Question: please solve them by typing with 0 similarty Question 1 Outdoors Equipment Company manufactures boots, which sell for $95 each. The variable costs of production

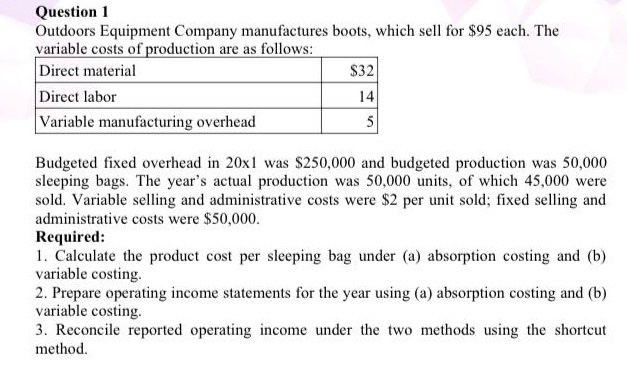

Question 1 Outdoors Equipment Company manufactures boots, which sell for $95 each. The variable costs of production are as follows: Direct material $32 Direct labor 14 Variable manufacturing overhead 5 Budgeted fixed overhead in 20x1 was $250,000 and budgeted production was 50,000 sleeping bags. The year's actual production was 50,000 units, of which 45,000 were sold. Variable selling and administrative costs were $2 per unit sold; fixed selling and administrative costs were $50,000. Required: 1. Calculate the product cost per sleeping bag under (a) absorption costing and (b) variable costing. 2. Prepare operating income statements for the year using (a) absorption costing and (b) variable costing. 3. Reconcile reported operating income under the two methods using the shortcut method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts