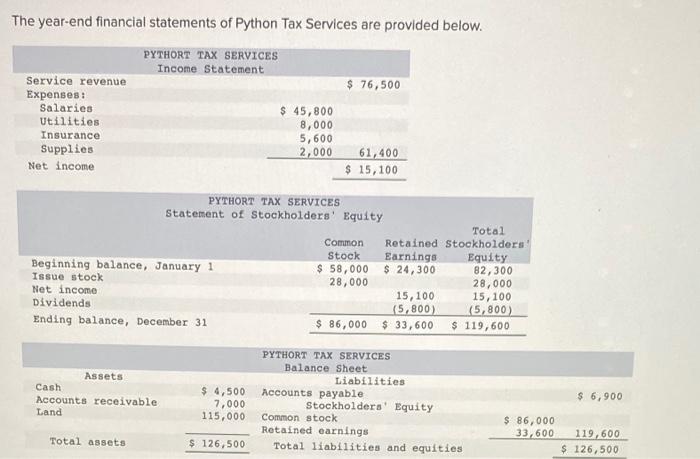

Question: please solve The year-end financial statements of Python Tax Services are provided below. PYTHORT TAX SERVICES Income Statement $ 76,500 Service revenue Expenses : Salaries

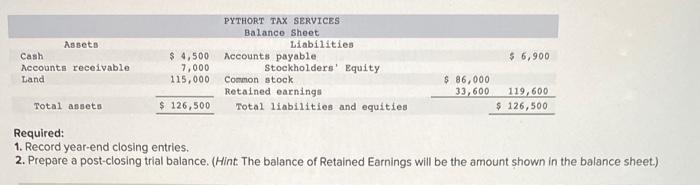

The year-end financial statements of Python Tax Services are provided below. PYTHORT TAX SERVICES Income Statement $ 76,500 Service revenue Expenses : Salaries Utilities Insurance Supplies Net income $ 45,800 8,000 5,600 2,000 61,400 $ 15,100 PYTHORT TAX SERVICES Statement of Stockholders' Equity Total Common Retained Stockholders' Stock Earnings Equity Beginning balance, January 1 $ 58,000 $ 24,300 82,300 Issue stock 28,000 28,000 Net income 15,100 15,100 Dividends (5,800) (5,800) Ending balance, December 31 $ 86,000 $ 33,600 $ 119,600 Assets Cash Accounts receivable Land PYTHORT TAX SERVICES Balance Sheet Liabilities Accounts payable Stockholders' Equity Common stock Retained earnings Total liabilities and equities $ 4,500 7,000 115,000 $ 6,900 Total assets $ 86,000 33,600 119,600 $ 126,500 $ 126,500 Assets Cash Accounts receivable $ 6,900 $ 4,500 7,000 115,000 PYTHORT TAX SERVICES Balance Sheet Liabilities Accounts payable Stockholders' Equity Common stock Retained earnings Total liabilities and equities Land $ 86,000 33,600 Total assets 119,600 $ 126,500 $ 126,500 Required: 1. Record year-end closing entries. 2. Prepare a post-closing trial balance. (Hint. The balance of Retained Earnings will be the amount shown in the balance sheet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts