Question: please solve the problems sunject: corporate finance 1. Consider a typical portfolio problem, where investor is facing two assets with the following characteristics - returns

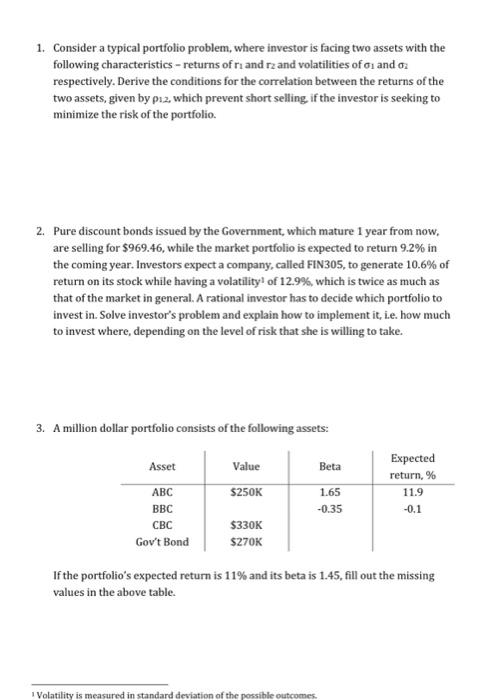

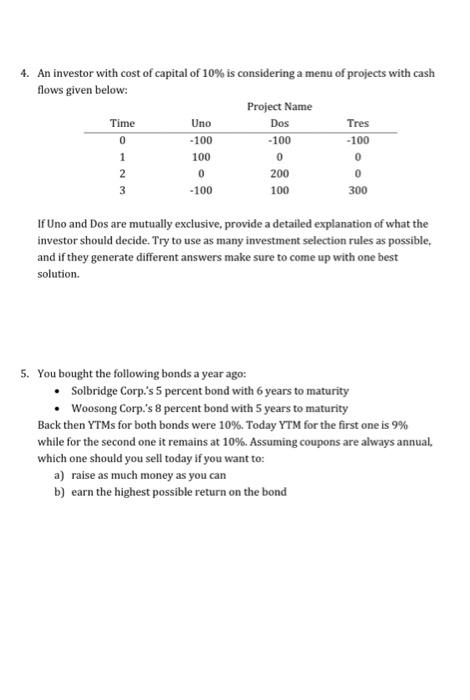

1. Consider a typical portfolio problem, where investor is facing two assets with the following characteristics - returns of r1 and r2 and volatilities of 1 and i respectively. Derive the conditions for the correlation between the returns of the two assets, given by p1, which prevent short selling if the investor is seeking to minimize the risk of the portfolio. 2. Pure discount bonds issued by the Government, which mature 1 year from now, are selling for $969.46, while the market portfolio is expected to return 9.2% in the coming year. Investors expect a company, called FIN 305 , to generate 10.6% of return on its stock while having a volatility 1 of 12.9%, which is twice as much as that of the market in general. A rational investor has to decide which portfolio to invest in. Solve investor's problem and explain how to implement it, i.e. how much to invest where, depending on the level of risk that she is willing to take. 3. A million dollar portfolio consists of the following assets: If the portfolio's expected return is 11% and its beta is 1.45 , fill out the missing values in the above table. 1 Volatility is measured in standard deviation of the possible outcomes. 4. An investor with cost of capital of 10% is considering a menu of projects with cash flows given below: If Uno and Dos are mutually exclusive, provide a detailed explanation of what the investor should decide. Try to use as many investment selection rules as possible, and if they generate different answers make sure to come up with one best solution. 5. You bought the following bonds a year ago: - Solbridge Corp.'s 5 percent bond with 6 years to maturity - Woosong Corp.'s 8 percent bond with 5 years to maturity Back then YTMs for both bonds were 10%. Today YTM for the first one is 9% while for the second one it remains at 10%. Assuming coupons are always annual, which one should you sell today if you want to: a) raise as much money as you can b) earn the highest possible return on the bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts