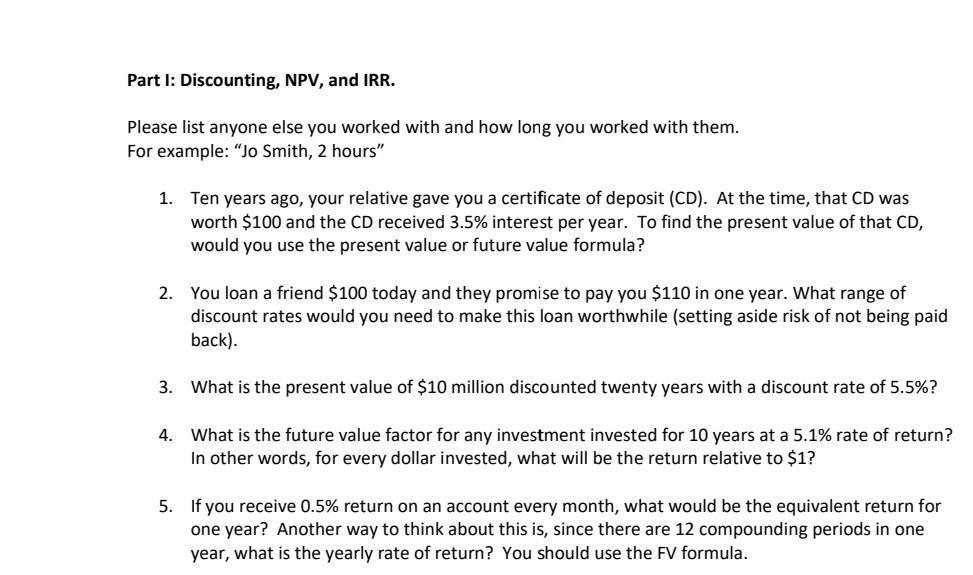

Part 1: Discounting, NPV, and IRR. Please list anyone else you worked with and how long you worked with them. For example: "Jo Smith, 2 hours" 1. Ten years ago, your relative gave you a certificate of deposit (CD). At the time, that CD was worth $100 and the CD received 3.5% interest per year. To find the present value of that CD, would you use the present value or future value formula? 2. You loan a friend $100 today and they promise to pay you $110 in one year. What range of discount rates would you need to make this loan worthwhile (setting aside risk of not being paid back). 3. What is the present value of $10 million discounted twenty years with a discount rate of 5.5%? 4. What is the future value factor for any investment invested for 10 years at a 5.1% rate of return? In other words, for every dollar invested, what will be the return relative to $1? 5. If you receive 0.5% return on an account every month, what would be the equivalent return for one year? Another way to think about this is, since there are 12 compounding periods in one year, what is the yearly rate of return? You should use the FV formula

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts