Question: please solve the question based on all the details and givens Phoenix Corporation faltered during the Covid pandemic but is recovering. Free cash flow has

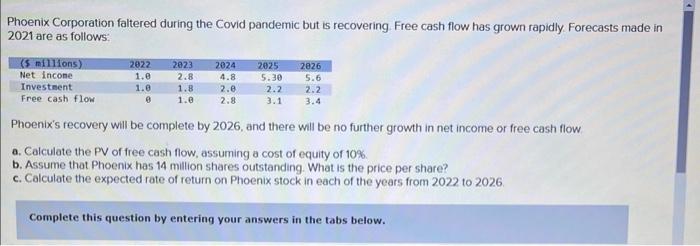

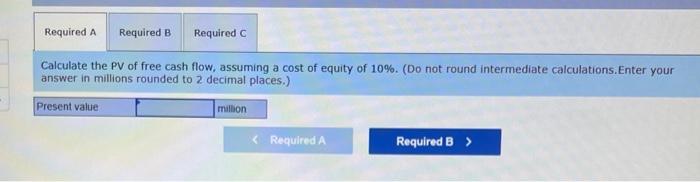

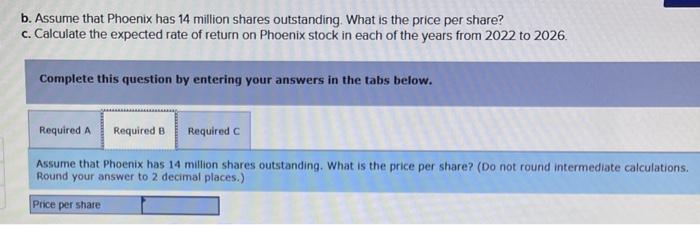

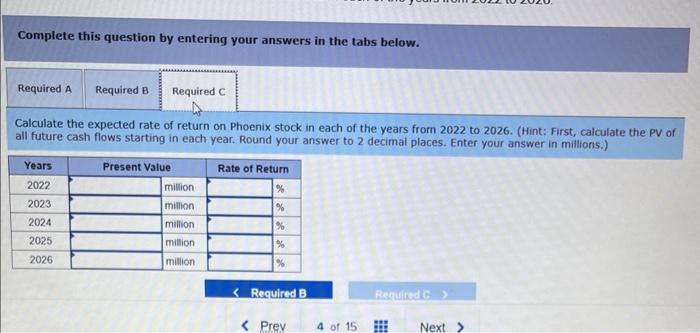

Phoenix Corporation faltered during the Covid pandemic but is recovering. Free cash flow has grown rapidly. Forecasts made in 2021 are as follows: Phoenix's recovery will be complete by 2026, and there will be no further growth in net income or free cash flow a. Calculate the PV of free cash flow, assuming a cost of equity of 10%. b. Assume that Phoenix has 14 million shares outstanding. What is the price per share? c. Calculate the expected rate of return on Phoenix stock in each of the years from 2022 to 2026. Complete this question by entering your answers in the tabs below. Calculate the PV of free cash flow, assuming a cost of equity of 10%. (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) b. Assume that Phoenix has 14 million shares outstanding. What is the price per share? c. Calculate the expected rate of return on Phoenix stock in each of the years from 2022 to 2026. Complete this question by entering your answers in the tabs below. Assume that Phoenix has 14 million shares outstanding. What is the price per share? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Complete this question by entering your answers in the tabs below. Calculate the expected rate of return on Phoenix stock in each of the years from 2022 to 2026. (Hint: First, calculate the PV of all future cash flows starting in each year. Round your answer to 2 decimal places. Enter your answer in millions.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts