Question: please solve the question quickly ? 5 On 31 December 2014, a company acquires land for 500,000. The land is revalued at 530,000 on 31

please solve the question quickly ?

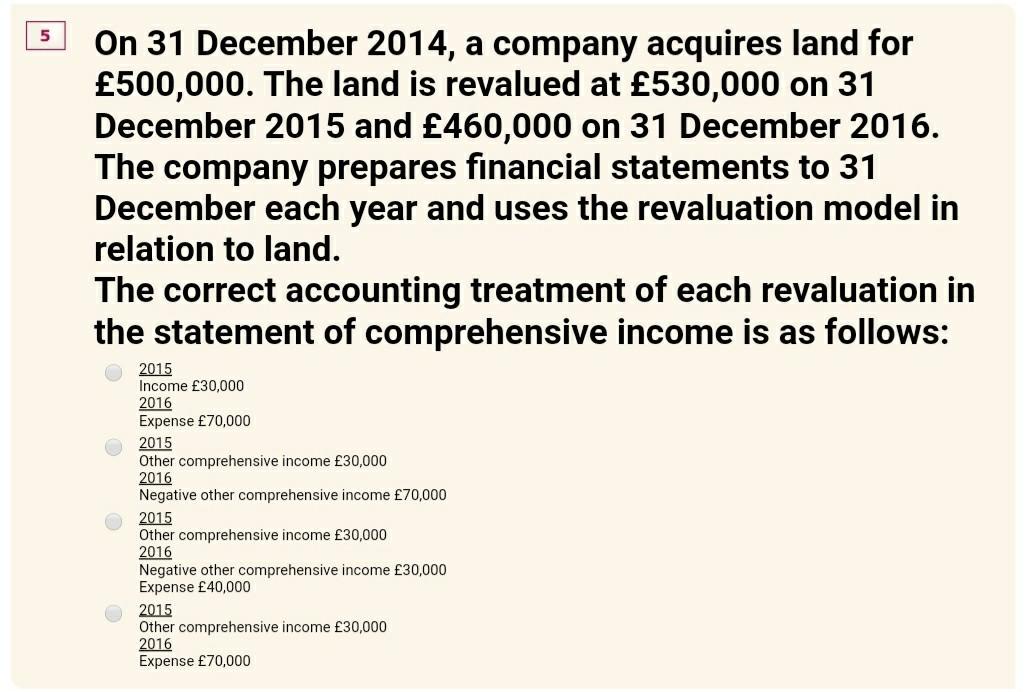

5 On 31 December 2014, a company acquires land for 500,000. The land is revalued at 530,000 on 31 December 2015 and 460,000 on 31 December 2016. The company prepares financial statements to 31 December each year and uses the revaluation model in relation to land. The correct accounting treatment of each revaluation in the statement of comprehensive income is as follows: 2015 Income 30,000 2016 Expense 70,000 2015 Other comprehensive income 30,000 2016 Negative other comprehensive income 70,000 2015 Other comprehensive income 30,000 2016 Negative other comprehensive income 30,000 Expense 40,000 2015 Other comprehensive income 30,000 2016 Expense 70,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts