Question: please solve the questions, as shown as in the examples. only three questions, remianing are examples for that Module 3 Problem Set Stocks and the

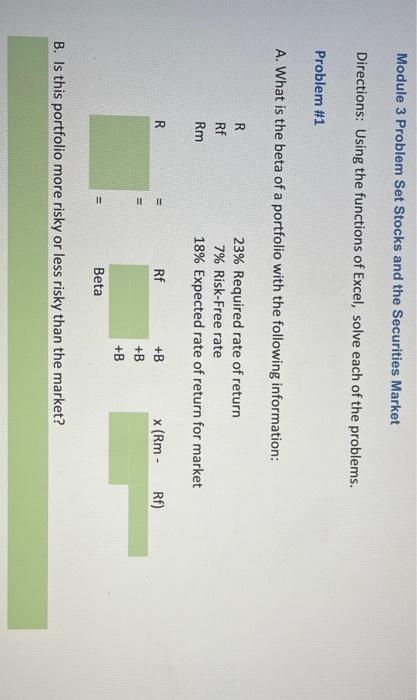

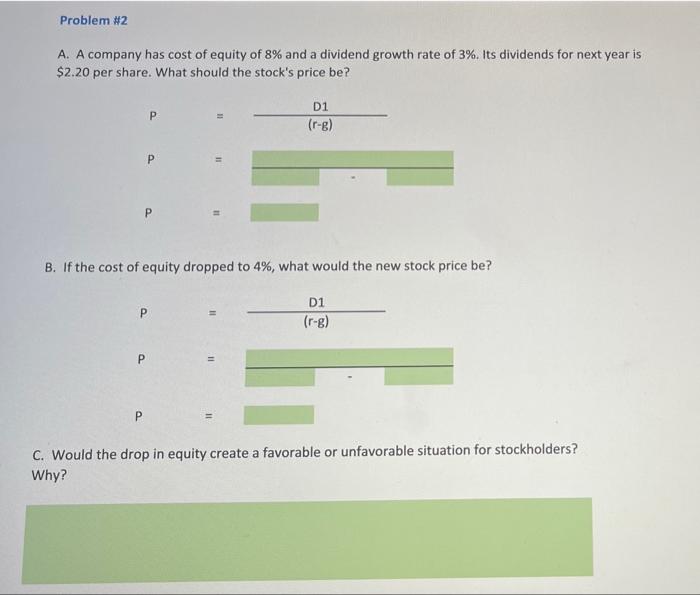

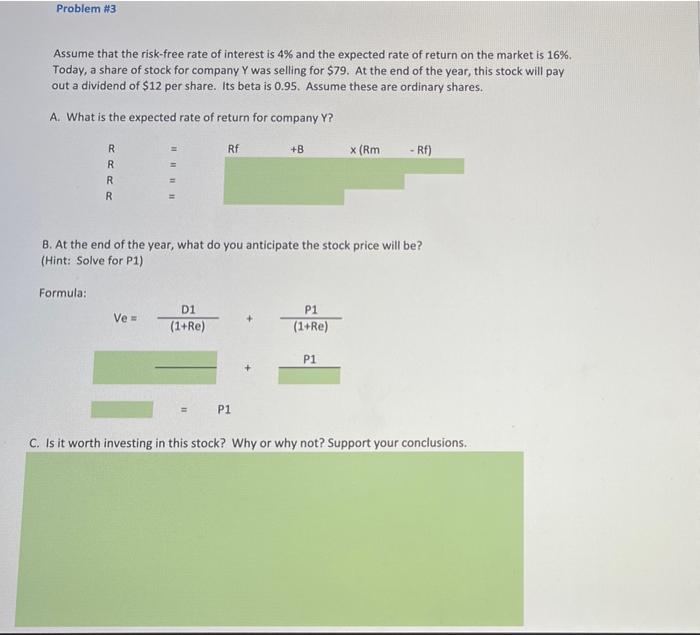

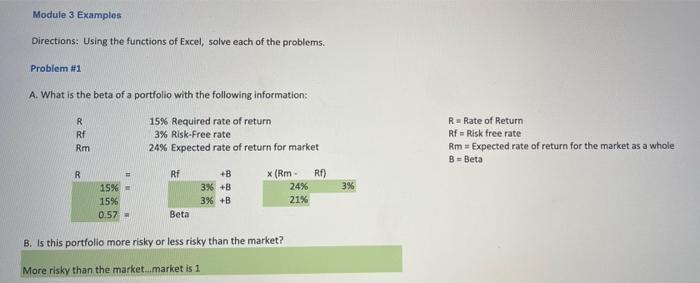

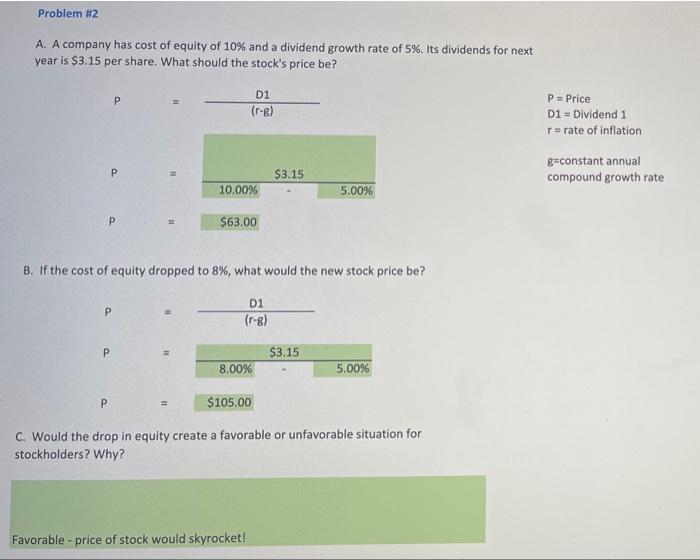

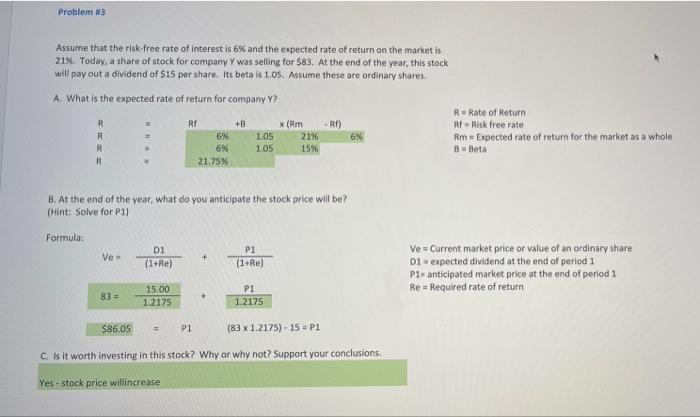

Module 3 Problem Set Stocks and the Securities Market Directions: Using the functions of Excel, solve each of the problems. Problem #1 A. What is the beta of a portfolio with the following information: R Rf Rm 23% Required rate of return 7% Risk-Free rate 18% Expected rate of return for market R Rf 111 x (Rm - Rf) +B +B +B Beta B. Is this portfolio more risky or less risky than the market? Problem #2 A. A company has cost of equity of 8% and a dividend growth rate of 3%. Its dividends for next year is $2.20 per share. What should the stock's price be? D1 (r-B) P P B. If the cost of equity dropped to 4%, what would the new stock price be? P D1 (r-g) C. Would the drop in equity create a favorable or unfavorable situation for stockholders? Why? Problem #3 Assume that the risk-free rate of interest is 4% and the expected rate of return on the market is 16%. Today, a share of stock for company Ywas selling for $79. At the end of the year, this stock will pay out a dividend of $12 per share. Its beta is 0.95. Assume these are ordinary shares. A. What is the expected rate of return for company Y? RE +B (Rm - Rf) R R R R 8. At the end of the year, what do you anticipate the stock price will be? (Hint: Solve for P1) Formula: Ve= D1 (1+Re) P1 (1+Re) P1 = P1 C. Is it worth investing in this stock? Why or why not? Support your conclusions. Module 3 Examples Directions: Using the functions of Excel, solve each of the problems. Problem #1 A. What is the beta of a portfolio with the following information: R 15% Required rate of return RE 3% Risk-Free rate Rm 24% Expected rate of return for market R RF +B * (Rm RA) 15% 3% +B 24% 15% 3% +B 21% 0.57 - Beta R = Rate of Return Rf - Risk free rate Rm = Expected rate of return for the market as a whole B - Beta 3% B. Is this portfolio more risky or less risky than the market? More risky than the market..market is 1 Problem #2 A. A company has cost of equity of 10% and a dividend growth rate of 5%. Its dividends for next year is $3.15 per share. What should the stock's price be? P D1 (r-8) P = Price D1 = Dividend 1 r = rate of inflation P $3.15 g=constant annual compound growth rate 10.00% 5.00% P $63.00 B. If the cost of equity dropped to 8%, what would the new stock price be? P D1 (r-g) P $3.15 8.00% 5.00% P $105.00 C. Would the drop in equity create a favorable or unfavorable situation for stockholders? Why? Favorable price of stock would skyrocket! Problem 3 Assume that the risk-free rate of interest is 6% and the expected rate of return on the market is 21%. Today, a share of stock for company was selling for $83. At the end of the year, this stock will pay out a dividend of $15 per share. Its beta is 105. Assume these are ordinary shares A. What is the expected rate of return for company Y? RRate of Return R RI +B x (Rm RA RRisk free rate R 6% 1.05 21% Rm = Expected rate of return for the market as a whole R 6% 1.05 15% BBeta R 21.75% 6% B. At the end of the year, what do you anticipate the stock price will be? (Hint: Solve for P1) Formula: Ves DI (1+Re) + P1 (1+Re) Ve=Current market price or value of an ordinary share D1 = expected dividend at the end of period 1 P1+ anticipated market price at the end of period 1 Re: Required rate of return 83 15.00 1.2175 + P1 1.2175 $86.05 P1 (83 x 1.2175) - 15 P1 C. Is it worth investing in this stock? Why or why not? Support your conclusions Yes - Stock price willincrease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts