Question: please solve the question Attempt all questions Question No. 1 Marks 9 The most recent financial statements for GPS, Inc., are shown here: Income Statement

please solve the question

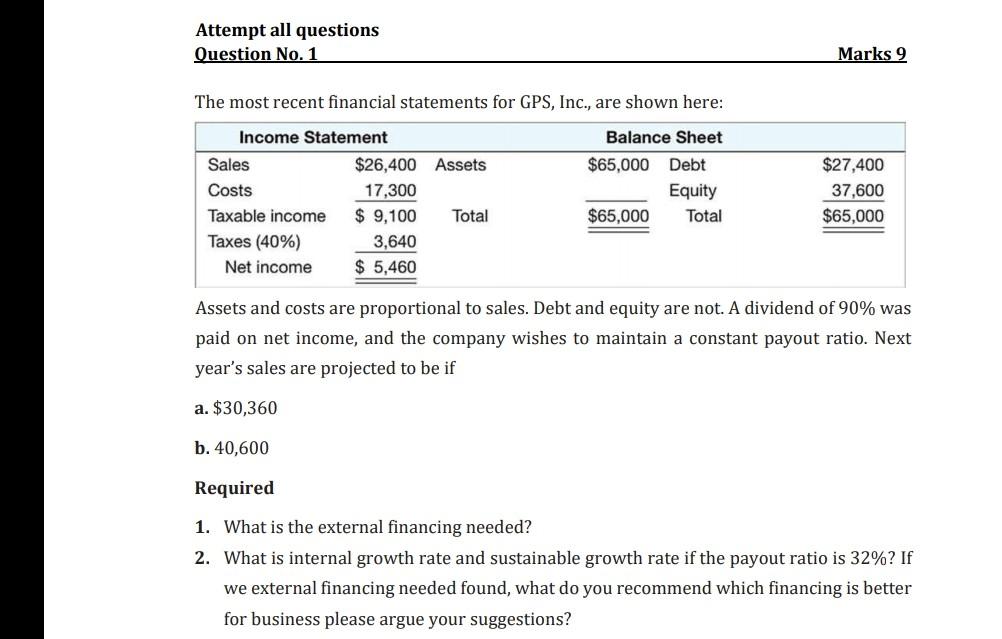

Attempt all questions Question No. 1 Marks 9 The most recent financial statements for GPS, Inc., are shown here: Income Statement Sales $26,400 Assets Costs 17,300 Taxable income $ 9,100 Total Taxes (40%) 3,640 Net income $ 5,460 Balance Sheet $65,000 Debt Equity $65,000 Total $27,400 37,600 $65,000 Assets and costs are proportional to sales. Debt and equity are not. A dividend of 90% was paid on net income, and the company wishes to maintain a constant payout ratio. Next year's sales are projected to be if a. $30,360 b. 40,600 Required 1. What is the external financing needed? 2. What is internal growth rate and sustainable growth rate if the payout ratio is 32%? If we external financing needed found, what do you recommend which financing is better for business please argue your suggestions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts