Question: please solve the red boxes Prepare journal entries to record the following transactions entered into by the Valente Company: (Credit account titles are automatically indented

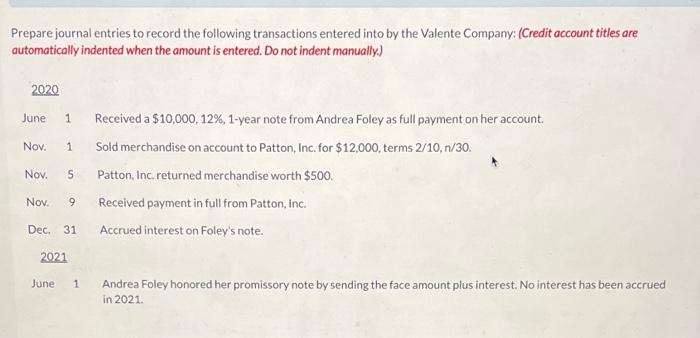

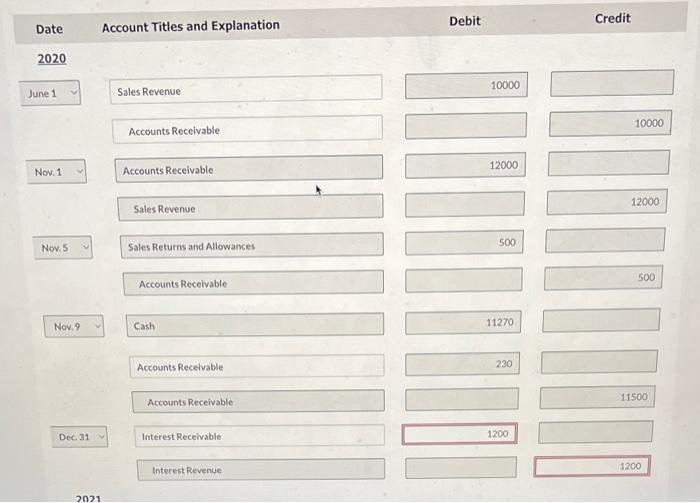

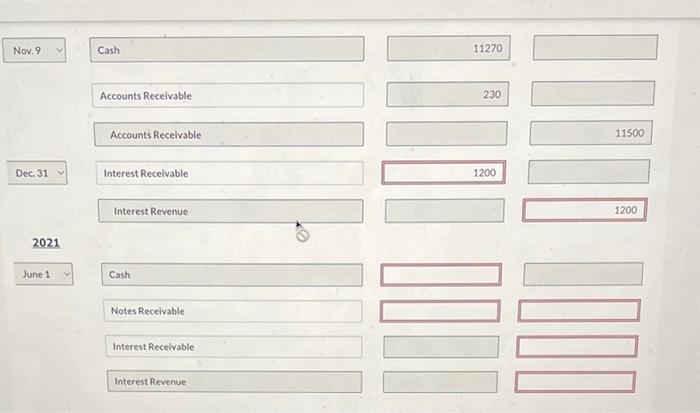

Prepare journal entries to record the following transactions entered into by the Valente Company: (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) 2020 June 1 Nov. 1 Nov. 5 Received a $10,000, 12%, 1-year note from Andrea Foley as full payment on her account. Sold merchandise on account to Patton, Inc. for $12,000, terms 2/10,n/30. Patton, Inc returned merchandise worth $500. Received payment in full from Patton, Inc. Accrued interest on Foley's note Nov. 9 Dec. 31 2021 June 1 Andrea Foley honored her promissory note by sending the face amount plus interest. No interest has been accrued in 2021 Debit Credit Date Account Titles and Explanation 2020 10000 June 1 Sales Revenue 10000 Accounts Receivable Nov. 1 12000 Accounts Receivable 12000 Sales Revenue Nov.5 Sales Returns and Allowances 500 500 Accounts Receivable Nov.9 Cash 11270 Accounts Receivable 230 Accounts Receivable 11500 Dec. 31 Interest Receivable 1200 Interest Revenue 1200 2021 Nov. 9 Cash 11270 Accounts Receivable 230 Accounts Receivable 11500 Dec. 31 Interest Receivable 1200 Interest Revenue 1200 2021 June 1 Cash Notes Receivable LIDO DOL Interest Receivable Interest Revenue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts