Question: please solve the question using excel or the formulas below thank you Suppose Nabisco Corporation just issued a dividend of $1.5 per share yesterday. Subsequent

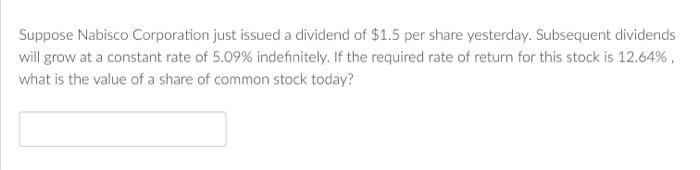

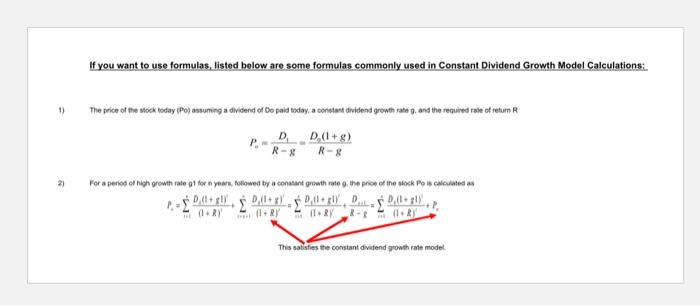

Suppose Nabisco Corporation just issued a dividend of $1.5 per share yesterday. Subsequent dividends will grow at a constant rate of 5.09% indefinitely. If the required rate of return for this stock is 12.64%, what is the value of a share of common stock today? If you want to use formulas, listed below are some formulas commonly used in Constant Dividend Growth Model Calculations: The price of the stock boday (Po) assuming a dividend of Do paid boday, a constast dividend growth rate g, and the requied rale of return R Pg=RgD1=RgD0(1+g) For a peried of high growth rate g1 for n year. folowed by a conasant growth rate 0 . the phot of the siock po is calculated as This satisfies the constant divifend growth rate model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts