Question: Please solve the whole question and explain the method completely Can you explain how to solve the five demands, and explain the method of calculation?

Please solve the whole question and explain the method completely Can you explain how to solve the five demands, and explain the method of calculation?

thank you

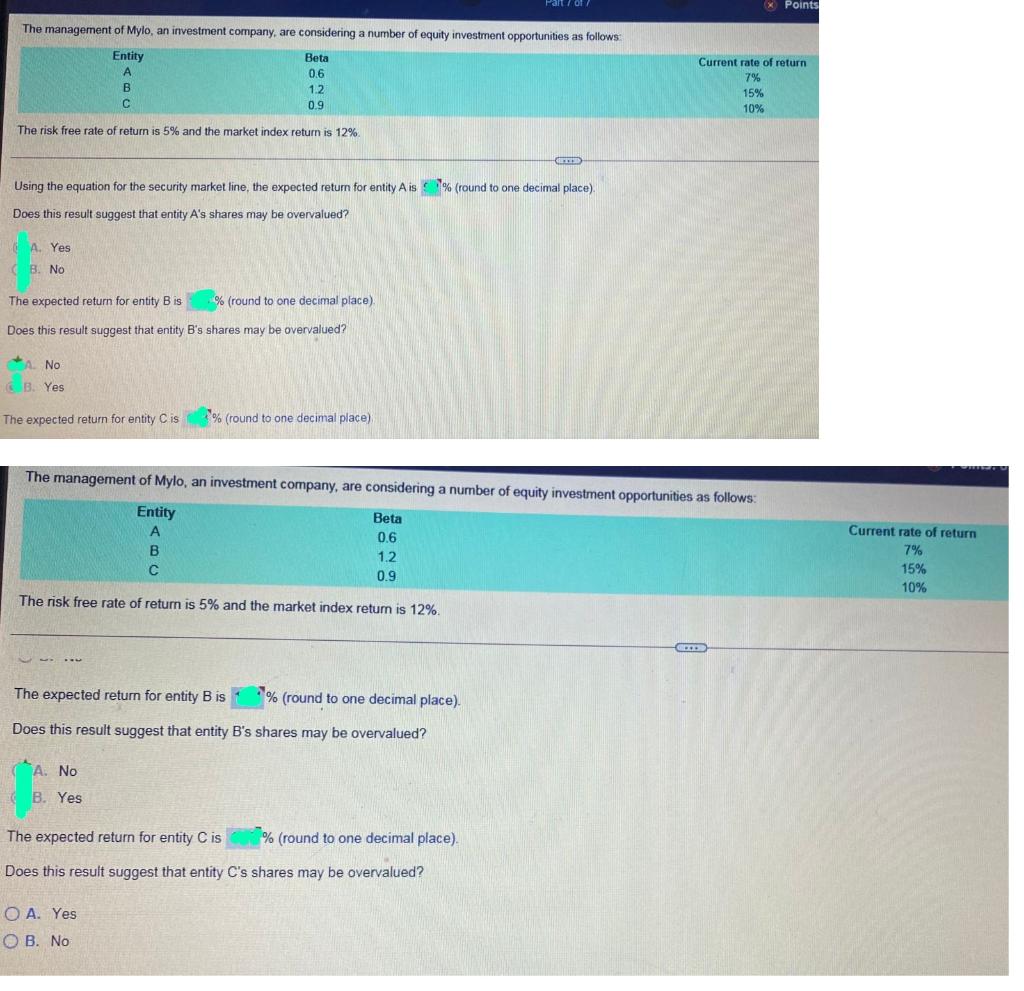

The management of Mylo, an investment company, are considering a number of equity investment opportunities as follows: Entity A B C Beta 0.6 1.2 0.9 The risk free rate of return is 5% and the market index return is 12%. Using the equation for the security market line, the expected return for entity A is % (round to one decimal place). Does this result suggest that entity A's shares may be overvalued? A. Yes (B. No The expected return for entity B is % (round to one decimal place). Does this result suggest that entity B's shares may be overvalued? A. No B. Yes The expected return for entity C is % (round to one decimal place) Points Current rate of return 7% 15% 10% The management of Mylo, an investment company, are considering a number of equity investment opportunities as follows: Entity A B C Beta 0.6 1.2 0.9 The risk free rate of return is 5% and the market index return is 12%. The expected return for entity B is % (round to one decimal place). Does this result suggest that entity B's shares may be overvalued? A. No B. Yes The expected return for entity C is % (round to one decimal place). Does this result suggest that entity C's shares may be overvalued? O A. Yes OB. No Current rate of return 7% 15% 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts