Question: please solve the two parts and explain why Problem 1 A project pays $1,200,000 in one year, requiring an initial investment of $1,000,000. The internal

please solve the two parts and explain why

please solve the two parts and explain why

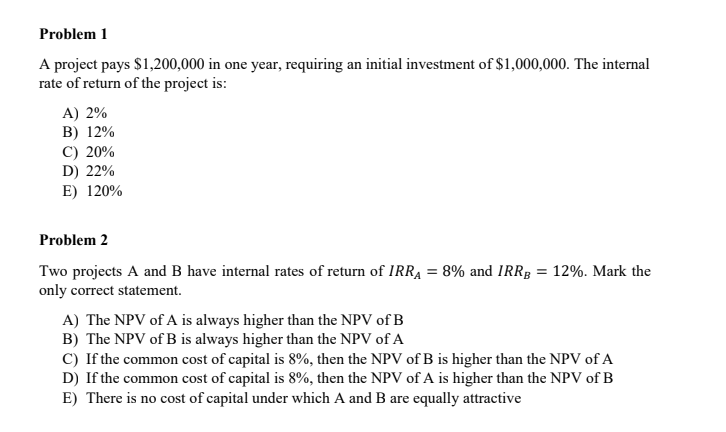

Problem 1 A project pays $1,200,000 in one year, requiring an initial investment of $1,000,000. The internal rate of return of the project is: A) 2% B) 12% C) 20% D) 22% E) 120% = Problem 2 Two projects A and B have internal rates of return of IRRA = 8% and IRRB = 12%. Mark the only correct statement A) The NPV of A is always higher than the NPV of B B) The NPV of B is always higher than the NPV of A C) If the common cost of capital is 8%, then the NPV of B is higher than the NPV of A D) If the common cost of capital is 8%, then the NPV of A is higher than the NPV of B E) There is no cost of capital under which A and B are equally attractive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts