Question: Please solve them without using EXCEL If a perfect timer can earn $10.00, while another investor with the same investment opportunities guesses the bull markets

Please solve them without using EXCEL

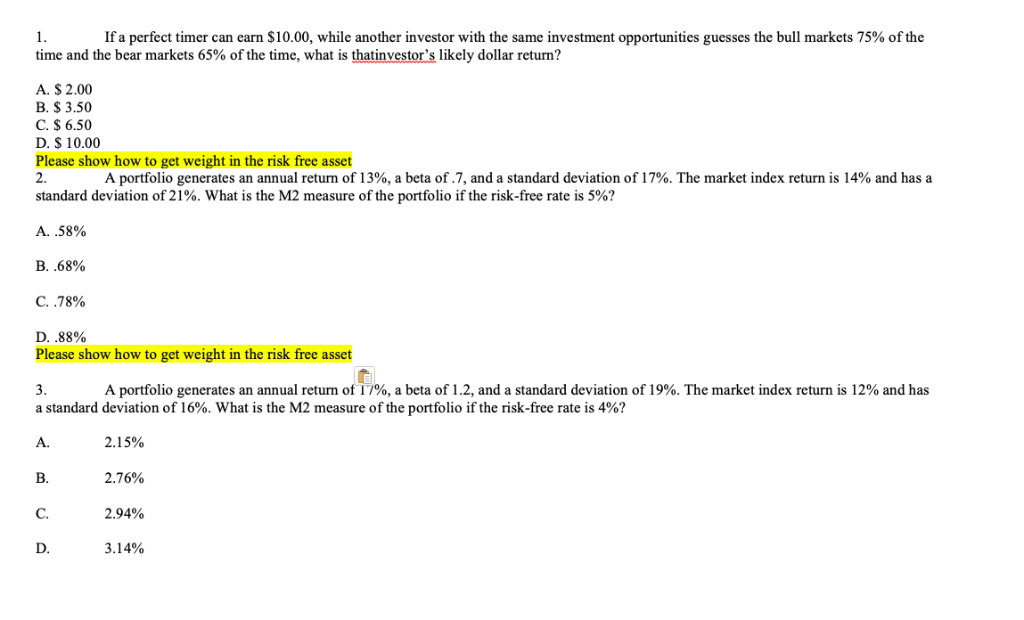

If a perfect timer can earn $10.00, while another investor with the same investment opportunities guesses the bull markets 75% of the time and the bear markets 65% of the time, what is thatinvestor's likely dollar return? A. $ 2.00 B. $ 3.50 C. $ 6.50 D. S 10.00 Please show how to get weight in the risk free asset 2. standard deviation of 21%, what is the M2 measure of the portfolio if the risk-free rate is 5%? A portfolio generates an annual return of 13%, a beta of .7, and a standard deviation of 17%. The market index return is 14% and has a A, S % B. .68% C. .78% D. .88% Please show how to get weight in the risk free asset A portfolio generates an annual return of 17%, a beta of 1.2, and a standard deviation of 19%. The market index return is 12% and has a standard deviation of 16%, what is the M2 measure of the portfolio if the risk-free rate is 4%? 2. I 5% 2.76% 2.94% 3.14% A. C. If a perfect timer can earn $10.00, while another investor with the same investment opportunities guesses the bull markets 75% of the time and the bear markets 65% of the time, what is thatinvestor's likely dollar return? A. $ 2.00 B. $ 3.50 C. $ 6.50 D. S 10.00 Please show how to get weight in the risk free asset 2. standard deviation of 21%, what is the M2 measure of the portfolio if the risk-free rate is 5%? A portfolio generates an annual return of 13%, a beta of .7, and a standard deviation of 17%. The market index return is 14% and has a A, S % B. .68% C. .78% D. .88% Please show how to get weight in the risk free asset A portfolio generates an annual return of 17%, a beta of 1.2, and a standard deviation of 19%. The market index return is 12% and has a standard deviation of 16%, what is the M2 measure of the portfolio if the risk-free rate is 4%? 2. I 5% 2.76% 2.94% 3.14% A. C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts