Question: please solve the question e from g ! And i'm not good to understand handwriting so plz write properly for me ! Thanks! I'm not

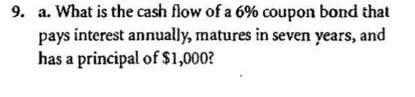

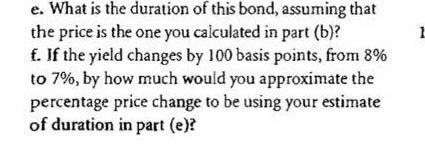

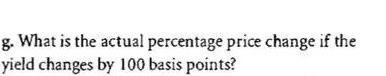

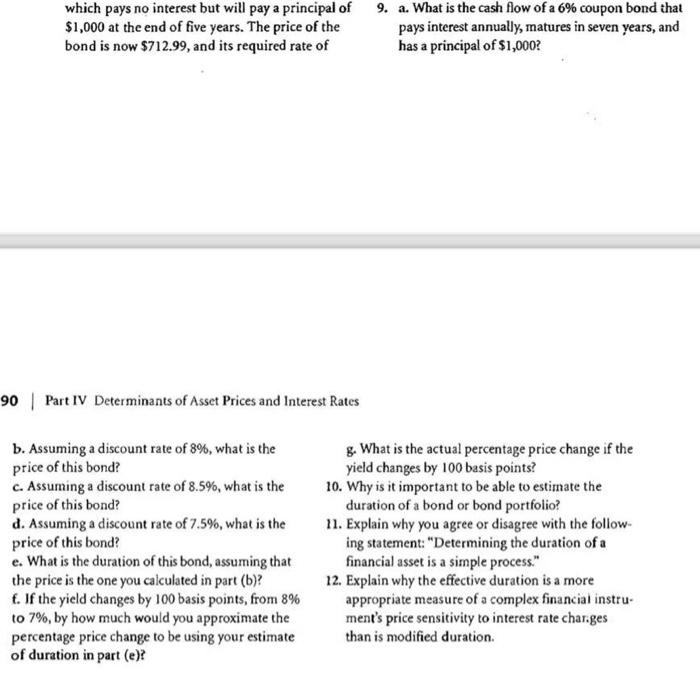

9. a. What is the cash flow of a 6% coupon bond that pays interest annually, matures in seven years, and has a principal of $1,000? e. What is the duration of this bond, assuming that the price is the one you calculated in part (b)? f. If the yield changes by 100 basis points, from 8% to 7%, by how much would you approximate the percentage price change to be using your estimate of duration in part (e)? g. What is the actual percentage price change if the yield changes by 100 basis points? which pays no interest but will pay a principal of 9. a. What is the cash flow of a 6% coupon bond that $1,000 at the end of five years. The price of the pays interest annually, matures in seven years, and bond is now $712.99, and its required rate of has a principal of $1,000? 90 Part IV Determinants of Asset Prices and Interest Rates b. Assuming a discount rate of 8%, what is the price of this bond? c. Assuming a discount rate of 8.5%, what is the price of this bond? d. Assuming a discount rate of 7.5%, what is the price of this bond? e. What is the duration of this bond, assuming that the price is the one you calculated in part (b)? f. If the yield changes by 100 basis points, from 8% to 7%, by how much would you approximate the percentage price change to be using your estimate of duration in part (e)? g. What is the actual percentage price change if the yield changes by 100 basis points? 10. Why is it important to be able to estimate the duration of a bond or bond portfolio? 11. Explain why you agree or disagree with the follow- ing statement: "Determining the duration of a financial asset is a simple process." 12. Explain why the effective duration is a more appropriate measure of a complex financial instru- ment's price sensitivity to interest rate charges than is modified duration

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts