Question: please solve these and show what i should plug in calculator for each value like ytm, pv, ect. thanks. and show steps eBook Problem Walk-Through

please solve these and show what i should plug in calculator for each value like ytm, pv, ect. thanks. and show steps

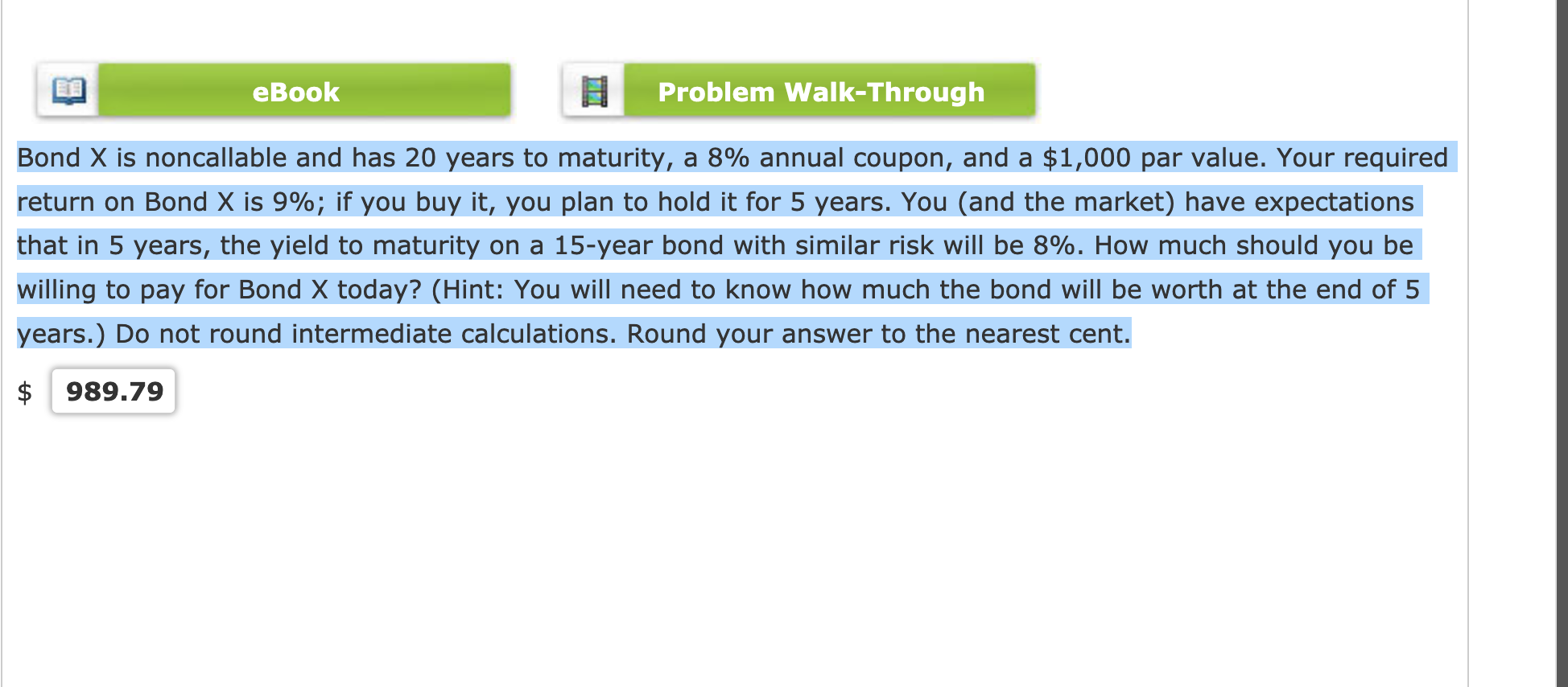

eBook Problem Walk-Through Bond X is noncallable and has 20 years to maturity, a 8% annual coupon, and a $1,000 par value. Your required return on Bond X is 9%; if you buy it, you plan to hold it for 5 years. You (and the market) have expectations that in 5 years, the yield to maturity on a 15-year bond with similar risk will be 8%. How much should you be willing to pay for Bond X today? (Hint: You will need to know how much the bond will be worth at the end of 5 years.) Do not round intermediate calculations. Round your answer to the nearest cent. $ 989.79 eBook You are considering a 15-year, $1,000 par value bond. Its coupon rate is 9%, and interest is paid semiannually. avigation Menu If you require an "effective" annual interest rate (not a nominal rate) of 8.1540%, how much should you be willing to pay for the bond? Do not round intermediate calculations. Round your answer to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts