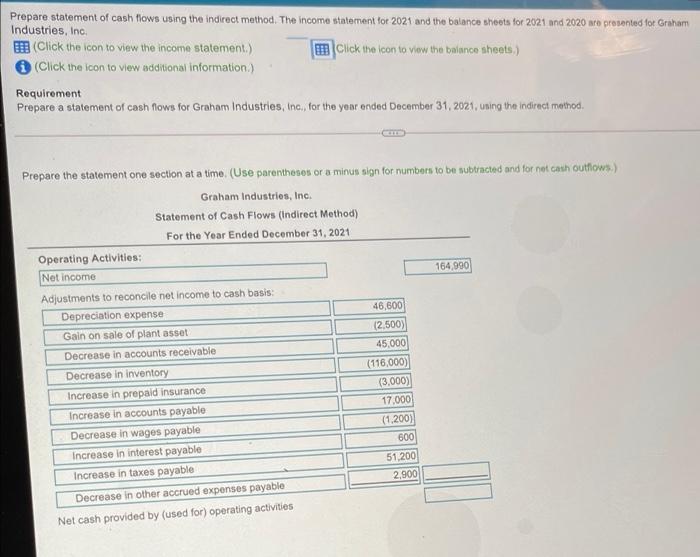

Question: please solve the whole problem if you need any information let me know III Homework: Ch 13 - Part 5 (P13- 36B) Balance sheets Prepare

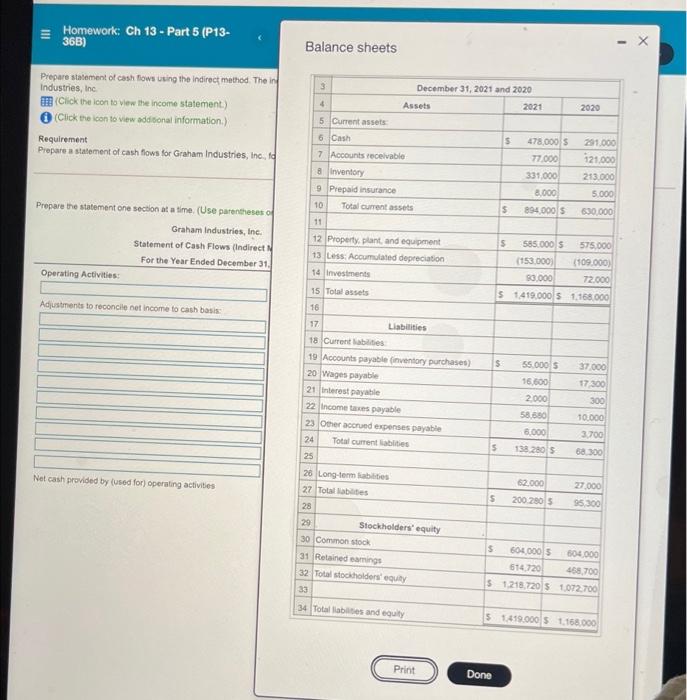

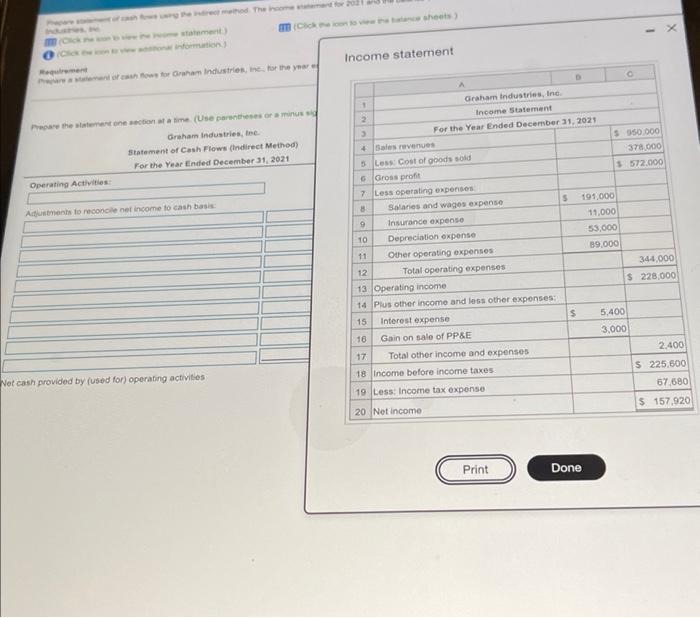

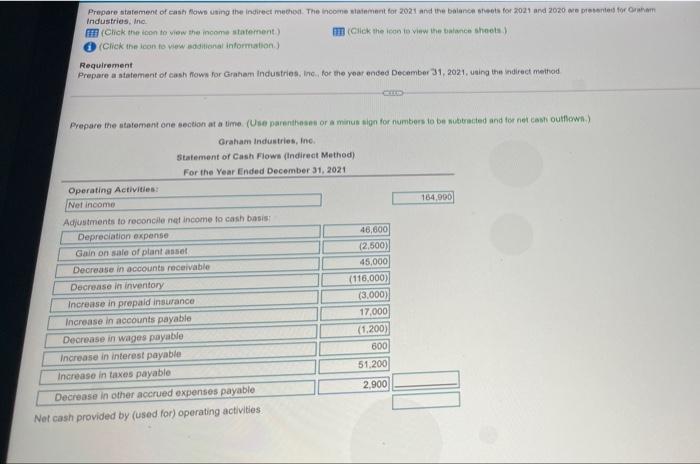

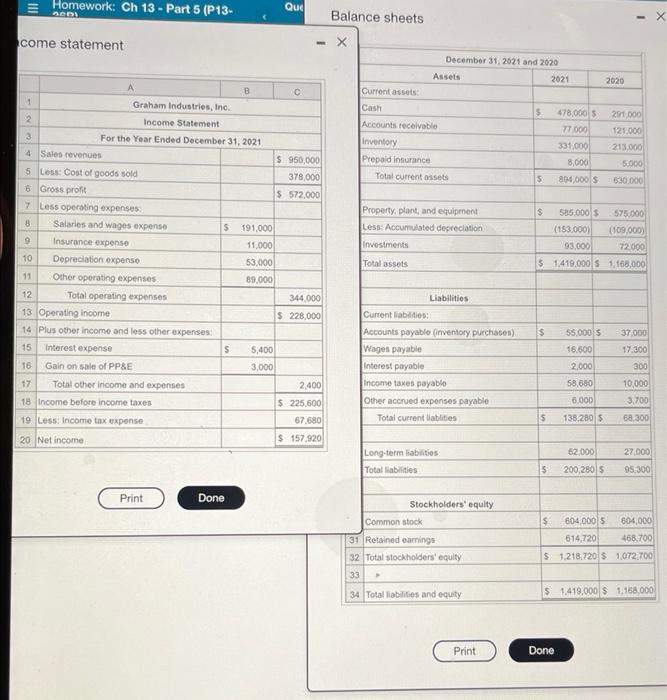

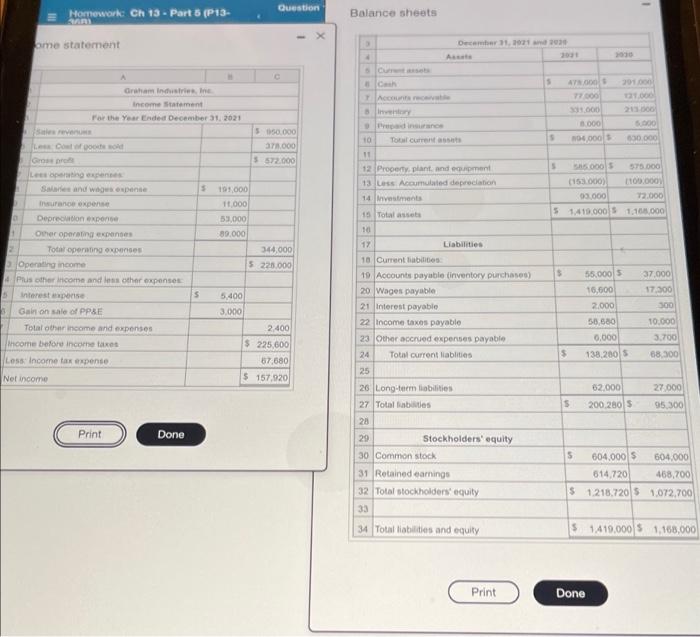

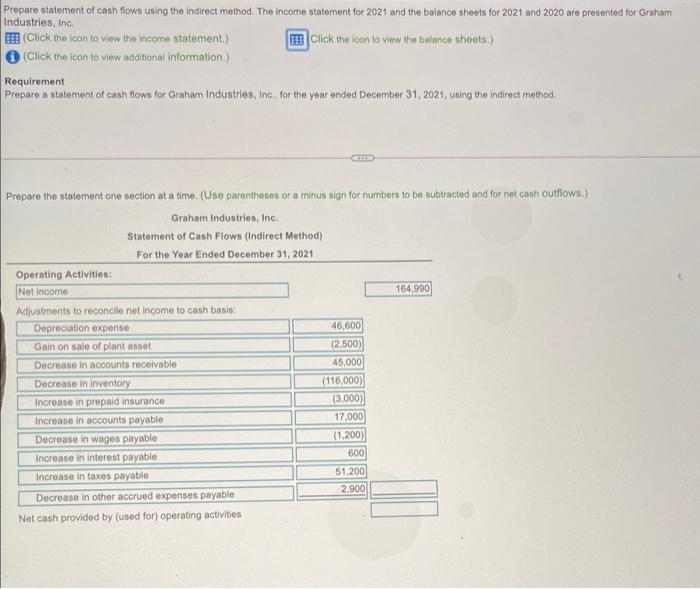

III Homework: Ch 13 - Part 5 (P13- 36B) Balance sheets Prepare statement of cash flows using the Indirect method. The in Industries, Inc Im Click the icon to view the income statement.) Click the icon to view additonal information) Requirement Prepare a statement of cash flows for Graham Industries, Inc. Prepare the statement one section at a time. (Use parentheses Graham Industries, Inc. Statement of Cash Flows (Indirect For the Year Ended December 31 Operating Activities: Adjustments to reconcile et income to cash basis 3 December 31, 2021 and 2020 4 Assets 2021 2020 5 Current assets 6 Cash S 478,000 281.000 7 Accounts receivable 77.000 121.000 & Inventory 331.000 213.000 9 Prepaid insurance 8.000 5.000 10 Total current assets 5 894.000 630.000 11 12 Property, plant, and equipment S 585.000 5 575.000 13 Less: Accumulated depreciation (153.000 (109.000 14 Investments 80.000 72.000 15 Total assets $ 1419.000 $ 1.168.000 16 17 Liabilities 18 Current bites 19 Accounts payable inventory purchases 55.000 5 37 000 20 Wages payable 16,500 17300 21 interest payable 2000 300 22 Income taxes payable 58.890 10.000 23 Other accrued expenses payable 6.000 3.700 24 Totalcumentalities 5 138.2805 68300 25 26 Long-term abities 62.000 27.000 27 Totatables 5 200 2805 95300 28 29 Stockholders equity 30 Common stock $ 60400015 504.000 31 Retained camins 514.720 468.700 32 Total stockholders equity $1.218.720 $ 1072.700 Net cash provided by used for operating activities * & 34 Totallables and equity 51419.000 51.168.000 Print Done had the info met mcsheets Income statement how for Graham Industries, ne for the years Pre the one section at a time (Use parentheses or minus Graham Industries, le Statement of Cash Flows (indirect Method) For the Year Ended December 31, 2021 Operating Activities: Austen to reconcile net income to cash basis Graham Industries, Ine 2 Income Statement For the Year Ended December 31, 2025 S950 000 revenues 378.000 5 Less Cost of goods sold 5572.000 Gross profit 7 Less operating expenses 191.000 8 5 Salaries and wagos expense 9 Insurance expense 19.000 10 Depreciation expense 53,000 11 Other operating expenses 89.000 12 Total operating expenses 344.000 13 Operating income $ 228.000 14 Plus other income and less other expenses 15 Interest expense $ 5,400 18 Gain on sale of PP&E 3.000 17 Total other income and expenses 2.400 18 Income before income taxes $ 225,600 19 Less: Income tax expense 67.680 20 Not income $157.920 Netcash provided by used for) operating activities Print Done Prepare statement of cash flows using the Indirect method. The income statement for 2021 and the balance sheets for 2021 and 2020 represented for me Industries, Inc. FB (Click the toon to view the income statement) im Click the icon to view the lance sheets (Click the icon to view additional information Requirement Prepare a statement of cash flows for Graham Industries, Inc. for the year ended December 31, 2021, using the indirect method Prepare the statement one section at a time. (Use parentheses or a minus sign for numbers to be subtracted and for net cash outflow) Graham Industries, Inc. Statement of Cash Flows (Indirect Method) For the Year Ended December 31, 2021 Operating Activities: Nof income 184,900 Adjustments to reconcile net income to cash basis Depreciation expense 46,600 Gain on sale of plant asset (2,500) Decrease in accounts receivable 45,000 Decrease in inventory (116,000) Increase in prepaid insurance (3.000) Increase in accounts payable 17.000 Decrease in wages payable (1.200) Increase in interest payable Increase in taxes payable 51.200 Decrease in other accrued expenses payable 2.900 Net cash provided by (used for) operating activities 600 III Homework: Ch 13 - Part 5 (P13- Que Ons Balance sheets come statement - X December 31, 2021 and 2020 Assets 2021 2020 Current assets Cash 5 291 000 Accounts receivable Inventory Prepaid insurance Total current assets 678.000 77000 331,000 8,000 84.000 125.000 213.000 5.000 630.000 5 Property, plant, and equipment Less: Accumulated depreciation A B 1 Graham Industries, Inc. 2 Income Statement 3 For the Year Ended December 31, 2021 4 Sales revenues $ 950,000 5 Less Cost of goods sold 378,000 6 Gross profit $ 572,000 7 Less operating expenses 8 Salaries and wages expense S 191.000 9 Insurance expense 11 000 10 Depreciation expenso 53,000 11 Other operating expenses 89,000 12 Total operating expenses 344,000 13 Operating income $ 220,000 14 Plus other income and less other expenses: 15 Interest expense S 5,400 16 Gain on sale of PPSE 3,000 17 Total other income and expenses 2.400 18 Income before income taxes $ 225,600 19 Less Income tax expense 67.680 $ 157.920 20 Net income $ 585.000 575.000 (153.000) (109.000) 93,000 72.000 $ 1,419,000 5 1,168,000 Investments Total assets $ 37.000 17.300 Liabilities Current liabilities: Accounts payable inventory purchases) Wages payable Interest payable Income taxes payable Other accrued expenses payable Total current liablities 55,000 5 16.500 2,000 58,680 6.000 138,2805 300 10,000 3.700 68.300 5 27.000 Long-term liabilities Total liabilities 62,000 200.280S 5 95,300 Print Done Stockholders' equity Common stock 31 Retained earnings 32 Total stockholders' equilty 33 5 604.000 5 604,000 614,720 468.700 $1.218.720 $ 1,072,700 34 Total liabilities and equity $ 1.419,000$ 1.168,000 Print Done Prepare statement of cash flows using the indirect method. The income statement for 2021 and the balance shoots for 2021 and 2020 are presented for Grahom Industries, Inc Click the icon to view the income statement) Click the icon to view the balance sheets) (Click the icon to view additional information) Requirement Prepare a statement of cash flows for Graham Industries, Inc., for the year ended December 31, 2021, using the Indirect method. Prepare the statement one section at a time (Use parentheses or a minus sign for numbers to be subtracted and for net cash outflows.) Graham Industries, Inc. Statement of Cash Flows (Indirect Method) For the Year Ended December 31, 2021 Operating Activities: Net income 164,990 Adjustments to reconcile net income to cash basis: Depreciation expense 46,600 Gain on sale of plant asset 12.500) Decrease in accounts receivable 45,000 Decrease in inventory (116,000) Increase in prepaid insurance (3.000) Increase in accounts payable 17.000 Decrease in wages payable (1.200) 600 Increase in interest payable 51.200 Increase in taxes payable 2.900 Decrease in other accrued expenses payable Net cash provided by (used for) operating activities Question - Homework: Ch 13 - Part 5 (P13- Balance sheets me statement Decr17 At 30 C 5 4000 Graham industrien Income Statement For the Year Ended December 31, 2021 TA 1.000 3.000 040001 2010 . 20.000 5.000 650.000 550.000 3.000 5572.000 and insurance 10 Total current 11 12. Property plant and en 13 Less Accumulated depreciation 14 Investments 5 SOOS 575.000 (155.000) 100.000 99.000 72.000 51.419.000'S 1.100.000 15 Total Lood Go Les operating expenses Sand wispense Insurance expense Deprecationen + Other operating expenses Total operating contes Operating income 4 Plus other income and less other expenses 5 Interest Gain on sale of PPSE 191.000 11.000 53,000 89.000 344,000 5228.000 10 $ 37.000 17.300 300 s 5,400 3.000 55.000 5 16,600 2.000 58.580 0.000 138.2005 10.000 3.700 Total other income and expenses home before income taxes Less Income tax expense Net Income 2.400 $ 225,600 67.680 $ 157.920 $ 68.300 17 Liabilities 10 Current liabilities 19 Accounts payable inventory purchases) 20 Wages payable 21 Interest payable 22 Income taxes payable 23 Other accrued expenses payable 24 Total current liablities 25 20 Long-teem liabilities 27 Totalbes 28 29 Stockholders' equity 30 Common stock 31 Retained earnings 32 Total stockholders equity 33 27.000 62.000 200.280 $ $ 95.300 Print Done 5 604.000 $ 604.000 614,720 468,700 $ 1.218.720S 1.072,700 34 Totallibilities and equity S1419.000 5 1,168,000 Print Done Prepare statement of cash flows using the Indirect method. The income staternent for 2021 and the balance sheets for 2021 and 2020 are presented for Graham Industries, Inc (Click the icon to view the income statement) Click the icon to view the balance sheets.) (Click the icon to view additional information) Requirement Prepare a statement of cash flows for Graham Industries, Inc. for the year ended December 31, 2021, using the Indirect method Prepare the statement one section at a time. (Use parentheses or a minus sign for numbers to be subtracted and for net cash outflows.) Graham Industries, Inc. Statement of Cash Flows (Indirect Method) For the Year Ended December 31, 2021 Operating Activities: Not income 164,990 Adjustments to reconcile net income to cash basis Depreciation expense 46,600 Gain on sale of plant asset (2,500) Decrease in accounts receivable 45,000 Decrease in inventory (116,000) Increase in prepaid insurance (3.000) Increase in accounts payable 17.000 Decrease in wages payable (1.200) Increase in interest payable Increase in taxes payable 51,200 2.900 Decrease in other accrued expenses payable Net cash provided by (used for) operating activities 600 III Homework: Ch 13 - Part 5 (P13- 36B) Balance sheets Prepare statement of cash flows using the Indirect method. The in Industries, Inc Im Click the icon to view the income statement.) Click the icon to view additonal information) Requirement Prepare a statement of cash flows for Graham Industries, Inc. Prepare the statement one section at a time. (Use parentheses Graham Industries, Inc. Statement of Cash Flows (Indirect For the Year Ended December 31 Operating Activities: Adjustments to reconcile et income to cash basis 3 December 31, 2021 and 2020 4 Assets 2021 2020 5 Current assets 6 Cash S 478,000 281.000 7 Accounts receivable 77.000 121.000 & Inventory 331.000 213.000 9 Prepaid insurance 8.000 5.000 10 Total current assets 5 894.000 630.000 11 12 Property, plant, and equipment S 585.000 5 575.000 13 Less: Accumulated depreciation (153.000 (109.000 14 Investments 80.000 72.000 15 Total assets $ 1419.000 $ 1.168.000 16 17 Liabilities 18 Current bites 19 Accounts payable inventory purchases 55.000 5 37 000 20 Wages payable 16,500 17300 21 interest payable 2000 300 22 Income taxes payable 58.890 10.000 23 Other accrued expenses payable 6.000 3.700 24 Totalcumentalities 5 138.2805 68300 25 26 Long-term abities 62.000 27.000 27 Totatables 5 200 2805 95300 28 29 Stockholders equity 30 Common stock $ 60400015 504.000 31 Retained camins 514.720 468.700 32 Total stockholders equity $1.218.720 $ 1072.700 Net cash provided by used for operating activities * & 34 Totallables and equity 51419.000 51.168.000 Print Done had the info met mcsheets Income statement how for Graham Industries, ne for the years Pre the one section at a time (Use parentheses or minus Graham Industries, le Statement of Cash Flows (indirect Method) For the Year Ended December 31, 2021 Operating Activities: Austen to reconcile net income to cash basis Graham Industries, Ine 2 Income Statement For the Year Ended December 31, 2025 S950 000 revenues 378.000 5 Less Cost of goods sold 5572.000 Gross profit 7 Less operating expenses 191.000 8 5 Salaries and wagos expense 9 Insurance expense 19.000 10 Depreciation expense 53,000 11 Other operating expenses 89.000 12 Total operating expenses 344.000 13 Operating income $ 228.000 14 Plus other income and less other expenses 15 Interest expense $ 5,400 18 Gain on sale of PP&E 3.000 17 Total other income and expenses 2.400 18 Income before income taxes $ 225,600 19 Less: Income tax expense 67.680 20 Not income $157.920 Netcash provided by used for) operating activities Print Done Prepare statement of cash flows using the Indirect method. The income statement for 2021 and the balance sheets for 2021 and 2020 represented for me Industries, Inc. FB (Click the toon to view the income statement) im Click the icon to view the lance sheets (Click the icon to view additional information Requirement Prepare a statement of cash flows for Graham Industries, Inc. for the year ended December 31, 2021, using the indirect method Prepare the statement one section at a time. (Use parentheses or a minus sign for numbers to be subtracted and for net cash outflow) Graham Industries, Inc. Statement of Cash Flows (Indirect Method) For the Year Ended December 31, 2021 Operating Activities: Nof income 184,900 Adjustments to reconcile net income to cash basis Depreciation expense 46,600 Gain on sale of plant asset (2,500) Decrease in accounts receivable 45,000 Decrease in inventory (116,000) Increase in prepaid insurance (3.000) Increase in accounts payable 17.000 Decrease in wages payable (1.200) Increase in interest payable Increase in taxes payable 51.200 Decrease in other accrued expenses payable 2.900 Net cash provided by (used for) operating activities 600 III Homework: Ch 13 - Part 5 (P13- Que Ons Balance sheets come statement - X December 31, 2021 and 2020 Assets 2021 2020 Current assets Cash 5 291 000 Accounts receivable Inventory Prepaid insurance Total current assets 678.000 77000 331,000 8,000 84.000 125.000 213.000 5.000 630.000 5 Property, plant, and equipment Less: Accumulated depreciation A B 1 Graham Industries, Inc. 2 Income Statement 3 For the Year Ended December 31, 2021 4 Sales revenues $ 950,000 5 Less Cost of goods sold 378,000 6 Gross profit $ 572,000 7 Less operating expenses 8 Salaries and wages expense S 191.000 9 Insurance expense 11 000 10 Depreciation expenso 53,000 11 Other operating expenses 89,000 12 Total operating expenses 344,000 13 Operating income $ 220,000 14 Plus other income and less other expenses: 15 Interest expense S 5,400 16 Gain on sale of PPSE 3,000 17 Total other income and expenses 2.400 18 Income before income taxes $ 225,600 19 Less Income tax expense 67.680 $ 157.920 20 Net income $ 585.000 575.000 (153.000) (109.000) 93,000 72.000 $ 1,419,000 5 1,168,000 Investments Total assets $ 37.000 17.300 Liabilities Current liabilities: Accounts payable inventory purchases) Wages payable Interest payable Income taxes payable Other accrued expenses payable Total current liablities 55,000 5 16.500 2,000 58,680 6.000 138,2805 300 10,000 3.700 68.300 5 27.000 Long-term liabilities Total liabilities 62,000 200.280S 5 95,300 Print Done Stockholders' equity Common stock 31 Retained earnings 32 Total stockholders' equilty 33 5 604.000 5 604,000 614,720 468.700 $1.218.720 $ 1,072,700 34 Total liabilities and equity $ 1.419,000$ 1.168,000 Print Done Prepare statement of cash flows using the indirect method. The income statement for 2021 and the balance shoots for 2021 and 2020 are presented for Grahom Industries, Inc Click the icon to view the income statement) Click the icon to view the balance sheets) (Click the icon to view additional information) Requirement Prepare a statement of cash flows for Graham Industries, Inc., for the year ended December 31, 2021, using the Indirect method. Prepare the statement one section at a time (Use parentheses or a minus sign for numbers to be subtracted and for net cash outflows.) Graham Industries, Inc. Statement of Cash Flows (Indirect Method) For the Year Ended December 31, 2021 Operating Activities: Net income 164,990 Adjustments to reconcile net income to cash basis: Depreciation expense 46,600 Gain on sale of plant asset 12.500) Decrease in accounts receivable 45,000 Decrease in inventory (116,000) Increase in prepaid insurance (3.000) Increase in accounts payable 17.000 Decrease in wages payable (1.200) 600 Increase in interest payable 51.200 Increase in taxes payable 2.900 Decrease in other accrued expenses payable Net cash provided by (used for) operating activities Question - Homework: Ch 13 - Part 5 (P13- Balance sheets me statement Decr17 At 30 C 5 4000 Graham industrien Income Statement For the Year Ended December 31, 2021 TA 1.000 3.000 040001 2010 . 20.000 5.000 650.000 550.000 3.000 5572.000 and insurance 10 Total current 11 12. Property plant and en 13 Less Accumulated depreciation 14 Investments 5 SOOS 575.000 (155.000) 100.000 99.000 72.000 51.419.000'S 1.100.000 15 Total Lood Go Les operating expenses Sand wispense Insurance expense Deprecationen + Other operating expenses Total operating contes Operating income 4 Plus other income and less other expenses 5 Interest Gain on sale of PPSE 191.000 11.000 53,000 89.000 344,000 5228.000 10 $ 37.000 17.300 300 s 5,400 3.000 55.000 5 16,600 2.000 58.580 0.000 138.2005 10.000 3.700 Total other income and expenses home before income taxes Less Income tax expense Net Income 2.400 $ 225,600 67.680 $ 157.920 $ 68.300 17 Liabilities 10 Current liabilities 19 Accounts payable inventory purchases) 20 Wages payable 21 Interest payable 22 Income taxes payable 23 Other accrued expenses payable 24 Total current liablities 25 20 Long-teem liabilities 27 Totalbes 28 29 Stockholders' equity 30 Common stock 31 Retained earnings 32 Total stockholders equity 33 27.000 62.000 200.280 $ $ 95.300 Print Done 5 604.000 $ 604.000 614,720 468,700 $ 1.218.720S 1.072,700 34 Totallibilities and equity S1419.000 5 1,168,000 Print Done Prepare statement of cash flows using the Indirect method. The income staternent for 2021 and the balance sheets for 2021 and 2020 are presented for Graham Industries, Inc (Click the icon to view the income statement) Click the icon to view the balance sheets.) (Click the icon to view additional information) Requirement Prepare a statement of cash flows for Graham Industries, Inc. for the year ended December 31, 2021, using the Indirect method Prepare the statement one section at a time. (Use parentheses or a minus sign for numbers to be subtracted and for net cash outflows.) Graham Industries, Inc. Statement of Cash Flows (Indirect Method) For the Year Ended December 31, 2021 Operating Activities: Not income 164,990 Adjustments to reconcile net income to cash basis Depreciation expense 46,600 Gain on sale of plant asset (2,500) Decrease in accounts receivable 45,000 Decrease in inventory (116,000) Increase in prepaid insurance (3.000) Increase in accounts payable 17.000 Decrease in wages payable (1.200) Increase in interest payable Increase in taxes payable 51,200 2.900 Decrease in other accrued expenses payable Net cash provided by (used for) operating activities 600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts