Question: please solve these questions B. Problems and Questions . A cash crop specialist requires increased harvesting capacity due to the purchase of an additional 2,000

please solve these questions

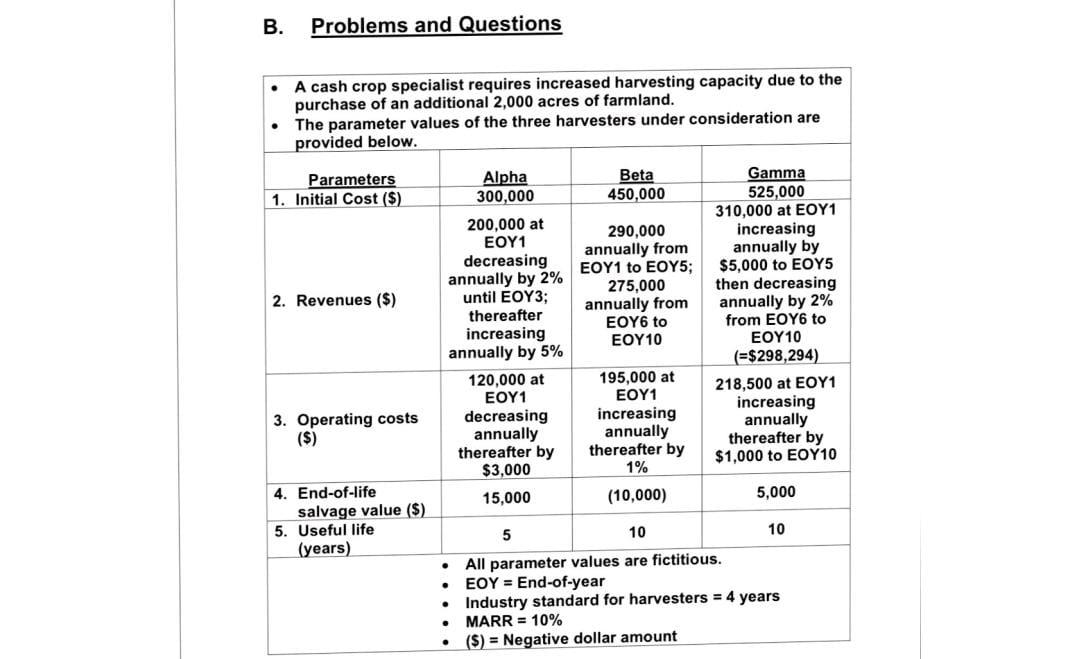

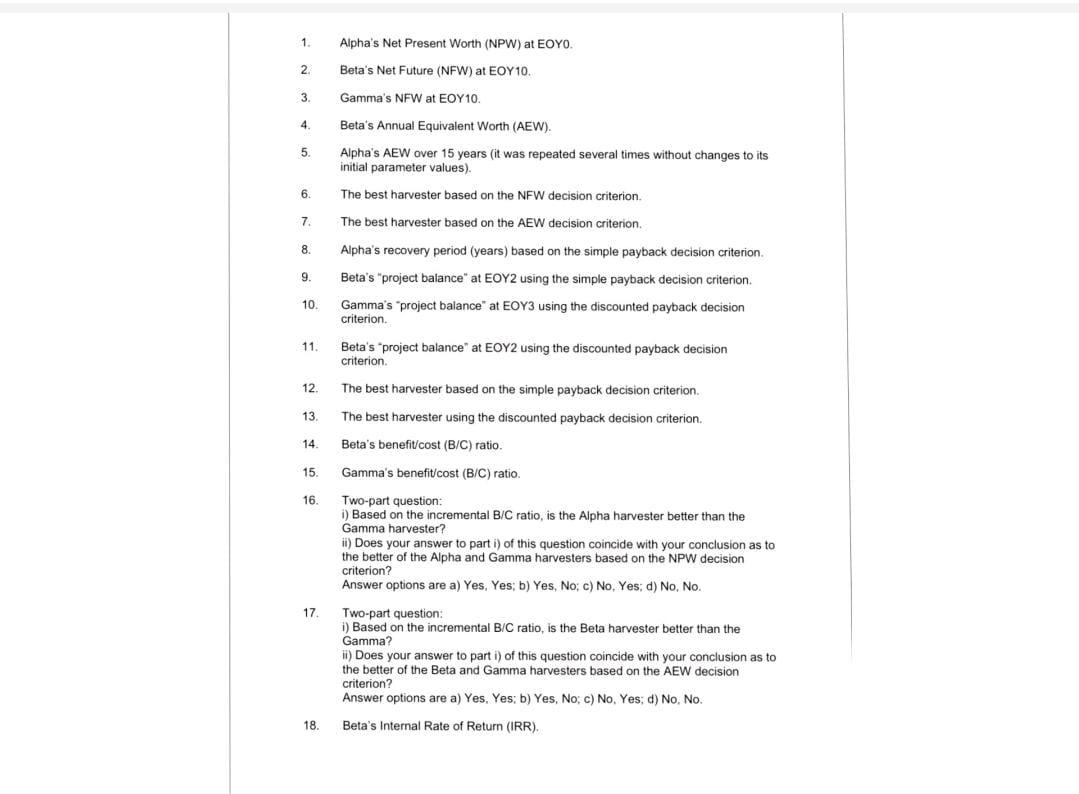

B. Problems and Questions . A cash crop specialist requires increased harvesting capacity due to the purchase of an additional 2,000 acres of farmland. The parameter values of the three harvesters under consideration are provided below. . Parameters 1. Initial Cost ($) 2. Revenues ($) Alpha Beta 300,000 450,000 200,000 at 290,000 EOY1 decreasing annually from annually by 2% EOY1 to EOY5; 275.000 until EOY3; annually from thereafter EOY6 to increasing EOY10 annually by 5% 120,000 at 195,000 at EOY1 EOY1 decreasing increasing annually annually thereafter by thereafter by $3,000 1% 15,000 (10,000) Gamma 525,000 310,000 at EOY1 increasing annually by $5,000 to EOY5 then decreasing annually by 2% from EOY6 to EOY10 (=$298,294) 218,500 at EOY1 increasing annually thereafter by $1,000 to EOY10 3. Operating costs ($) 5,000 4. End-of-life salvage value ($) 5. Useful life (years) 5 10 10 . All parameter values are fictitious. EOY = End-of-year Industry standard for harvesters = 4 years MARR = 10% ($) = Negative dollar amount . 1. Alpha's Net Present Worth (NPW) at EOYO. Beta's Net Future (NFW) at EOY10 2. 3 Gamma's NFW at EOY10. 4. Beta's Annual Equivalent Worth (AEW). 5. 6. 7. Alpha's AEW over 15 years (it was repeated several times without changes to its initial parameter values). The best harvester based on the NFW decision criterion . The best harvester based on the AEW decision criterion Alpha's recovery period (years) based on the simple payback decision criterion Beta's "project balance" at EOY2 using the simple payback decision criterion. Gamma's "project balance at EOY3 using the discounted payback decision criterion. 8. 9. 10. 11 Beta's "project balance at EOY2 using the discounted payback decision criterion. 12. The best harvester based on the simple payback decision criterion. 13 The best harvester using the discounted payback decision criterion. 14. Beta's benefit/cost (B/C) ratio. 15 16. Gamma's benefit/cost (B/C) ratio. Two-part question: i) Based on the incremental B/C ratio, is the Alpha harvester better than the Gamma harvester? ii) Does your answer to parti) of this question coincide with your conclusion as to the better of the Alpha and Gamma harvesters based on the NPW decision criterion? Answer options are a) Yes, Yes; b) Yes, No; c) No. Yes: d) No, No Two-part question: 1) Based on the incremental B/C ratio, is the Beta harvester better than the Gamma? ii) Does your answer to parti) of this question coincide with your conclusion as to the better of the Beta and Gamma harvesters based on the AEW decision criterion? Answer options are a) Yes, Yes; b) Yes, No; c) No, Yes; d) No, No. 17. 18. Beta's Internal Rate of Return (IRR), B. Problems and Questions . A cash crop specialist requires increased harvesting capacity due to the purchase of an additional 2,000 acres of farmland. The parameter values of the three harvesters under consideration are provided below. . Parameters 1. Initial Cost ($) 2. Revenues ($) Alpha Beta 300,000 450,000 200,000 at 290,000 EOY1 decreasing annually from annually by 2% EOY1 to EOY5; 275.000 until EOY3; annually from thereafter EOY6 to increasing EOY10 annually by 5% 120,000 at 195,000 at EOY1 EOY1 decreasing increasing annually annually thereafter by thereafter by $3,000 1% 15,000 (10,000) Gamma 525,000 310,000 at EOY1 increasing annually by $5,000 to EOY5 then decreasing annually by 2% from EOY6 to EOY10 (=$298,294) 218,500 at EOY1 increasing annually thereafter by $1,000 to EOY10 3. Operating costs ($) 5,000 4. End-of-life salvage value ($) 5. Useful life (years) 5 10 10 . All parameter values are fictitious. EOY = End-of-year Industry standard for harvesters = 4 years MARR = 10% ($) = Negative dollar amount . 1. Alpha's Net Present Worth (NPW) at EOYO. Beta's Net Future (NFW) at EOY10 2. 3 Gamma's NFW at EOY10. 4. Beta's Annual Equivalent Worth (AEW). 5. 6. 7. Alpha's AEW over 15 years (it was repeated several times without changes to its initial parameter values). The best harvester based on the NFW decision criterion . The best harvester based on the AEW decision criterion Alpha's recovery period (years) based on the simple payback decision criterion Beta's "project balance" at EOY2 using the simple payback decision criterion. Gamma's "project balance at EOY3 using the discounted payback decision criterion. 8. 9. 10. 11 Beta's "project balance at EOY2 using the discounted payback decision criterion. 12. The best harvester based on the simple payback decision criterion. 13 The best harvester using the discounted payback decision criterion. 14. Beta's benefit/cost (B/C) ratio. 15 16. Gamma's benefit/cost (B/C) ratio. Two-part question: i) Based on the incremental B/C ratio, is the Alpha harvester better than the Gamma harvester? ii) Does your answer to parti) of this question coincide with your conclusion as to the better of the Alpha and Gamma harvesters based on the NPW decision criterion? Answer options are a) Yes, Yes; b) Yes, No; c) No. Yes: d) No, No Two-part question: 1) Based on the incremental B/C ratio, is the Beta harvester better than the Gamma? ii) Does your answer to parti) of this question coincide with your conclusion as to the better of the Beta and Gamma harvesters based on the AEW decision criterion? Answer options are a) Yes, Yes; b) Yes, No; c) No, Yes; d) No, No. 17. 18. Beta's Internal Rate of Return (IRR)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts