Question: Please solve the question if you are completely sure about the solution, otherwise I will downvote it. Thanks. Company P acquired 90 percent of the

Please solve the question if you are completely sure about the solution, otherwise I will downvote it.

Thanks.

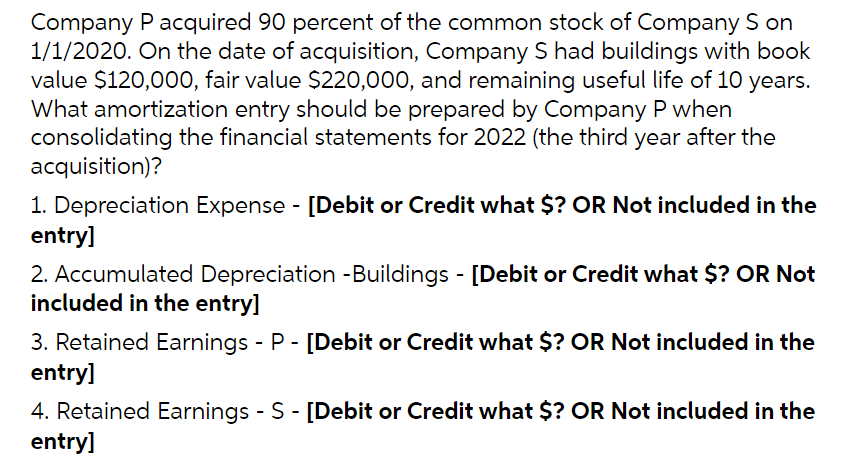

Company P acquired 90 percent of the common stock of Company S on 1/1/2020. On the date of acquisition, Company S had buildings with book value $120,000, fair value $220,000, and remaining useful life of 10 years. What amortization entry should be prepared by Company P when consolidating the financial statements for 2022 (the third year after the acquisition)? 1. Depreciation Expense - [Debit or Credit what $? OR Not included in the entry] 2. Accumulated Depreciation - Buildings - [Debit or Credit what $? OR Not included in the entry] 3. Retained Earnings - P - [Debit or Credit what $? OR Not included in the entry] 4. Retained Earnings - S - [Debit or Credit what $? OR Not included in the entry]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts