Question: Please solve the remainder of the 4 problems. Answer all the ones with X's by them, please. Please include your work, so if there are

Please solve the remainder of the 4 problems. Answer all the ones with X's by them, please. Please include your work, so if there are any errors, I could follow along and possibly fix them.

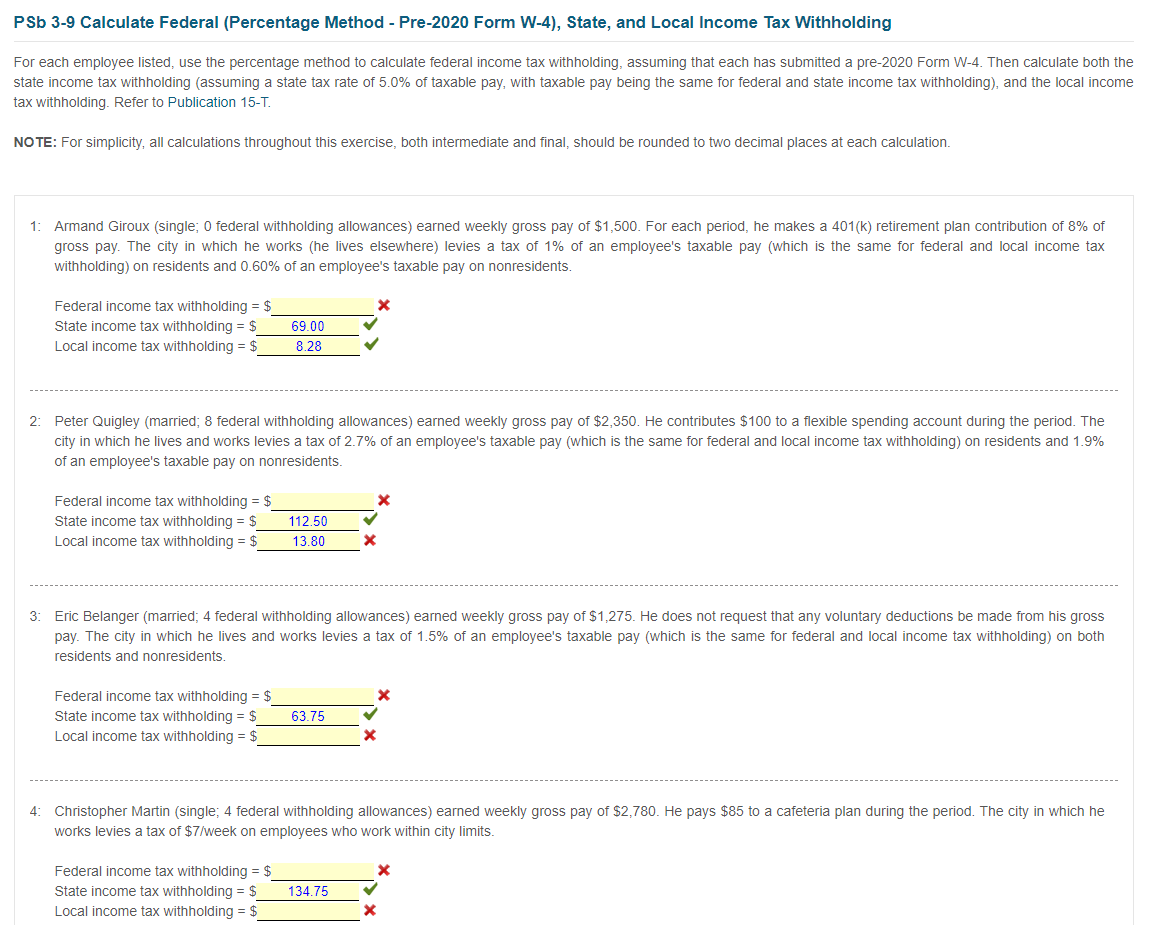

PSb 3-9 Calculate Federal (Percentage Method - Pre-2020 Form W-4), State, and Local Income Tax Withholding For each employee listed, use the percentage method to calculate federal income tax withholding, assuming that each has submitted a pre-2020 Form W-4. Then calculate both the state income tax withholding (assuming a state tax rate of 5.0% of taxable pay, with taxable pay being the same for federal and state income tax withholding), and the local income tax withholding. Refer to Publication 15-T. NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. 1: Armand Giroux (single; 0 federal withholding allowances) earned weekly gross pay of $1,500. For each period, he makes a 401(k) retirement plan contribution of 8% of gross pay. The city in which he works (he lives elsewhere) levies a tax of 1% of an employee's taxable pay (which is the same for federal and local income tax withholding) on residents and 0.60% of an employee's taxable pay on nonresidents. Federal income tax withholding = $ State income tax withholding = $ 69.00 Local income tax withholding = $ 8.28 2: Peter Quigley (married; 8 federal withholding allowances) earned weekly gross pay of $2,350. He contributes $100 to a flexible spending account during the period. The city in which he lives and works levies a tax of 2.7% of an employee's taxable pay (which is the same for federal and local income tax withholding) on residents and 1.9% of an employee's taxable pay on nonresidents. Federal income tax withholding = $ State income tax withholding = $_ 112.50 Local income tax withholding = $ 13.80 X 3: Eric Belanger (married; 4 federal withholding allowances) earned weekly gross pay of $1,275. He does not request that any voluntary deductions be made from his gross pay. The city in which he lives and works levies a tax of 1.5% of an employee's taxable pay (which is the same for federal and local income tax withholding) on both residents and nonresidents. Federal income tax withholding = $ X State income tax withholding = $ 63.75 Local income tax withholding = $ : Christopher Martin (single; 4 federal withholding allowances) earned weekly gross pay of $2,780. He pays $85 to a cafeteria plan during the period. The city in which he works levies a tax of $7/week on employees who work within city limits. Federal income tax withholding = $ State income tax withholding = $_ 134.75 Local income tax withholding = $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts